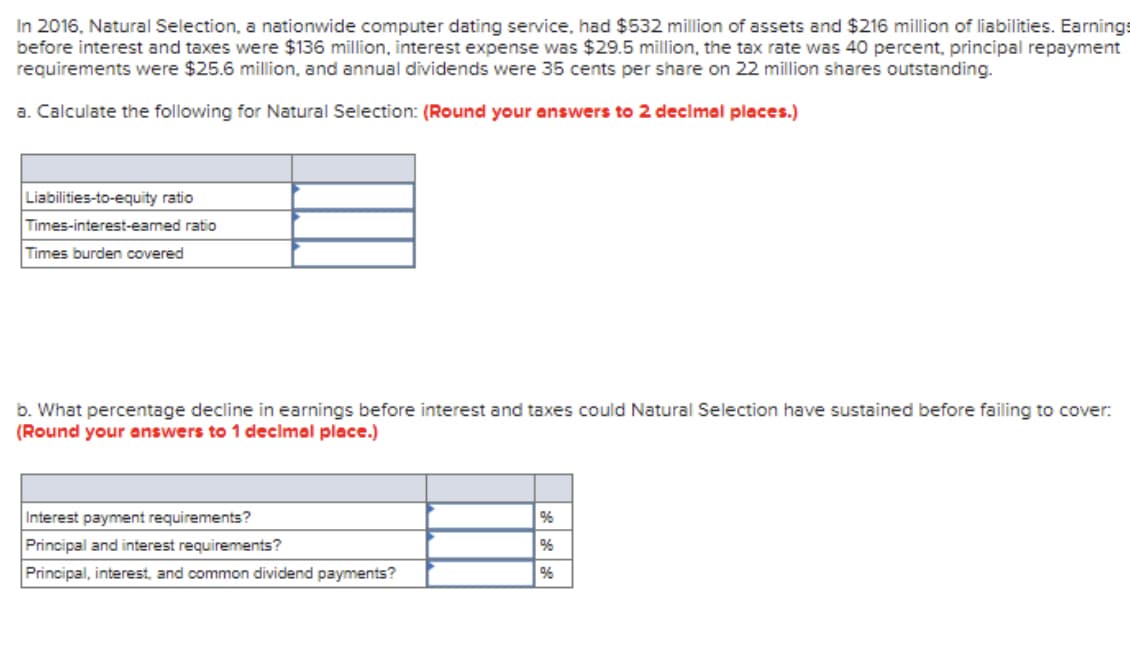

In 2016, Natural Selection, a nationwide computer dating service, had $532 million of assets and $216 million of liabilities. Earning before interest and taxes were $136 million, interest expense was $29.5 million, the tax rate was 40 percent, principal repayment requirements were $25.6 million, and annual dividends were 35 cents per share on 22 million shares outstanding. a. Calculate the following for Natural Selection: (Round your answers to 2 decimal places.) Liabilities-to-equity ratio Times-interest-earned ratio Times burden covered

In 2016, Natural Selection, a nationwide computer dating service, had $532 million of assets and $216 million of liabilities. Earning before interest and taxes were $136 million, interest expense was $29.5 million, the tax rate was 40 percent, principal repayment requirements were $25.6 million, and annual dividends were 35 cents per share on 22 million shares outstanding. a. Calculate the following for Natural Selection: (Round your answers to 2 decimal places.) Liabilities-to-equity ratio Times-interest-earned ratio Times burden covered

Chapter12: Corporate Valuation And Financial Planning

Section: Chapter Questions

Problem 7P

Related questions

Question

I need the last part and the answer is not 68.9. That is incorrect. Please solve the problem and write out all steps. I only need the last part answered please.

Transcribed Image Text:In 2016, Natural Selection, a nationwide computer dating service, had $532 million of assets and $216 million of liabilities. Earnings

before interest and taxes were $136 million, interest expense was $29.5 million, the tax rate was 40 percent, principal repayment

requirements were $25.6 million, and annual dividends were 35 cents per share on 22 million shares outstanding.

a. Calculate the following for Natural Selection: (Round your answers to 2 decimal places.)

Liabilities-to-equity ratio

Times-interest-earned ratio

Times burden covered

b. What percentage decline in earnings before interest and taxes could Natural Selection have sustained before failing to cover:

(Round your answers to 1 decimal place.)

Interest payment requirements?

%

Principal and interest requirements?

96

Principal, interest, and common dividend payments?

%6

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning