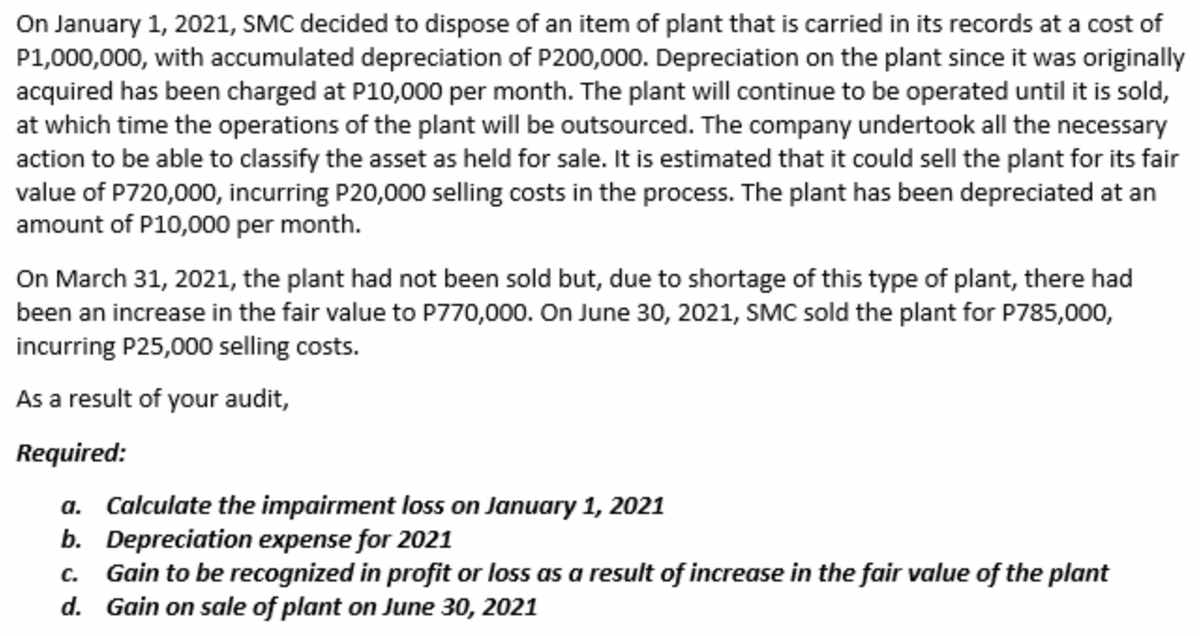

On January 1, 2021, SMC decided to dispose of an item of plant that is carried in its records at a cost of P1,000,000, with accumulated depreciation of P200,000. Depreciation on the plant since it was originally acquired has been charged at P10,000 per month. The plant will continue to be operated until it is sold, at which time the operations of the plant will be outsourced. The company undertook all the necessary action to be able to classify the asset as held for sale. It is estimated that it could sell the plant for its fair value of P720,000, incurring P20,000 selling costs in the process. The plant has been depreciated at an amount of P10,000 per month. On March 31, 2021, the plant had not been sold but, due to shortage of this type of plant, there had been an increase in the fair value to P770,000. On June 30, 2021, SMC sold the plant for P785,000, incurring P25,000 selling costs. As a result of your audit, Required: a. Calculate the impairment loss on January 1, 2021 b. Depreciation expense for 2021 Gain to be recognized in profit or loss as a result of increase in the fair value of the plant d. Gain on sale of plant on June 30, 2021 C.

On January 1, 2021, SMC decided to dispose of an item of plant that is carried in its records at a cost of P1,000,000, with accumulated depreciation of P200,000. Depreciation on the plant since it was originally acquired has been charged at P10,000 per month. The plant will continue to be operated until it is sold, at which time the operations of the plant will be outsourced. The company undertook all the necessary action to be able to classify the asset as held for sale. It is estimated that it could sell the plant for its fair value of P720,000, incurring P20,000 selling costs in the process. The plant has been depreciated at an amount of P10,000 per month. On March 31, 2021, the plant had not been sold but, due to shortage of this type of plant, there had been an increase in the fair value to P770,000. On June 30, 2021, SMC sold the plant for P785,000, incurring P25,000 selling costs. As a result of your audit, Required: a. Calculate the impairment loss on January 1, 2021 b. Depreciation expense for 2021 Gain to be recognized in profit or loss as a result of increase in the fair value of the plant d. Gain on sale of plant on June 30, 2021 C.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 7RE: Bliss Company owns an asset with an estimated life of 15 years and an estimated residual value of...

Related questions

Question

Transcribed Image Text:On January 1, 2021, SMC decided to dispose of an item of plant that is carried in its records at a cost of

P1,000,000, with accumulated depreciation of P200,000. Depreciation on the plant since it was originally

acquired has been charged at P10,000 per month. The plant will continue to be operated until it is sold,

at which time the operations of the plant will be outsourced. The company undertook all the necessary

action to be able to classify the asset as held for sale. It is estimated that it could sell the plant for its fair

value of P720,000, incurring P20,000 selling costs in the process. The plant has been depreciated at an

amount of P10,000 per month.

On March 31, 2021, the plant had not been sold but, due to shortage of this type of plant, there had

been an increase in the fair value to P770,000. On June 30, 2021, SMC sold the plant for P785,000,

incurring P25,000 selling costs.

As a result of your audit,

Required:

a. Calculate the impairment loss on January 1, 2021

b. Depreciation expense for 2021

c. Gain to be recognized in profit or loss as a result of increase in the fair value of the plant

d. Gain on sale of plant on June 30, 2021

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT