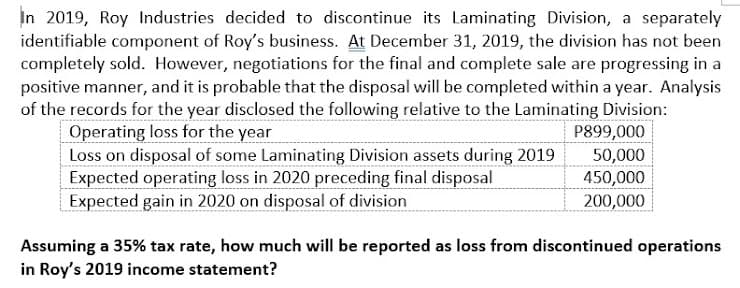

In 2019, Roy Industries decided to discontinue its Laminating Division, a separately identifiable component of Roy's business. At December 31, 2019, the division has not been completely sold. However, negotiations for the final and complete sale are progressing in a positive manner, and it is probable that the disposal will be completed within a year. Analysis of the records for the year disclosed the following relative to the Laminating Division: Operating loss for the year Loss on disposal of some Laminating Division assets during 2019 Expected operating loss in 2020 preceding final disposal Expected gain in 2020 on disposal of division P899,000 50,000 450,000 200,000

Q: Information for Duncan Corporation is shown below: 20X1 Net Income ₱ 400,000 Average Inv...

A: Formula: Capital Turnover = Sales Revenue/Average Investment

Q: Ly engage in discussi e11 strategy is employed rming groun technique

A: Decision making refers to the procedure of making the choices through assessing, identifying the dec...

Q: ABC has a major supplier that offers a credit term of 2/15, n/45. Cash not yet used for payments are...

A: Credit term 2/15, n/45means 2% discount offered if payment made within 15 days. And full payment (wi...

Q: a. An analysis of WTI' Insurance policies shows that $2,400 of coverage has expired. b. An Inventory...

A: Adjusted trial balance is prepared by management for its own use. It is not part of financial statem...

Q: E19.12 (LO 1) (Deferred Tax Asset) Callaway SA has a deferred tax asset account with a balance of €1...

A: Calculation of Temporary difference for 2022: Temporary difference = 500,000 – 375,000 = 125,000

Q: 2010 Casey made a taxable gift of $5.7 million to both Stephanie and Linda (a to quired: Iculate the...

A: A gift tax is a tax imposed on cash or assets given by one person or corporation to another. A gift ...

Q: Hache Corporation uses the weighted-average method in its process costing system. The first processi...

A: Lets understand the basics. In weighted average costing, costs are average out and applied evenly on...

Q: In a job-order costing system, manufacturing overhead applied is recorded as a debit to: Work in Pro...

A:

Q: During July at Loeb Corporation, $83,000 of raw materials were requisitioned from the storeroom for ...

A: Journal entry paass when issue raw materials from storeroom to use in production. Separate entry pas...

Q: An inventory count shows that teaching supplies costing $2.800 are available at year-end. Note: Ente...

A: Adjustment for teaching supplies expense = Unadjusted teaching supplies - Closing inventory count ...

Q: 8,088 4 Accounts Payable 6,960 Accounts Receivable 13,445 Cash 4,800 Equipment Insurance Expense 7 1...

A: The question is based on the concept of Financial Accounting.

Q: Present Value Index When funds for capital investments are limited, projects can be ranked using a p...

A: Present value of net cash flow = Annual cash flow x PVF@6%, 5 years = 58,000 x 4.2124 ...

Q: On 17 June 2020, RM7,000 was saved in a bank that offered 6.6% simple interest per annum. Find the a...

A: Solution Concept Under exact simple interest number of days taken in a year is 365 days Given Da...

Q: Milktopia, Inc. produces and sells milk flavored bubble gum. Over the last fiv months Milktopia had ...

A: The fixed cost and variable cost per month can be calculated with the help of high low method.

Q: An annuity-immediate has 3 annual payments of $200, followed by a perpetuity of $300 starting in the...

A: solution given cash flow diagram Year Cash flow Beginning of year 1 200 Beginning of...

Q: The following information is available for Zephyr Company before closing the accounts. After all of ...

A: The closing entries are prepared to close the temporary accounts of the business including revenue, ...

Q: QUESTION 8 Grandview Ltd acquired 100% of the issued capital of Electro Ltd on 1 July 2021 for $110,...

A:

Q: The Wizarding Company uses the Process Cost System and the Average Costing Method. Materials and Con...

A:

Q: reported the following: Asset – Php400 Million; Liabilities – Php100 Million; Assuming Lumina Inc ha...

A: Book to market ratio = Book value per share/ Market value per share where, Book value per share = To...

Q: For each transaction, (1) analyze the transaction using the accounting equation, (2) record the tran...

A: SOLUTION

Q: P6-3. Listed Automobile industry players has the following market value and earnings per share: Mark...

A: P:E Ratio = Market value per share / Earnings per share where, Earnings per share = (Net income - Pr...

Q: Total Manufacturing Costs ₱325,000 Applied Overhead Costs, 75% of direct labor cost ...

A: Manufacturing cost = P 325000 Manufacturing overhead = P 75000 Labor = Manufacturing overhead/0.75 L...

Q: Average Rate of Return The average rate of return is another method that does not use present value ...

A: Step 2 solution in the question.

Q: Hearts Company has various cash generating units. One cash generating unit has the following carryin...

A: As given , we need to determine amount of impairment loss . Value in use as determined by management...

Q: Margo receives a gift of real estate with an adjusted basis of $175,000 and a fair market value of $...

A: Given data, Adjusted basis =$175,000 Fair market value =$100,000 Margo has generated zero recogniz...

Q: iness. For example, Coca‐Cola has announced that it wants to buy China Huiyuan Juice Gr

A: The details are discussed as follows

Q: what is the value of the firm?

A: Free cash flow refers to the cash flow generated by the company in the year from its operations afte...

Q: What is the incremental cost associated with this special order

A: Since 2/3 of overhead is fixed, the remaining 1/3 will be variable. Overhead cost per unit ₱ 3 ...

Q: THIS QUESTION REQUIRES AN ESSAY STYLE ANSWER Timing is very important when preparing the end of fina...

A: Services: Services (theoretical) are act or use for which a shopper, firm, or government will pay. E...

Q: ABC Corporation would like to know what its optimal cash balance for its petty cash fund. The daily ...

A: Computation of optimum cash balance Square root of (2A * P/S) Where A = Annual cash disbursement P ...

Q: QUESTION 4 Jeremiah invested RM100 every month into his Paradise Mutual Fund account for 8 years at ...

A: First we can convert the invested amount and the interest % to annual. 1 month =100 12 months=100*12...

Q: E5-2 (L02,3) (Classification of Balance Sheet Accounts) Presented below are the captions of Faulk Co...

A: Solution We are required to classify the given items to the respective heads of the balance sheet Th...

Q: Compute the amount of raw materials used during November if $30,000 of raw materials were purchased ...

A: Raw material used during November = Beginning Inventory + Raw material purchased during the month - ...

Q: The following are selected budgeted data for Green Company for the coming year: Budgeted sales ₱60...

A: Breakeven point is point at which no profit no loss, means total cost is equal to total revenue. For...

Q: Adamson Corporation is considering four average-risk projects with the following costs and rates of ...

A: The question is based on the concept of Financial Management.

Q: Barton Industries expects that its target capital structure for raising funds in the future for its ...

A: The question is based on the concept of Financial Management.

Q: San Jose Company operates a Manufacturing Division and an Assembly Division. Both divisions are eval...

A: When it is related to transfer price, (a) When the full capacity is not utilized, then variable pric...

Q: The Fresh Sausage Company takes fresh ingredients and turns them into sausage for sale in the chille...

A: Inventory: Inventory refers to all of the things, commodities, merchandise, and supplies that a firm...

Q: QS 2-10 Computing T-account balance LO C4 Determine the ending balance of each of the following T-ac...

A: A T-account is slang for a set of financial records that use double-entry bookkeeping. The term refe...

Q: c) A lawn mower machine has a scrap value of RM6,900 at the end of 10 years. The book value at the e...

A: Depreciation is the decrease in the value of fixed asset with the passage of time due to wear and te...

Q: Carlos is a resident citizen. He maintains a savings account deposit with the BPI-Baguio City Branch...

A: Solution Given Carlos is a resident citizen Interest income from saving account deposit =6000 F...

Q: On October 1, Ebony Ernst organized Ernst Consulting: on October 3, the owner contributed $84,580 in...

A: Solution: Statement of retained earnings represents changes in retained profits during the year. Sta...

Q: ABC has a major supplier that offers a credit term of 2/15, n/45. Cash not yet used for payments are...

A: creditors are considered to be important part of the effective cash management system .It is impor...

Q: Dash Company adopted a standard costing system several years ago. The standard costs for the prime c...

A: Note: As per our guidelines, only the first three subparts will be answered. d. Materials price va...

Q: How do the activities of a company benefit society?

A: Even though a company have a profit motive, a cost can benefit society in many ways.

Q: For each of the summarized transactions for the Village of Sycamore General Fund, prepare the genera...

A:

Q: YellowCard Property Managers operates upscale student apartment buildings. On May 1, 2020, Cheyenne ...

A: When a contract is signed between two or more parties, it entails that there are some terms and cond...

Q: In a job-order costing system, indirect labor cost is usually recorded as a debit to: Work in Proces...

A: Introduction:- Job order costing system mainly used by organizations providing services according to...

Q: discuss the different instances when there is no duty to disclose in insider trading

A: Answer: Insider trading is the trading of internal information to outside market which is illegal. T...

Q: As a CPA do you advise your clients to stay away from digital investments or do you encourage them t...

A: As a CPA when giving investment advices to my client I first of all start by making them aware of al...

Step by step

Solved in 2 steps

- Lee Manufacturing Corporation was incorporated on January 3, 2018. The corporations financial statements for its first years operations were not examined by a CPA. You have been engaged to examine the financial statements for the year ended December 31, 2019, and your examination is substantially completed. Lees trial balance at December 31, 2019, appears as follows: The following information relates to accounts that may vet require adjustment: 1. Patents for Lees manufacturing process were acquired January 2, 2019, at a cost of 68,000. An additional 17,000 was spent in December 2019 to improve machinery covered by the patents and charged to the Patent account. Depreciation on fixed assets has been properly recorded for 2019 in accordance with Lees practice which provides a full years depreciation for property on hand June 30 and no depreciation otherwise. Lee uses the straight-line method fix all depreciation and amortization and amortizes its patents over their legal life. 2. On January 3. 2018, Lee purchased licensing Agreement No. 1, which was believed to have an indefinite useful life. The balance in the licensing Agreement No. 1 account includes its purchase price of 48,000 and costs of 2,000 related to the acquisition. On January 1, 2019, Lee purchased licensing Agreement No. 2, which has a life expectancy of 10 years. The balance in the Licensing Agreement No. 2 account includes its 48,000 purchase price and 2,000 in acquisition costs, but it has been reduced by a credit of 1,000 for the advance collection of 2020 revenue from the agreement. In late December 2018, an explosion caused a permanent 60% reduction in the expected revenue-producing value of licensing Agreement No. 1, and in January 2020 a flood caused additional damage that rendered the agreement worthless. 3. The balance in the Goodwill account includes (a) 8,000 paid December 30, 2018, for newspaper advertising for the next 4 years following the payment, and (b) legal costs of 16,000 incurred for Lees incorporation on January 3, 2018. 4. The Leasehold Improvements account includes (a) the 15,000 cost of improvements with a total estimated useful life of 12 years, which Lee, as tenant, made to leased premises in January 2018; (b) movable assembly line equipment costing 8,500 that was installed in the leased premises in December 2019; and (c) real estate taxes of 2,500 paid by Lee in 2019, which under the terms of the lease should have been paid by the land-lord. Lee paid its rent in full during 2019. A 10-year nonrenewable lease was signed January 3, 2018, fix the leased building that Lee used in manufacturing operations. 5. The balance in the Organization Costs account includes costs incurred during the organizational period. Required: Prepare a worksheet (spreadsheet) to adjust accounts that require adjustment and prepare financial statements. Formal adjusting journal entries and financial statements are not required. No intangible assets are impaired at the end of 2019. Ignore income taxes.On July 1, 2020, an entity decided to discontinue its Electronics Division, a separately identifiable component of business. On December 31,2020, the division has not been completely sold. However, negotiations for the final and complete sale are progressing in a positive manner and it is probable that the disposal will be completed within a year. Analysis of the records for the year disclosed the following data relative to the Electronics Division:Operating loss for 2020 8,000,000Loss on disposal of some Electronics Division assets during 2020 500,000Expected operating loss in 2021 preceding final disposal 1,000,000Expected gain in 2021 on disposal of division 2,000,000Income tax…On November 1, 2021, Jamison Inc. adopted a plan to discontinue its barge division, which qualifies as a separate component of the business according to GAAP regarding discontinued operations. The disposal of the division was expected to be concluded by April 30, 2022. On December 31, 2021, the company's year-end, the following information relative to the discontinued division was accumulated: Operating loss Jan. 1–Dec. 31, 2021 $ 65 million Estimated operating losses, Jan. 1 to April 30, 2022 80 million Excess of fair value, less costs to sell, over book value at Dec. 31, 2021 15 million In its income statement for the year ended December 31, 2021, Jamison would report a before-tax loss on discontinued operations of: Multiple Choice $65 million. $50 million. $130 million. $145 million.

- During 2020, SBD closed facilities which were made redundant by the acquisition of Niscayah. Assume that they recognized a charge of $125 associated with closures during 2020 of which $50 was for severance and other benefits to be paid to employees during 2021 and 2022 (the employees were terminated in 2020) and $75 million was for impairment of the property, plant and equipment. $40 of the severance was paid in 2021, with the remainder to be paid in 2022. What journal entries would SBD have recorded in 2020 and 2021?On January 1, 2021, Concretti Inc. had a division that met the criteria for discontinuance of a business component. For the period January 1 through October 15, 2021, the component had revenue of P500,000 and expenses of P800,000. The assets of the component were sold on October 15, 2021 at a loss of P100,000. How should Concretti report the component's operation for 2021? A. 500,000 and 800,000 should be included in continuing operationsB. 400,000 should be reported as loss on discontinued operationsC. 400,000 should be reported as an extraordinary lossD. 300,000 should be reported as loss on discontinued operationsOn January 1, 2021, Concretti Inc. had a division that met the criteria for discontinuance of a business component. For the period January 1 through October 15, 2021, the component had revenue of P500,000 and expenses of P800,000. The assets of the component were sold on October 15, 2021 at a loss of P100,000. How should Concretti report the component's operation for 2021?

- In February 2019, Wall Corp decided to sell its entire Plant division. The Plant division was a major part of Wall Corp’s business and the sale will result in a strategic change in direction for the company. The sale was completed in January 2020 and resulted in a gain on disposal of P500,000. In 2019 Plant’s net losses were P350,000 and P20,000 in 2020 up until the date of sale. Excluding taxation, what should the net gain/(loss) to be reported in the income statements of Wall Corp for its Plant division?In February 2019, Walley Corp decided to sell its entire Plant division. The Plant division was a major part of Walley Corp’s business and the sale will result in a strategic change in direction for the company. The sale was completed in January 2020 and resulted in a gain on disposal of P500,000. In 2019 Plant’s net losses were P350,000 and P20,000 in 2020 up until the date of sale. Excluding taxation, what should the net gain/(loss) to be reported in the income statements of Walley Corp for its Plant division? Select one: a. 2019 P 230,000 / 2020 P 0 b. 2019 (P 350,000) / 2020 P 480,000 c. 2019 P 0 / 2020 P 230,000 d. 2019 (P 350,000) / 2020 P 500,000Kandon Enterprises, Inc., has two operating divisions; one manufactures machinery and the other breeds and sells horses. Both divisions are considered separate components as defined by generally accepted accounting principles. The horse division has been unprofitable, and, on November 15, 2021, Kandon adopted a formal plan to sell the division. The sale was completed on April 30, 2022. At December 31, 2021, the component was considered held for sale.On December 31, 2021, the company’s fiscal year-end, the book value of the assets of the horse division was $240,000. On that date, the fair value of the assets, less costs to sell, was $200,000. The before-tax loss from operations of the division for the year was $140,000. The company’s effective tax rate is 25%. The after-tax income from continuing operations for 2021 was $400,000.Required:1. Prepare a partial income statement for 2021 beginning with income from continuing operations. Ignore EPS disclosures.2. Repeat requirement 1…

- On September 15, 2020, ZTH Inc.'s Board of Directors developed a formal plan to dispose of its Horse division and, the sale qualifies for discontinued operations treatement. On December 1, 2020 ZTH found a buyer for the Horse Division. The agreed sales price was $1,500,000 and ownership will transfer on Janury 31, 2021. ZTH's year end is December 31. Pertainent data related to the Horse Division is as follows: ZTH net income for the year ended December 31, 2020 (includes Horse division net income for the year) $1,840,000 Horse Division net income January 1-September 15, 2020 $325,000 Horse Division net loss September 15-December 31, 2020 -$150,000 Fair value less cost to sell of Horse Division's net assets $1,500,000 Carrying value of Horse Division's net assets $1,750,000 ZTH's tax rate is 25% on all sources of income. Net incomes and net losses reported above are net of taxes. ZTH prepares its financial statements in accordance with IFRS. Required: Prepare a partial statement of…Chance Company had two operating divisions, one manufacturing farm equipment and the other office supplies. Both divisions are considered separate components as defined by generally accepted accounting principles. The farm equipment component had been unprofitable, and on September 1, 2021, the company adopted a plan to sell the assets of the division. The actual sale was completed on December 15, 2021, at a price of $600,000. The book value of the division’s assets was $1,000,000, resulting in a before-tax loss of $400,000 on the sale. The division incurred a before-tax operating loss from operations of $120,000 from the beginning of the year through December 15. The income tax rate is 25%. Chance’s after-tax income from its continuing operations is $550,000.Required:Prepare an income statement for 2021 beginning with income from continuing operations. Include appropriate EPS disclosures assuming that 100,000 shares of common stock were outstanding throughout the year.Chance Company had two operating divisions, one manufacturing farm equipment and the other office supplies. Both divisions are considered separate components as defined by generally accepted accounting principles. The farm equipment component had been unprofitable, and on September 1, 2021, the company adopted a plan to sell the assets of the division. The actual sale was completed on December 15, 2021, at a price of $800,000. The book value of the division’s assets was $1,410,000, resulting in a before-tax loss of $610,000 on the sale.The division incurred a before-tax operating loss from operations of $260,000 from the beginning of the year through December 15. The income tax rate is 25%. Chance’s after-tax income from its continuing operations is $750,000. Required:Prepare an income statement for 2021 beginning with income from continuing operations. Include appropriate EPS disclosures assuming that 100,000 shares of common stock were outstanding throughout the year. (Amounts to be…