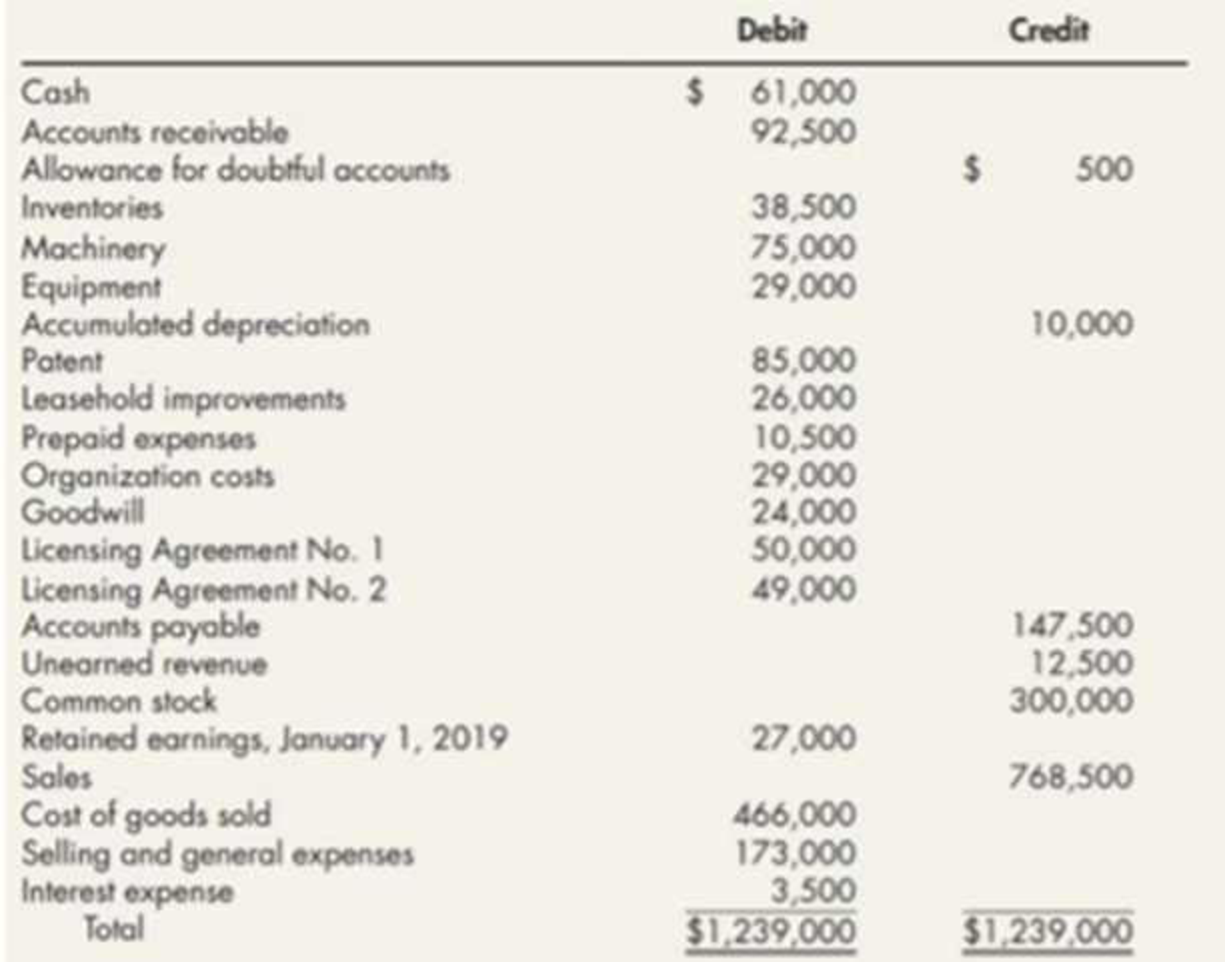

Lee Manufacturing Corporation was incorporated on January 3, 2018. The corporation’s financial statements for its first year’s operations were not examined by a CPA. You have been engaged to examine the financial statements for the year ended December 31, 2019, and your examination is substantially completed. Lee’s

The following information relates to accounts that may vet require adjustment:

- 1. Patents for Lee’s manufacturing process were acquired January 2, 2019, at a cost of $68,000. An additional $17,000 was spent in December 2019 to improve machinery covered by the patents and charged to the Patent account.

Depreciation on fixed assets has been properly recorded for 2019 in accordance with Lee’s practice which provides a full year’s depreciation for property on hand June 30 and no depreciation otherwise. Lee uses the straight-line method fix all depreciation and amortization and amortizes its patents over their legal life. - 2. On January 3. 2018, Lee purchased licensing Agreement No. 1, which was believed to have an indefinite useful life. The balance in the licensing Agreement No. 1 account includes its purchase price of $48,000 and costs of $2,000 related to the acquisition. On January 1, 2019, Lee purchased licensing Agreement No. 2, which has a life expectancy of 10 years. The balance in the Licensing Agreement No. 2 account includes its $48,000 purchase price and $2,000 in acquisition costs, but it has been reduced by a credit of $1,000 for the advance collection of 2020 revenue from the agreement. In late December 2018, an explosion caused a permanent 60% reduction in the expected revenue-producing value of licensing Agreement No. 1, and in January 2020 a flood caused additional damage that rendered the agreement worthless.

- 3. The balance in the

Goodwill account includes (a) $8,000 paid December 30, 2018, for newspaper advertising for the next 4 years following the payment, and (b) legal costs of $16,000 incurred for Lee’s incorporation on January 3, 2018. - 4. The Leasehold Improvements account includes (a) the $15,000 cost of improvements with a total estimated useful life of 12 years, which Lee, as tenant, made to leased premises in January 2018; (b) movable assembly line equipment costing $8,500 that was installed in the leased premises in December 2019; and (c) real estate taxes of $2,500 paid by Lee in 2019, which under the terms of the lease should have been paid by the land-lord. Lee paid its rent in full during 2019. A 10-year nonrenewable lease was signed January 3, 2018, fix the leased building that Lee used in manufacturing operations.

- 5. The balance in the Organization Costs account includes costs incurred during the organizational period.

Required:

Prepare a worksheet (spreadsheet) to adjust accounts that require adjustment and prepare financial statements. Formal

Trending nowThis is a popular solution!

Chapter 12 Solutions

Intermediate Accounting: Reporting And Analysis

- The following selected circumstances relate to pending lawsuits for Erismus, Incorporated Erismus’s fiscal year ends on December 31. Financial statements are issued in March 2025. Erismus prepares its financial statements according to U.S. GAAP. Required: Indicate the amount Erismus would record as an asset, a liability or if no accrual would be necessary in the following circumstances. Erismus is defending against a lawsuit. Erismus's management believes the company has a slightly worse than 50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,430,000. Erismus is defending against a lawsuit. Erismus's management believes it is probable that the company will lose in court. If it loses, management believes that damages could fall anywhere in the range of $2,830,000 to $5,660,000, with any damage in that range equally likely. Erismus is defending against a lawsuit. Erismus's management believes it is probable that the company will lose in court.…arrow_forwardWhen the records of Debra Hanson Corporation were reviewed at the close of 2021, the following errors were discovered. For each item, indicate by a check mark in the appropriate column whether the error resulted in an overstatement, an understatement, or had no effect on net income for the years 2020 and 2021. 2020 2021 Item Over-statement Under-statement No Effect Over-statement Under-statement No Effect 1. Failure to record amortization of patent in 2021. 2. Failure to record the correct amount of ending 2020 inventory. The amount was understated because of an error in calculation. 3. Failure to record merchandise purchased in 2020. Merchandise was also omitted from ending inventory in 2020 but was not yet sold. 4. Failure to record accrued interest on notes payable in 2020; that amount was recorded when paid in 2021. 5. Failure to reflect…arrow_forwardPolska SA, in preparation of its December 31, 2019, financial statements, is attempting todetermine the proper accounting treatment for each of the following situations.1. As a result of uninsured accidents during the year, personal injury suits for €350,000 and €60,000have been filed against the company. It is the judgment of Polska's legal counsel that an unfavorableoutcome is unlikely in the €60,000 case but that an unfavorable verdict approximating €250,000 willprobably result in the €350,000 case.2. Polska Corporation owns a subsidiary in a foreign country that has a book value of €5,725,000 andan estimated fair value of €9,500,000. The foreign government has communicated to Polska itsintention to expropriate the assets and business of all foreign investors. On the basis of settlementsother firms have received from this same country, it is virtually certain that Polska will receive 40%of the fair value of its properties as final settlement.3. Polska's chemical product division…arrow_forward

- Xing Fu ltd., in preparation of its December 31, 2019, financial statements, is attempting to determine the proper accounting treatment for each of the following situations.1. As a result of uninsured accidents during the year, personal injury suits for €175,000 and €50,000 have been filed against the company. It is the judgment of Xing Fu's legal counsel that an unfavorable outcome is unlikely in the €50,000 case but that an unfavorable verdict approximating €150,000 will probably result in the €175,000 case.2. Xing Fu owns a subsidiary in a foreign country that has a book value of €6,500,000 and an estimated fair value of €10,000,000. The foreign government has communicated to Xing Fu its intention to expropriate the assets and business of all foreign investors. On the basis of settlements other firms have received from this same country, it is virtually certain that Xing Fu will receive 50% of the fair value of its properties as final settlement.3. Xing Fu operates profitably from a…arrow_forwardOn November 5, 2020, a Dunn Company truck was in an accident with an auto driven by Bell. The entity received notice on January 12, 2021 of a lawsuit for P700,000 damages for personal injuries suffered by Bell. The entity's counsel believed it is probable that Bell will be awarded an estimated amount in the range between P200,000 and P500,000. The possible outcomes are equally likely. The accounting year ends on December 31 and the 2020 financial statements were issued on March 31, 2021. What amount of provision should be accrued on December 31, 2020?arrow_forwardROSE Company entered into a lawsuit on December 20, 2021 and recognized on the same date a provision of ₱2,000,000. On February 28, 2022, when the financial statements for the year ended December 31, 2021 had not yet been authorized for issue, the case was settled and the court decided the final total damages to be paid by the entity at ₱3,000,000. In addition, the Company has a loan payable of ₱2,000,000 due on June 30, 2022. On January 1, 2022, before the authorization of the issuance of financial statements, the bank agreed to refinance the loan, extending the maturity to June 30, 2024. Also, another loan amounting to ₱7,000,000 due on December 1, 2022 was obtained by the Company on January 2, 2022 from BPI. ROSE Company has the discretion to refinance or roll over the loan for at least twelve months from December 31, 2022. REQUIRED: 1. At what amount should the current liability be presented in the statement of financial position? 2. At what amount should the non-current…arrow_forward

- Sunshine Limited, in preparation of its December 31, 2020, financial statements, is attempting to determine theproper accounting treatment for each of the following situations.1. As a result of uninsured accidents during the year, personal injury suits for $350,000 and $60,000 have beenfiled against the company. It is the judgement of Sunshine’s legal counsel that an unfavourable outcome isunlikely in the $60,000 case but that an unfavourable verdict approximating $250,000 will probably result in the$350,000 case.2. Sunshine Limited owns a subsidiary in a foreign country that has a book value of $5,725,000 and an estimatedfair value of $9,500,000. The foreign government has communicated to Sunshine its intention to expropriate theassets and business of all foreign investors. On the basis of settlements other firms have received from this samecountry, it is virtually certain that Sunshine will receive 40% of the fair value of its properties as final settlement.3. Sunshine’s chemical…arrow_forwardTyeso Company entered into a lawsuit on December 25, 2020 and recognized on the same date a provision of P2,000,000. On February 28, 2021, when the financial statements for the year ended December 31, 2020 had not yet been authorized for issue, the case was settled and the court decided the final total damages to paid by the entity at P3,000,000. In addition, the Company has a loan payable of P2,000,000 due on June 30, 2021. On January 1, 2021, before the authorization of the issuance of financial statements, the bank agreed to refinance the loan, extending the maturity to June 30, 2023. Also, another loan amounting to P7,000,000 due on December 1, 2021 was obtained by the Company from BDO. TYESO Company has the discretion to refinance or roll over the loan for at least twelve months from December 31, 2021. 1. Compute for the current liability to be presented in the financial position a. P12 million b. P10 million c. P5 million d. P4 million Answer: 2. Compute for…arrow_forwardLeni Company had a balance of P820,000 in the professional fees expense account on December 31, 2020, before considering year-end adjustments relating to the following: ➢Consultants were hired for a special project at a total fee not to exceed P650,000.The entity had recorded P550,000 of these fees based on building for work performed in 2020. ➢The attorney’s letter requested by the auditor dated Jan. 31, 2021, indicated that legal fees of P60,000 were billed on Jan. 15, 2021 for worked performed in Nov.2020, and the unbilled fees for Dec. 31, 2020 were P70,000. What amount should be reported as professional fees expense for the year ended December 31, 2020?arrow_forward

- Euphoria Company had a balance of P820,000 in the professional fees expense account on December 31, 2020, before considering year-end adjustments relating to the following:➢ Consultants were hired for a special project at a total fee not to exceed P650,000. The entity had recorded P550,000 of these fees based on building for work performed in 2020.➢ The attorney’s letter requested by the auditor dated Jan. 31, 2021, indicated that legal fees of P60,000 were billed on Jan. 15, 2021 for worked performed in Nov. 2020, and the unbilled fees for Dec. 31, 2020 were P70,000.What amount should be reported as professional fees expense for the year ended December 31, 2020?arrow_forwardPolska SA, in preparation of its December 31, 2019, financial statements, is attempting to determine the proper accounting treatment for each of the following situations. As a result of uninsured accidents during the year, personal injury suits for €350,000 and €60,000 have been filed against the company. It is the judgment of Polska's legal counsel that an unfavorable outcome is unlikely in the €60,000 case but that an unfavorable verdict approximating €250,000 will probably result in the €350,000 case. Polska Corporation owns a subsidiary in a foreign country that has a book value of €5,725,000 and an estimated fair value of €9,500,000. The foreign government has communicated to Polska its intention to expropriate the assets and business of all foreign investors. On the basis of settlements other firms have received from this same country, it is virtually certain that Polska will receive 40% of the fair value of its properties as final settlement. Polska's chemical product division…arrow_forwardA corporation filed its Annual Income Tax Return for the taxable year 2018 on April 15, 2019 together with its required attachments such as the Audited Annual Financial Statements. On March 17, 2020, the company’s accountant discovered an error for excluding a sales amounting to 7,500,000 which comprises a 30% under declaration of sales. a. What necessary action must be done by the company in relation to its discovery? b. Assume that the company was subjected to a BIR audit or was issued a Letter of Authority (LOA) prior to the amendment of its Annual Income Tax Return, is the company allowed to make any amendment? Justify your answerarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning