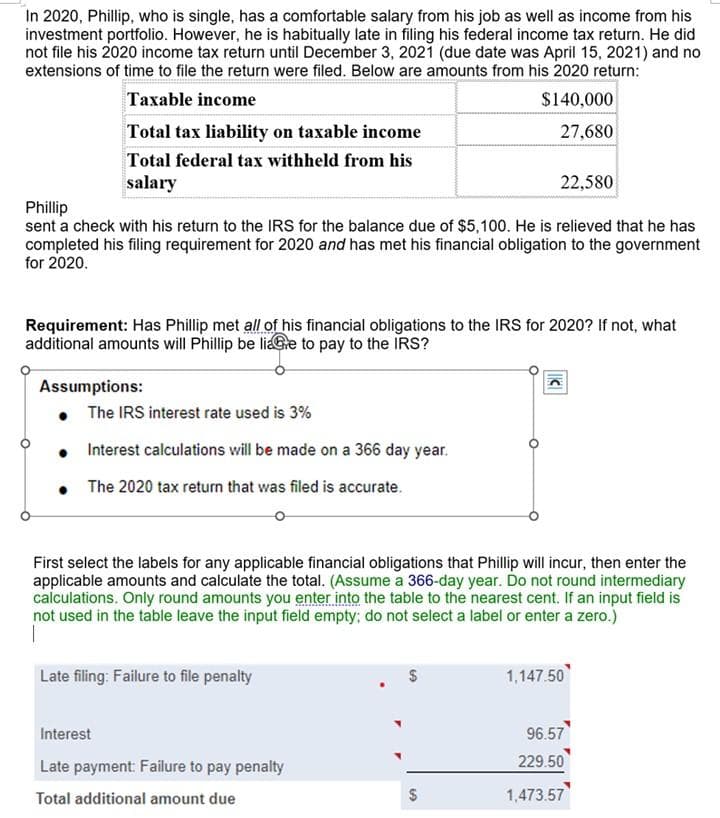

In 2020, Phillip, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal income tax return. He did not file his 2020 income tax return until December 3, 2021 (due date was April 15, 2021) and no extensions of time to file the return were filed. Below are amounts from his 2020 return: Taxable income $140,000 27,680 Total tax liability on taxable income Total federal tax withheld from his salary 22,580 Phillip sent a check with his return to the IRS for the balance due of $5,100. He is relieved that he has completed his filing requirement for 2020 and has met his financial obligation to the government for 2020. Requirement: Has Phillip met all of his financial obligations to the IRS for 2020? If not, what additional amounts will Phillip be liage to pay to the IRS? Assumptions: • • The IRS interest rate used is 3% Interest calculations will be made on a 366 day year. The 2020 tax return that was filed is accurate. First select the labels for any applicable financial obligations that Phillip will incur, then enter the applicable amounts and calculate the total. (Assume a 366-day year. Do not round intermediary calculations. Only round amounts you enter into the table to the nearest cent. If an input field is not used in the table leave the input field empty; do not select a label or enter a zero.) | Late filing: Failure to file penalty Interest Late payment: Failure to pay penalty Total additional amount due $ 60 O 1,147.50 96.57 229.50 1,473.57

In 2020, Phillip, who is single, has a comfortable salary from his job as well as income from his investment portfolio. However, he is habitually late in filing his federal income tax return. He did not file his 2020 income tax return until December 3, 2021 (due date was April 15, 2021) and no extensions of time to file the return were filed. Below are amounts from his 2020 return: Taxable income $140,000 27,680 Total tax liability on taxable income Total federal tax withheld from his salary 22,580 Phillip sent a check with his return to the IRS for the balance due of $5,100. He is relieved that he has completed his filing requirement for 2020 and has met his financial obligation to the government for 2020. Requirement: Has Phillip met all of his financial obligations to the IRS for 2020? If not, what additional amounts will Phillip be liage to pay to the IRS? Assumptions: • • The IRS interest rate used is 3% Interest calculations will be made on a 366 day year. The 2020 tax return that was filed is accurate. First select the labels for any applicable financial obligations that Phillip will incur, then enter the applicable amounts and calculate the total. (Assume a 366-day year. Do not round intermediary calculations. Only round amounts you enter into the table to the nearest cent. If an input field is not used in the table leave the input field empty; do not select a label or enter a zero.) | Late filing: Failure to file penalty Interest Late payment: Failure to pay penalty Total additional amount due $ 60 O 1,147.50 96.57 229.50 1,473.57

Chapter2: Income Tax Concepts

Section: Chapter Questions

Problem 35P

Related questions

Question

100%

Q - 67

Transcribed Image Text:In 2020, Phillip, who is single, has a comfortable salary from his job as well as income from his

investment portfolio. However, he is habitually late in filing his federal income tax return. He did

not file his 2020 income tax return until December 3, 2021 (due date was April 15, 2021) and no

extensions of time to file the return were filed. Below are amounts from his 2020 return:

Taxable income

$140,000

27,680

Total tax liability on taxable income

Total federal tax withheld from his

salary

Phillip

sent a check with his return to the IRS for the balance due of $5,100. He is relieved that he has

completed his filing requirement for 2020 and has met his financial obligation to the government

for 2020.

Requirement: Has Phillip met all of his financial obligations to the IRS for 2020? If not, what

additional amounts will Phillip be liage to pay to the IRS?

Assumptions:

The IRS interest rate used is 3%

Interest calculations will be made on a 366 day year.

The 2020 tax return that was filed is accurate.

22,580

First select the labels for any applicable financial obligations that Phillip will incur, then enter the

applicable amounts and calculate the total. (Assume a 366-day year. Do not round intermediary

calculations. Only round amounts you enter into the table to the nearest cent. If an input field is

not used in the table leave the input field empty; do not select a label or enter a zero.)

|

Late filing: Failure to file penalty

Interest

Late payment: Failure to pay penalty

Total additional amount due

S

1,147.50

96.57

229.50

1,473.57

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT