Tisti purchased a residence this year. This voor Misti recei

Chapter10: Deductions And Losses: Certain Itemized Deductions

Section: Chapter Questions

Problem 2BCRQ

Related questions

Question

F.26.

Transcribed Image Text:12.

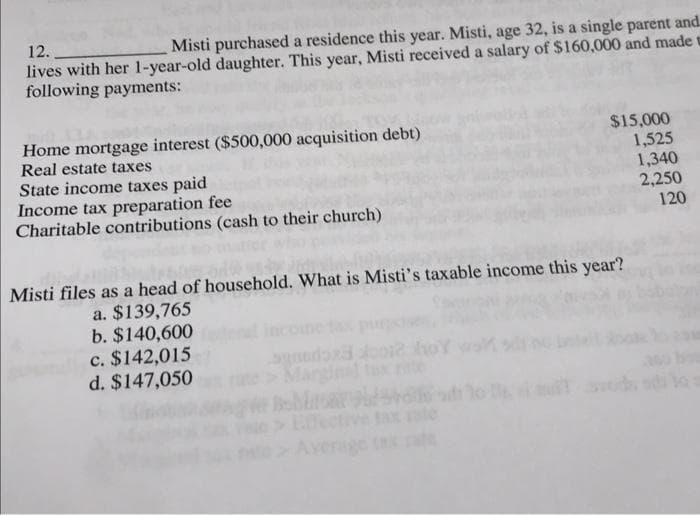

Misti purchased a residence this year. Misti, age 32, is a single parent and

lives with her 1-year-old daughter. This year, Misti received a salary of $160,000 and made

following payments:

Home mortgage interest ($500,000 acquisition debt)

Real estate taxes

State income taxes paid

Income tax preparation fee

Charitable contributions (cash to their church)

Misti files as a head of household. What is Misti's taxable income this year?

a. $139,765

b. $140,600ndenad

c. $142,015

d. $147,050

ognadoxa 40012

Marginal

$15,000

1,525

1,340

2,250

120

ho

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you