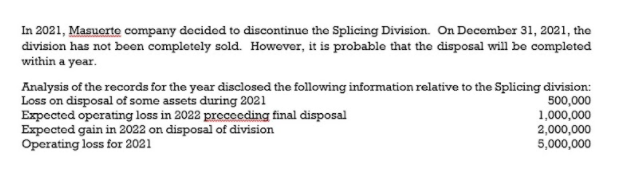

In 2021, Masuerte company decided to discontinue the Splicing Division. On December 31, 2021, the division has not boen completely sold. However, it is probable that the disposal will be completed within a year. Analysis of the records for the year disclosed the following information relative to the Splicing division: Loss on disposal of some assets during 2021 Expected operating loss in 2022 precceding final disposal Expected gain in 2022 on disposal of division Operating loss for 2021 500,000 1,000,000 2,000,000 5,000,000

Q: Weekly

A: Weekly cycle billing helps inconsistently the cash flow and makes work simpler and free from errors.

Q: Widgets & Gadgets in a merchandiser that sells gadgets and widgets. They had the following transacti...

A: Journal Entry The purpose of preparing the journal entry to enter the required transaction into debi...

Q: Calculate the retained earnings of P Company immediately after the combination:

A: Net assets of S company = Total assets - total liabilities = P 8,000,000 - P 2,000,000 = P 6,000,0...

Q: Alpha Beta Inc. was organized on Jan. 1, 2021. It is authorized to issue 20,000 preference shares wi...

A: GIVEN Jan 10 issued 10,000 ordinary shares for cash at P35 per share Mar 1 Issued 10,000 prefere...

Q: On January 1, 20X9, Ute Company acquired 70 percent of Cougar Company's common shares at the underly...

A: Non-controlling interest refers to when a company has no control over the decision of the shares not...

Q: TROPA Inc. was incorporated on January 1, 2020, Information about its authorized shares is shown bel...

A: Total shareholders equity will consists of Equity share capital and securities premium and reserves ...

Q: Golf Corporation estimates that its production for the coming year will be 25,000 units, which is 90...

A: The predetermined overhead rate can be calculated by dividing the total estimated overhead by differ...

Q: ou are an audit senior in Riskam and Co and you are commencing the planning of the audit of CariBev ...

A: Audit risks refer to the risk of material misstatements that are identified during the planning stag...

Q: How is the beginning value for the second year got from the table below

A:

Q: Accounts Debit Credit Cash 5,450 Accounts Receivable 16,200 Supplies Prepaid Insurance Equipment Not...

A: The adjustment entries are prepared to adjust the revenue and expenses for the current period.

Q: On January 1, 20xx, A, B, C and D formed 5G Trading Co., a partnership with capital 4. contributions...

A: Partnership is the type of business in which two or more interested persons join hands by contributi...

Q: Bulldogs Inc. expected to sell in October 2021 1,000 units of Dell laptops with a purchase cost per ...

A: Sales price variance = ( Actual price - standard Price ) x Units Sold Sales Price - Cost = Gross Pro...

Q: Discuss why adherence by the accounting profession to a single, GAAP-based view is inappropriate.

A: Accounting Profession: The role of an accountant is to maintain and analyse financial records, which...

Q: Daring watercraft manufactures small boats. Materials are added at the beginning of the process and ...

A: Answer:- Production cost report:- The production cost report basically describes the production and...

Q: 4 The performance obligation is satisfied over time. However, performance obligation but expects to ...

A: As it cannot be reasonably measure the outcome of the performance obligation but expects to recover ...

Q: The following information were gathered from 3 Stripes Company for the month ended December 31, 2022...

A: Statement of proof of cash is prepared to reconcile the balance as per bank book and bank column of ...

Q: How can the separate entity concept benefit the owner and the business

A: Separate entity concept: It refers to the practice of Recording separately the transactions of the B...

Q: The change in the credit policy would result to increase (decrease) in incremental profit of (Use 36...

A: Profits without Incremental Sales: Sales : P30,00,000 (-) Cost of products (P30,00,000 X 4...

Q: Which of the following statements is most correct?

A: Companies or government require funds and for that sometimes they issue the bonds or debentures inst...

Q: Upperchurch Company reports the following components of stockholders' equity on January 1. Common st...

A: Date Transaction Impact on Equity Amount Jan'1 Total Stockholders' Equity - January'1 $ 98...

Q: ABC Company leases equipment to its customers under non-cancelable leases. On January 1,2019, ABC Co...

A: Workings: We know the formulas: Gross investment in the lease: It refers to the total amount of MLP ...

Q: Real Sdn Bhd did not keep his books of accounts under double entry system. Depreciation on Non-curre...

A: Ledgers: When information from the journals is sorted and summarized, it is entered as debits and c...

Q: (The following information applies to the questions displayed below.] Lone Star Company is a calenda...

A: Dividend Income: Dividend income is the amount of money paid to stockholders from a corporation's pr...

Q: Please answer this correctly. Thank you:) 1. Describe the two economic events that occur for payrol...

A: Payroll is the compensation an employer pay to its employees for a set period or on a given date.

Q: arcia Com

A: These are the accounting transactions that are having a monetary impact on the financial statement o...

Q: PART 2 All Things Brass produces brass handles for the furniture industry in a four-stage process -M...

A: 1.) Statement of Equivalent Production Input output Input cost Direct Material Added Conversion ...

Q: ,pppPeter operates a dental office in his home. The office occupies 250 square feet of his residence...

A: The cost of operations incurred by a firm in order to earn revenue is referred to as its expenditure...

Q: A firm with seasonal sales would probably select which of the following types of loans from a bank t...

A: Seasonal sales where the products of the company would be sold only in particular season of the year...

Q: Profit center responsibility reporting for a service company Red Line Railroad Inc. has three regio...

A: East West Central Revenues 1,400,000 2,000,000 3,200,000 Operating expenses 800,000 1,350,000 ...

Q: The following trial balance was extracted from the books of Movies To The Max Ltd at July 31, the en...

A: Adjusting journal entries Multi-step income statement

Q: page Corporation manufactures two products with the following characteristics. Unit Contribution Mac...

A: Limiting factor is that factor which is available in limited quantity. Limiting factor should be pru...

Q: Mike Greenberg opened Monty Window Washing Co. on July 1, 2022. During July, the following transacti...

A:

Q: ABC Company is engaged in leasing equipment. An equipment was delivered to a lessee on December 31,2...

A: Lease receivable for the lessor is calculated as sum total of Present Value of Annual Lease payments...

Q: On January 1,2020, ABC Company leased its equipment to DEF Company under a 3 year operating lease at...

A: Lease rent include all fixed rent ,bouns and additional rent. Following is the ABC Company's rent re...

Q: Upperchurch Company reports the following components of stockholders' equity on January 1. Common st...

A: UPPERCHURCH CORPORATION Stockholders' Equity Section of the Balance Sheet December'31 Common S...

Q: Turner, Roth, and Lowe are partners who share income and loss in a 1:4:5 ratio (in percents: Turner,...

A: Solution Partnership is an arrangement between two or more people to oversee business operations and...

Q: A company manufactures Cricket Bats. In May 2010 the budgeted sales and production were 19,000 bats ...

A: In this question, we have to calculate different variances.

Q: market value The annual ope d will increas

A: Given, MARR = 10% per year

Q: Exclusive Souvenirs Hut does customize, hand-crafted memorabilia for hotels, in which each batch of ...

A: The overhead is overapplied when applied overhead is more than the actual overhead incurred during t...

Q: 1. Prepare the journal entries to record the February transactions. 2. Set up the following ledger a...

A: Journalizing- Journalizing is the method used by businesses to keep track of their transactions in a...

Q: Total consideration from share issuances amounted to P3,000,000. A land and building were acquired t...

A: GIVEN Total consideration from share issuances amounted to P3,000,000. A land and building were a...

Q: On December 31, 2019, the balance sheet for the XYZ Partnership follows: The percentages shown are ...

A: At the time of liquidation first the outside liabilities are settled and then if any cash remain it ...

Q: What is trail balance ? What are the features and reasons for its preparation?

A: A trial balance is indeed a statement that summarizes the closing balances of all ledger accounts an...

Q: State and explain five differences between a job costing system and process costing system.

A: Job Costing System: This is the method of costing where cost related to each specific job is determi...

Q: Complete this question by entering your answers in the tabs below. c. Compute the production costs f...

A: activity based costing is a such a method that is used in order to assign the overhead and indirect ...

Q: A company just starting business made the following four inventory purchases in June: Number of unit...

A: Average cost per unit = Total cost Total number of units purchased ...

Q: HBB Beverages and Fizzy Sodas are two of the largest and most successful beverage companies in the w...

A: Answer) Calculation of receivable turnover ratios Formula: Receivable turnover ratio = Net Credit Sa...

Q: Greenwood Company manufactures two products—15,000 units of Product Y and 7,000 units of Product Z. ...

A: The Activity based costing is the modern technique to assign cost to various activities. The cost of...

Q: . An analysis of clerical costs in the billing department of Craig Company indicates that total unit...

A: The Total Cost is calculated as sum of Total Fixed Cost and Total Variable Cost. The Variable Cost p...

Q: Lavage Rapide is a Canadian company that owns and operates a large automatic car wash facility near ...

A: Lets understand the basics. For calculating activity variance, budgeted cost for decided activity is...

What amount should be reported as pretax loss from discontinued operations in 2021?

Step by step

Solved in 2 steps

- During 2019, White Company determined that machinery previously depreciated over a 7-year life had a total estimated useful life of only 5 years. An accounting change was made in 2019 to reflect the change in estimate. If the change had been made in 2018, accumulated depreciation at December 31, 2018, would have been 1,600,000 instead of 1,200,000. As a result of this change, the 2019 depreciation expense was 100,000 greater than it would have been if no change were made. Ignoring income tax considerations, what is the proper amount of the adjustment to Whites January 1, 2019, balance of retained earnings? a. 0 b. 100,000 c. 280,000 d. 400,000Comprehensive: Acquisition, Subsequent Expenditures, and Depreciation On January 2, 2019, Lapar Corporation purchased a machine for 50,000. Lapar paid shipping expenses of 500, as well as installation costs of 1,200. The company estimated that the machine would have a useful life of 10 years and a residual value of 3,000. On January 1, 2020, Lapar made additions costing 3,600 to the machine in order to comply with pollution-control ordinances. These additions neither prolonged the life of the machine nor increased the residual value. Required: 1. If Lapar records depreciation expense under the straight-line method, how much is the depreciation expense for 2020? 2. Assume Lapar determines the machine has three significant components as shown below. If Lapar uses IFRS, what is the amount of depreciation expense that would be recorded?On May 1, 2015, Zoe Inc. purchased Branta Corp. for $15,000,000 in cash. They only received $12,000,000 in net assets. In 2016, the market value of the goodwill obtained from Branta Corp. was valued at $4,000,000, but in 2017 it dropped to $2,000,000. Prepare the journal entry for the creation of goodwill and the entry to record any impairments to it in subsequent years.

- At the beginning of 2020, Holden Companys controller asked you to prepare correcting entries for the following three situations: 1. Machine X was purchased for 100,000 on January 1, 2015. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 45,000. The estimated residual value remains at 10,000, but the service life is now estimated to be 1 year longer than originally estimated. 2. Machine Y was purchased for 40,000 on January 1, 2018. It had an estimated residual value of 4,000 and an estimated service life of 8 years. It has been depreciated under the sum-of-the-years-digits method for 2 years. Now, the company has decided to change to the straight-line method. 3. Machine Z was purchased for 80,000 on January 1, 2019. Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value is 8,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry for each situation to record the depreciation for 2020. Ignore income taxes.During 2019, Ryel Companys controller asked you to prepare correcting journal entries for the following three situations: 1. Machine A was purchased for 50,000 on January 1, 2014. Straight-line depreciation has been recorded for 5 years, and the Accumulated Depreciation account has a balance of 25,000. The estimated residual value remains at 5,000, but the service life is now estimated to be 1 year longer than estimated originally. 2. Machine B was purchased for 40,000 on January 1, 2017. It had an estimated residual value of 5,000 and an estimated service life of 10 years. it has been depreciated under the double-declining-balance method for 2 years. Now, at the beginning of the third year, Ryel has decided to change to the straight-line method. 3. Machine C was purchased for 20,000 on January 1, 2018, Double-declining-balance depreciation has been recorded for 1 year. The estimated residual value of the machine is 2,000 and the estimated service life is 5 years. The computation of the depreciation erroneously included the estimated residual value. Required: Prepare any necessary correcting journal entries for each situation. Also prepare the journal entry necessary for each situation to record depreciation expense for 2019.At the end of 2020, Magenta Manufacturing Company discovered that construction cost had been capitalized as a cost of the factory building in 2015 when it should have been treated as a cost of production equipment installation costs. As a result of the misclassification, the depreciation through 2018 was understated by 110,000, and depreciation for 2019 was understated by 90,000. What would be the consequences of correcting for the misclassification of the property cost? a. The taxpayer uses the FIFO inventory method, and 25% of goods produced during the period were included in the ending inventory. b. The taxpayer uses the LIFO inventory method, and no new LIFO layer was added during 2019.

- On January 1, 2014, Klinefelter Company purchased a building for 520,000. The building had an estimated life of 20 years and an estimated residual value of 20,000. The company has been depreciating the building using straight-line depreciation. At the beginning of 2020, the following independent situations occur: a. The company estimates that the building has a remaining life of 10 years (for a total of 16 years). b. The company changes to the sum-of-the-years-digits method. c. The company discovers that it had ignored the estimated residual value in the computation of the annual depreciation each year. Required: For each of the independent situations, prepare all journal entries related to the building for 2020. Ignore income taxes.The following are independent errors: a. In January 2019, repair costs of 9,000 were debited to the Machinery account. At the beginning of 2019, the book value of the machinery was 100,000. No residual value is expected, the remaining estimated life is 10 years, and straight-line depreciation is used. b. All purchases of materials for construction contracts still in progress have been immediately expensed. It is discovered that the use of these materials was 10,000 during 2018 and 12,000 during 2019. c. Depreciation on manufacturing equipment has been excluded from manufacturing costs and treated as a period expense. During 2019, 40,000 of depreciation was accounted for in that manner. Production was 15,000 units during 2019, of which 3,000 remained in inventory at the end of the year. Assume there was no inventory at the beginning of 2019. Required: Prepare journal entries for the preceding errors discovered during 2020. Ignore income taxes.Gray Companys financial statements showed income before income taxes of 4,030,000 for the year ended December 31, 2020, and 3,330,000 for the year ended December 31, 2019. Additional information is as follows: Capital expenditures were 2,800,000 in 2020 and 4,000,000 in 2019. Included in the 2020 capital expenditures is equipment purchased for 1,000,000 on January 1, 2020, with no salvage value. Gray used straight-line depreciation based on a 10-year estimated life in its financial statements. As a result of additional information now available, it is estimated that this equipment should have only an 8-year life. Gray made an error in its financial statements that should be regarded as material. A payment of 180,000 was made in January 2020 and charged to expense in 2020 for insurance premiums applicable to policies commencing and expiring in 2019. No liability had been recorded for this item at December 31, 2019. The allowance for doubtful accounts reflected in Grays financial statements was 7,000 at December 31, 2020, and 97,000 at December 31, 2019. During 2020, 90,000 of uncollectible receivables were written off against the allowance for doubtful accounts. In 2019, the provision for doubtful accounts was based on a percentage of net sales. The 2020 provision has not yet been recorded. Net sales were 58,500,000 for the year ended December 31, 2020, and 49,230,000 for the year ended December 31, 2019. Based on the latest available facts, the 2020 provision for doubtful accounts is estimated to be 0.2% of net sales. A review of the estimated warranty liability at December 31, 2020, which is included in other liabilities in Grays financial statements, has disclosed that this estimated liability should be increased 170,000. Gray has two large blast furnaces that it uses in its manufacturing process. These furnaces must be periodically relined. Furnace A was relined in January 2014 at a cost of 230,000 and in January 2019 at a cost of 280,000. Furnace B was relined for the first time in January 2020 at a cost of 300,000. In Grays financial statements, these costs were expensed as incurred. Since a relining will last for 5 years, Grays management feels it would be preferable to capitalize and depreciate the cost of the relining over the productive life of the relining. Gray has decided to nuke a change in accounting principle from expensing relining costs as incurred to capitalizing them and depreciating them over their productive life on a straight-line basis with a full years depreciation in the year of relining. This change meets the requirements for a change in accounting principle under GAAP. Required: 1. For the years ended December 31, 2020 and 2019, prepare a worksheet reconciling income before income taxes as given previously with income before income taxes as adjusted for the preceding additional information. Show supporting computations in good form. Ignore income taxes and deferred tax considerations in your answer. The worksheet should have the following format: 2. As of January 1, 2020, compute the retrospective adjustment of retained earnings for the change in accounting principle from expensing to capitalizing relining costs. Ignore income taxes and deferred tax considerations in your answer.

- On November 1, 2021, Jamison Inc. adopted a plan to discontinue its barge division, which qualifies as a separate component of the business according to GAAP regarding discontinued operations. The disposal of the division was expected to be concluded by April 30, 2022. On December 31, 2021, the company's year-end, the following information relative to the discontinued division was accumulated: Operating loss Jan. 1–Dec. 31, 2021 $ 65 million Estimated operating losses, Jan. 1 to April 30, 2022 80 million Excess of fair value, less costs to sell, over book value at Dec. 31, 2021 15 million In its income statement for the year ended December 31, 2021, Jamison would report a before-tax loss on discontinued operations of: Multiple Choice $65 million. $50 million. $130 million. $145 million.During 2020, SBD closed facilities which were made redundant by the acquisition of Niscayah. Assume that they recognized a charge of $125 associated with closures during 2020 of which $50 was for severance and other benefits to be paid to employees during 2021 and 2022 (the employees were terminated in 2020) and $75 million was for impairment of the property, plant and equipment. $40 of the severance was paid in 2021, with the remainder to be paid in 2022. What journal entries would SBD have recorded in 2020 and 2021?On July 1, 2020, an entity decided to discontinue its Electronics Division, a separately identifiable component of business. On December 31,2020, the division has not been completely sold. However, negotiations for the final and complete sale are progressing in a positive manner and it is probable that the disposal will be completed within a year. Analysis of the records for the year disclosed the following data relative to the Electronics Division:Operating loss for 2020 8,000,000Loss on disposal of some Electronics Division assets during 2020 500,000Expected operating loss in 2021 preceding final disposal 1,000,000Expected gain in 2021 on disposal of division 2,000,000Income tax…