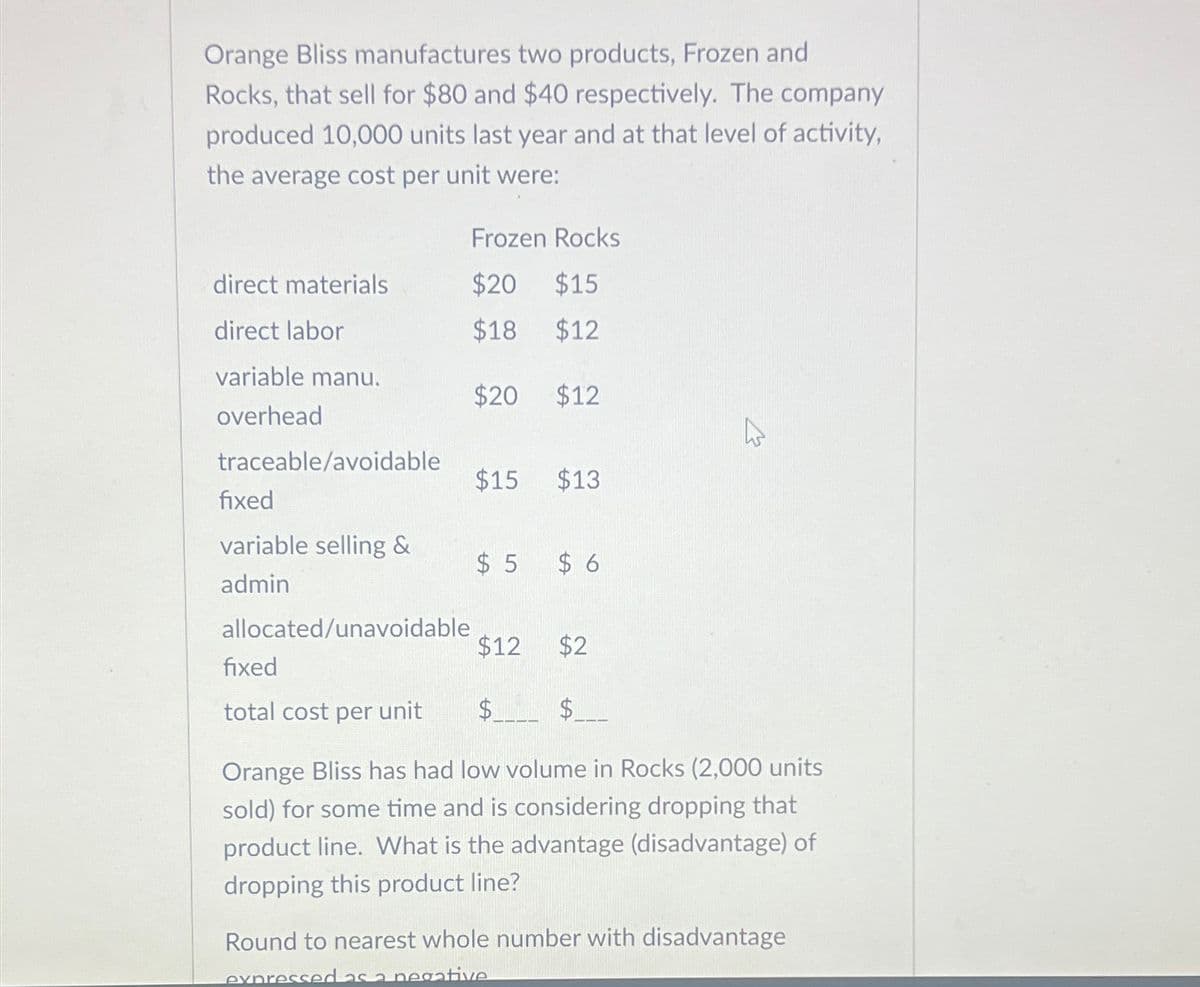

Orange Bliss manufactures two products, Frozen and Rocks, that sell for $80 and $40 respectively. The company produced 10,000 units last year and at that level of activity, the average cost per unit were: Frozen Rocks direct materials $20 $15 direct labor $18 $12 variable manu. $20 $12 overhead traceable/avoidable $15 $13 fixed variable selling & $ 5 $ 6 admin allocated/unavoidable $12 $2 fixed total cost per unit $ $ 13 Orange Bliss has had low volume in Rocks (2,000 units sold) for some time and is considering dropping that product line. What is the advantage (disadvantage) of dropping this product line? Round to nearest whole number with disadvantage expressed as a negative

Orange Bliss manufactures two products, Frozen and Rocks, that sell for $80 and $40 respectively. The company produced 10,000 units last year and at that level of activity, the average cost per unit were: Frozen Rocks direct materials $20 $15 direct labor $18 $12 variable manu. $20 $12 overhead traceable/avoidable $15 $13 fixed variable selling & $ 5 $ 6 admin allocated/unavoidable $12 $2 fixed total cost per unit $ $ 13 Orange Bliss has had low volume in Rocks (2,000 units sold) for some time and is considering dropping that product line. What is the advantage (disadvantage) of dropping this product line? Round to nearest whole number with disadvantage expressed as a negative

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter20: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 4CMA: Eagle Brand Inc. produces two products as follows: Eagle Brand has 1,000 lbs. of raw materials that...

Related questions

Question

Transcribed Image Text:Orange Bliss manufactures two products, Frozen and

Rocks, that sell for $80 and $40 respectively. The company

produced 10,000 units last year and at that level of activity,

the average cost per unit were:

Frozen Rocks

direct materials

$20 $15

direct labor

$18

$12

variable manu.

$20 $12

overhead

traceable/avoidable

$15

$13

fixed

variable selling &

$ 5

$ 6

admin

allocated/unavoidable

$12

$2

fixed

total cost per unit

$

$

13

Orange Bliss has had low volume in Rocks (2,000 units

sold) for some time and is considering dropping that

product line. What is the advantage (disadvantage) of

dropping this product line?

Round to nearest whole number with disadvantage

expressed as a negative

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning