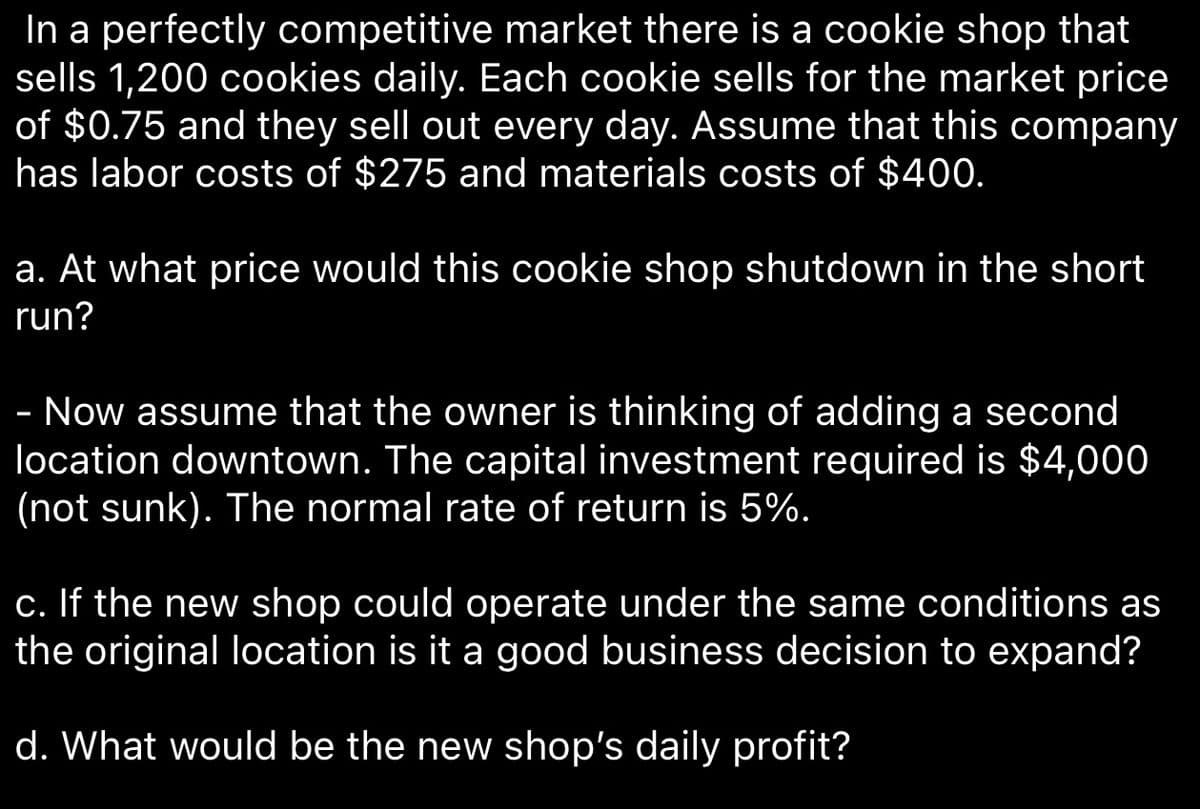

In a perfectly competitive market there is a cookie shop that sells 1,200 cookies daily. Each cookie sells for the market price of $0.75 and they sell out every day. Assume that this company has labor costs of $275 and materials costs of $400. a. At what price would this cookie shop shutdown in the short run? - Now assume that the owner is thinking of adding a second location downtown. The capital investment required is $4,000 (not sunk). The normal rate of return is 5%. c. If the new shop could operate under the same conditions as the original location is it a good business decision to expand? d. What would be the new shop's daily profit?

In a perfectly competitive market there is a cookie shop that sells 1,200 cookies daily. Each cookie sells for the market price of $0.75 and they sell out every day. Assume that this company has labor costs of $275 and materials costs of $400. a. At what price would this cookie shop shutdown in the short run? - Now assume that the owner is thinking of adding a second location downtown. The capital investment required is $4,000 (not sunk). The normal rate of return is 5%. c. If the new shop could operate under the same conditions as the original location is it a good business decision to expand? d. What would be the new shop's daily profit?

Chapter11: The Firm: Production And Costs

Section: Chapter Questions

Problem 21P

Related questions

Question

Please answer parts C and D:

Transcribed Image Text:In a perfectly competitive market there is a cookie shop that

sells 1,200 cookies daily. Each cookie sells for the market price

of $0.75 and they sell out every day. Assume that this company

has labor costs of $275 and materials costs of $400.

a. At what price would this cookie shop shutdown in the short

run?

- Now assume that the owner is thinking of adding a second

location downtown. The capital investment required is $4,000

(not sunk). The normal rate of return is 5%.

c. If the new shop could operate under the same conditions as

the original location is it a good business decision to expand?

d. What would be the new shop's daily profit?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc