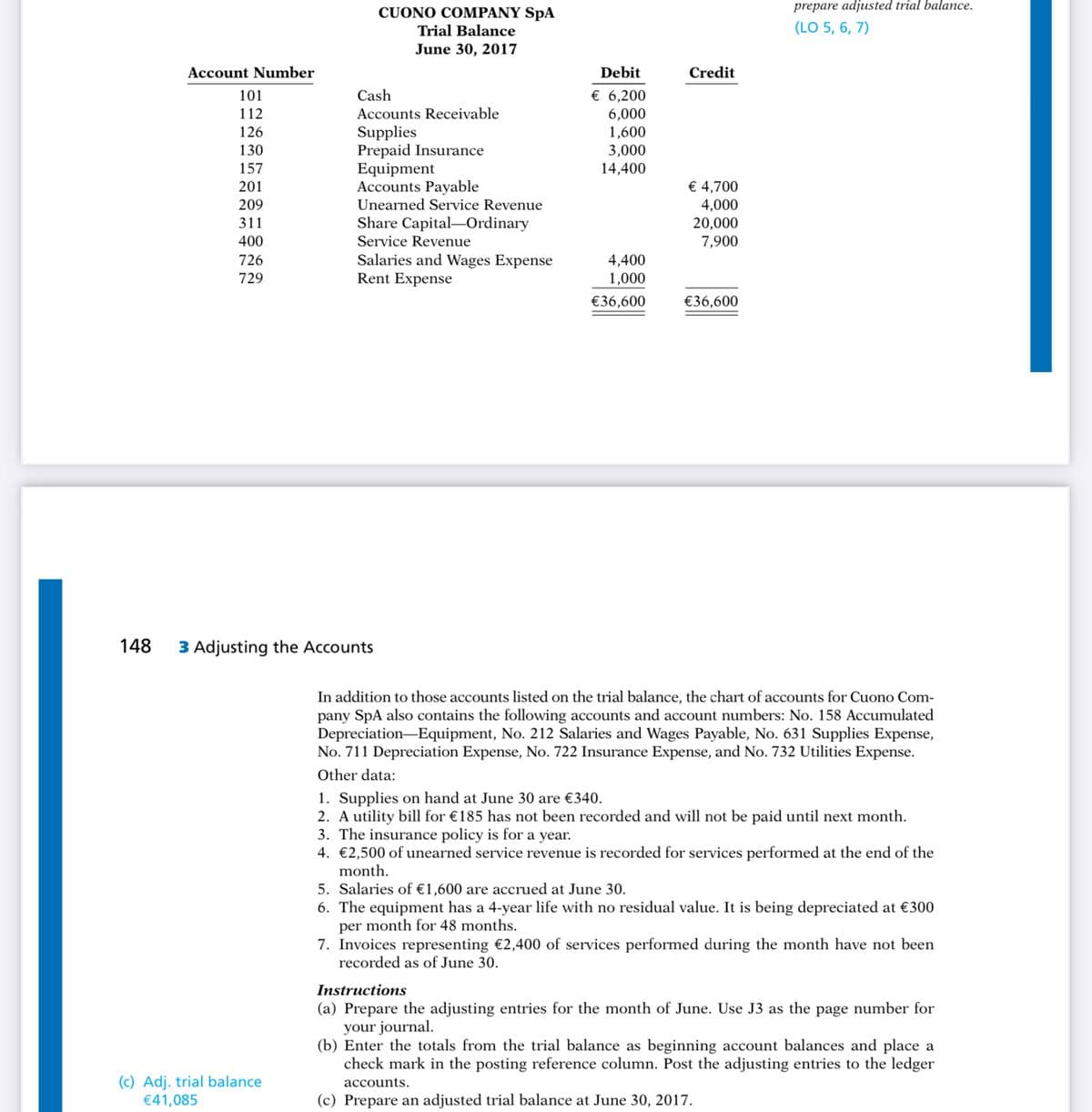

In addition to those accounts listed on the trial balance, the chart of accounts for Cuono Com- pany SpA also contains the following accounts and account numbers: No. 158 Accumulated Depreciation-Equipment, No. 212 Salaries and Wages Payable, No. 631 Supplies Expense, No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 732 Utilities Expense. Other data: 1. Supplies on hand at June 30 are €340. 2. A utility bill for €185 has not been recorded and will not be paid until next month. 3. The insurance policy is for a year. 4. €2,500 of unearned service revenue is recorded for services performed at the end of the month. 5. Salaries of €1,600 are accrued at June 30. 6. The equipment has a 4-year life with no residual value. It is being depreciated at €300 per month for 48 months. 7. Invoices representing €2,400 of services performed during the month have not been recorded as of June 30. Instructions (a) Prepare the adjusting entries for the month of June. Use J3 as the page number for your journal. (b) Enter the totals from the trial balance as beginning account balances and place a check mark in the posting reference column. Post the adjusting entries to the ledger dj. trial balance 41,085 accounts. (c) Prepare an adjusted trial balance at June 30, 2017.

In addition to those accounts listed on the trial balance, the chart of accounts for Cuono Com- pany SpA also contains the following accounts and account numbers: No. 158 Accumulated Depreciation-Equipment, No. 212 Salaries and Wages Payable, No. 631 Supplies Expense, No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 732 Utilities Expense. Other data: 1. Supplies on hand at June 30 are €340. 2. A utility bill for €185 has not been recorded and will not be paid until next month. 3. The insurance policy is for a year. 4. €2,500 of unearned service revenue is recorded for services performed at the end of the month. 5. Salaries of €1,600 are accrued at June 30. 6. The equipment has a 4-year life with no residual value. It is being depreciated at €300 per month for 48 months. 7. Invoices representing €2,400 of services performed during the month have not been recorded as of June 30. Instructions (a) Prepare the adjusting entries for the month of June. Use J3 as the page number for your journal. (b) Enter the totals from the trial balance as beginning account balances and place a check mark in the posting reference column. Post the adjusting entries to the ledger dj. trial balance 41,085 accounts. (c) Prepare an adjusted trial balance at June 30, 2017.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Joey Cuono started his own consulting firm, Cuono Company SpA on June 1, 2017. The

Transcribed Image Text:prepare adjusted trial balance.

CUONO COMPANY SpA

Trial Balance

(LO 5, 6, 7)

June 30, 2017

Account Number

Debit

Credit

101

Cash

€ 6,200

112

Accounts Receivable

6,000

1,600

3,000

14,400

Supplies

Prepaid Insurance

Equipment

Accounts Payable

Unearned Service Revenue

Share Capital–Ordinary

126

130

157

€ 4,700

4,000

201

209

311

20,000

7,900

400

Service Revenue

Salaries and Wages Expense

Rent Expense

726

4,400

729

1,000

€36,600

€36,600

148

3 Adjusting the Accounts

In addition to those accounts listed on the trial balance, the chart of accounts for Cuono Com-

pany SpA also contains the following accounts and account numbers: No. 158 Accumulated

Depreciation-Equipment, No. 212 Salaries and Wages Payable, No. 631 Supplies Expense,

No. 711 Depreciation Expense, No. 722 Insurance Expense, and No. 732 Utilities Expense.

Other data:

1. Supplies on hand at June 30 are €340.

2. A utility bill for €185 has not been recorded and will not be paid until next month.

3. The insurance policy is for a year.

4. €2,500 of unearned service revenue is recorded for services performed at the end of the

month.

5. Salaries of €1,600 are accrued at June 30.

6. The equipment has a 4-year life with no residual value. It is being depreciated at €300

per month for 48 months.

7. Invoices representing €2,400 of services performed during the month have not been

recorded as of June 30.

Instructions

(a) Prepare the adjusting entries for the month of June. Use J3 as the page number for

your journal.

(b) Enter the totals from the trial balance as beginning account balances and place a

check mark in the posting reference column. Post the adjusting entries to the ledger

(c) Adj. trial balance

€41,085

accounts.

(c) Prepare an adjusted trial balance at June 30, 2017.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education