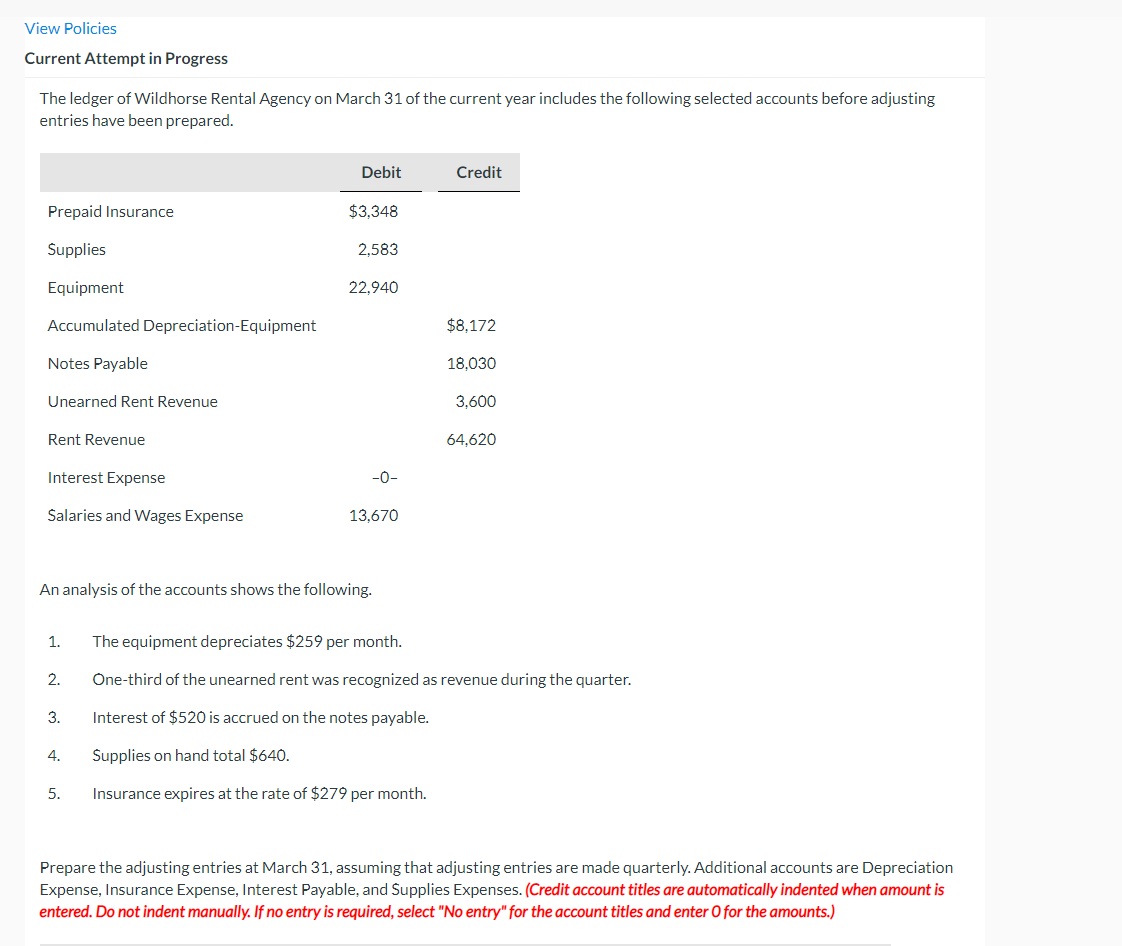

The ledger of Wildhorse Rental Agency on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared. Debit Credit Prepaid Insurance $3,348 Supplies 2,583 Equipment 22,940 Accumulated Depreciation-Equipment $8,172 Notes Payable 18,030 Unearned Rent Revenue 3,600 Rent Revenue 64.620 Interest Expense -0- Salaries and Wages Expense 13,670 An analysis of the accounts shows the following. 1. The equipment depreciates $259 per month. 2. One-third of the unearned rent was recognized as revenue during the quarter. 3. Interest of $520 is accrued on the notes payable. 4. Supplies on hand total $640. 5. Insurance expires at the rate of $279 per month. Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts are Depreciation Expense, Insurance Expense, Interest Payable, and Supplies Expenses. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.)

The ledger of Wildhorse Rental Agency on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared. Debit Credit Prepaid Insurance $3,348 Supplies 2,583 Equipment 22,940 Accumulated Depreciation-Equipment $8,172 Notes Payable 18,030 Unearned Rent Revenue 3,600 Rent Revenue 64.620 Interest Expense -0- Salaries and Wages Expense 13,670 An analysis of the accounts shows the following. 1. The equipment depreciates $259 per month. 2. One-third of the unearned rent was recognized as revenue during the quarter. 3. Interest of $520 is accrued on the notes payable. 4. Supplies on hand total $640. 5. Insurance expires at the rate of $279 per month. Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts are Depreciation Expense, Insurance Expense, Interest Payable, and Supplies Expenses. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.)

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter22: End-of-fiscal-period Work For A Corporation

Section22.1: Preparing Adjusting Entries

Problem 1WT

Related questions

Question

Please help me

Transcribed Image Text:View Policies

Current Attempt in Progress

The ledger of Wildhorse Rental Agency on March 31 of the current year includes the following selected accounts before adjusting

entries have been prepared.

Debit

Credit

Prepaid Insurance

$3,348

Supplies

2,583

Equipment

22,940

Accumulated Depreciation-Equipment

$8,172

Notes Payable

18,030

Unearned Rent Revenue

3.600

Rent Revenue

64,620

Interest Expense

-0-

Salaries and Wages Expense

13,670

An analysis of the accounts shows the following.

1.

The equipment depreciates $259 per month.

2.

One-third of the unearned rent was recognized as revenue during the quarter.

3.

Interest of $520 is accrued on the notes payable.

4.

Supplies on hand total $640.

5.

Insurance expires at the rate of $279 per month.

Prepare the adjusting entries at March 31, assuming that adjusting entries are made quarterly. Additional accounts are Depreciation

Expense, Insurance Expense, Interest Payable, and Supplies Expenses. (Credit account titles are automatically indented when amount is

entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,