In an effort to keep low-wage workers' salaries commensurate with the cost of living, a number of states have amended their constitutions to allow the minimum wage to be adjusted with inflation. You are the accountant for a company that owns a chain of 14 fast food restaurants in a state which adjusts the minimum wage for inflation. Each restaurant employs 25 workers, each averaging 20 hours per week at th current federal minimum wage, $7.25 per hour. (a) How many hours at minimum wage are paid out each week by the company? 7000 hr

In an effort to keep low-wage workers' salaries commensurate with the cost of living, a number of states have amended their constitutions to allow the minimum wage to be adjusted with inflation. You are the accountant for a company that owns a chain of 14 fast food restaurants in a state which adjusts the minimum wage for inflation. Each restaurant employs 25 workers, each averaging 20 hours per week at th current federal minimum wage, $7.25 per hour. (a) How many hours at minimum wage are paid out each week by the company? 7000 hr

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter7: Employee Earnings And Deductions

Section: Chapter Questions

Problem 2E

Related questions

Question

100%

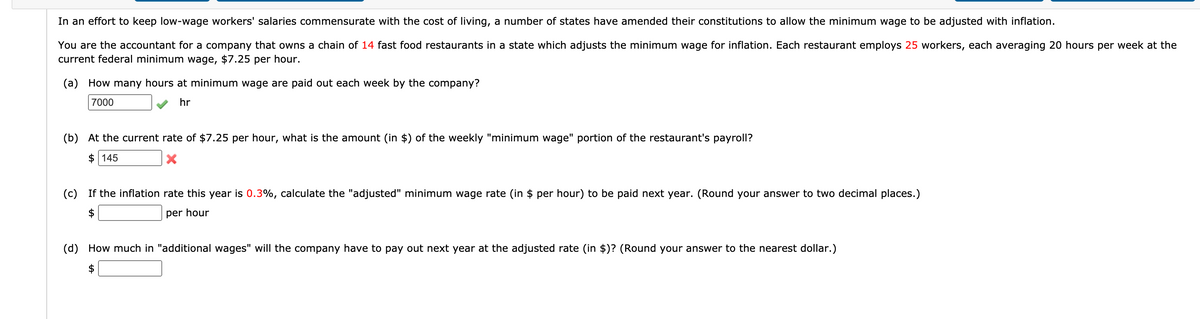

Transcribed Image Text:In an effort to keep low-wage workers' salaries commensurate with the cost of living, a number of states have amended their constitutions to allow the minimum wage to be adjusted with inflation.

You are the accountant for a company that owns a chain of 14 fast food restaurants in a state which adjusts the minimum wage for inflation. Each restaurant employs 25 workers, each averaging 20 hours per week at the

current federal minimum wage, $7.25 per hour.

(a) How many hours at minimum wage are paid out each week by the company?

7000

hr

(b) At the current rate of $7.25 per hour, what is the amount (in $) of the weekly "minimum wage" portion of the restaurant's payroll?

$ 145

(c) If the inflation rate this year is 0.3%, calculate the "adjusted" minimum wage rate (in $ per hour) to be paid next year. (Round your answer to two decimal places.)

$

per hour

(d) How much in "additional wages" will the company have to pay out next year at the adjusted rate (in $)? (Round your answer to the nearest dollar.)

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning