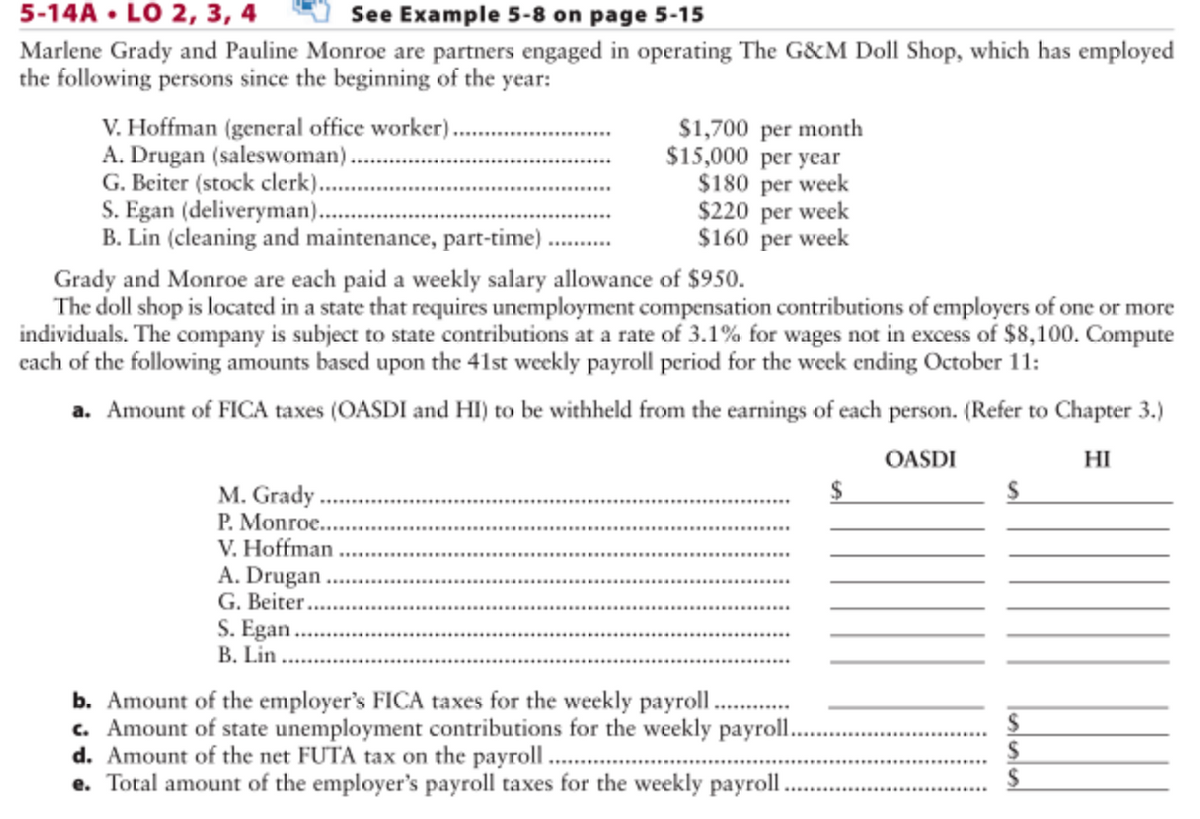

Marlene Grady and Pauline Monroe are partners engaged in operating The G&M Doll Shop, which has employed the following persons since the beginning of the year: V. Hoffman (general office worker). A. Drugan (saleswoman). G. Beiter (stock clerk).. S. Egan (deliveryman).. B. Lin (cleaning and maintenance, part-time) $1,700 per month $15,000 per year $180 per week $220 per week $160 per week Grady and Monroe are each paid a weekly salary allowance of $950. The doll shop is located in a state that requires unemployment compensation contributions of employers of one or more individuals. The company is subject to state contributions at a rate of 3.1% for wages not in excess of $8,100. Compute cach of the following amounts based upon the 41st weekly payroll period for the week ending October 11: a. Amount of FICA taxes (OASDI and HI) to be withheld from the earnings of each person. (Refer to Chapter 3.) OASDI HI 2$ M. Grady P. Monroe.. V. Hoffman A. Drugan G. Beiter. S. Egan. В. Lin ......... b. Amount of the employer's FICA taxes for the weekly payroll. c. Amount of state unemployment contributions for the weekly payroll.. d. Amount of the net FUTA tax on the payroll. e. Total amount of the employer's payroll taxes for the weekly payroll.

Marlene Grady and Pauline Monroe are partners engaged in operating The G&M Doll Shop, which has employed the following persons since the beginning of the year: V. Hoffman (general office worker). A. Drugan (saleswoman). G. Beiter (stock clerk).. S. Egan (deliveryman).. B. Lin (cleaning and maintenance, part-time) $1,700 per month $15,000 per year $180 per week $220 per week $160 per week Grady and Monroe are each paid a weekly salary allowance of $950. The doll shop is located in a state that requires unemployment compensation contributions of employers of one or more individuals. The company is subject to state contributions at a rate of 3.1% for wages not in excess of $8,100. Compute cach of the following amounts based upon the 41st weekly payroll period for the week ending October 11: a. Amount of FICA taxes (OASDI and HI) to be withheld from the earnings of each person. (Refer to Chapter 3.) OASDI HI 2$ M. Grady P. Monroe.. V. Hoffman A. Drugan G. Beiter. S. Egan. В. Lin ......... b. Amount of the employer's FICA taxes for the weekly payroll. c. Amount of state unemployment contributions for the weekly payroll.. d. Amount of the net FUTA tax on the payroll. e. Total amount of the employer's payroll taxes for the weekly payroll.

Accounting

27th Edition

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Chapter12: Accounting For Partnerships And Limited Liability Companies

Section: Chapter Questions

Problem 12.3BPR

Related questions

Question

Transcribed Image Text:5-14A • LO 2, 3, 4

Marlene Grady and Pauline Monroe are partners engaged in operating The G&M Doll Shop, which has employed

the following persons since the beginning of the year:

See Example 5-8 on page 5-15

V. Hoffman (general office worker).

A. Drugan (saleswoman).

G. Beiter (stock clerk)...

S. Egan (deliveryman).

B. Lin (cleaning and maintenance, part-time) .

$1,700 per month

$15,000 per year

$180 per week

$220 per week

$160 per week

Grady and Monroe are each paid a weekly salary allowance of $950.

The doll shop is located in a state that requires unemployment compensation contributions of employers of one or more

individuals. The company is subject to state contributions at a rate of 3.1% for wages not in excess of $8,100. Compute

cach of the following amounts based upon the 41st weekly payroll period for the week ending October 11:

a. Amount of FICA taxes (OASDI and HI) to be withheld from the earnings of each person. (Refer to Chapter 3.)

OASDI

HI

2$

M. Grady.

P. Monroe..

V. Hoffman

A. Drugan.

G. Beiter.

S. Egan.

В. Lin

.....

b. Amount of the employer's FICA taxes for the weekly payroll.

c. Amount of state unemployment contributions for the weekly payroll..

d. Amount of the net FUTA tax on the payroll .

e. Total amount of the employer's payroll taxes for the weekly payrol.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting (Text Only)

Accounting

ISBN:

9781285743615

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning