In comparing the current ratios of two companies, why is it invalid to assume that the company with the higher current ratio is the better company? Select the correct response: The current ratio includes assets other than cash. A high current ratio may indicate inadequate inventory on hand. A high current ratio may indicate inefficient use of various assets and liabilities. O The two companies may define working capital in different terms.

In comparing the current ratios of two companies, why is it invalid to assume that the company with the higher current ratio is the better company? Select the correct response: The current ratio includes assets other than cash. A high current ratio may indicate inadequate inventory on hand. A high current ratio may indicate inefficient use of various assets and liabilities. O The two companies may define working capital in different terms.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter3: Taxes On The Financial Statements

Section: Chapter Questions

Problem 5RP

Related questions

Question

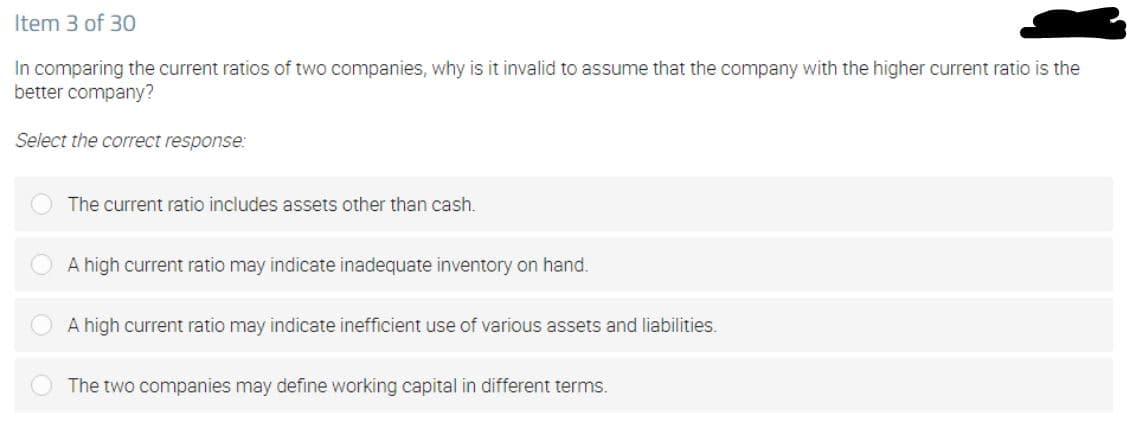

Transcribed Image Text:Item 3 of 30

In comparing the current ratios of two companies, why is it invalid to assume that the company with the higher current ratio is the

better company?

Select the correct response:

The current ratio includes assets other than cash.

A high current ratio may indicate inadequate inventory on hand.

A high current ratio may indicate inefficient use of various assets and liabilities.

The two companies may define working capital in different terms.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781285065137

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning