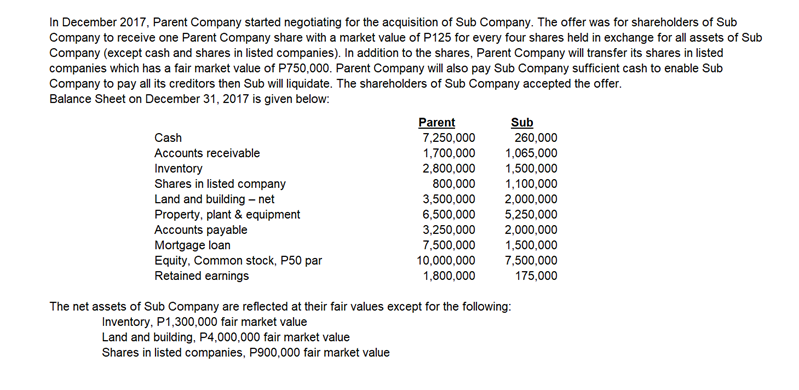

In December 2017, Parent Company started negotiating for the acquisition of Sub Company. The offer was for shareholders of Sub Company to receive one Parent Company share with a market value of P125 for every four shares held in exchange for all assets of Sub Company (except cash and shares in listed companies). In addition to the shares, Parent Company will transfer its shares in listed companies which has a fair market value of P750,000. Parent Company will also pay Sub Company sufficient cash to enable Sub Company to pay all its creditors then Sub will liquidate. The shareholders of Sub Company accepted the offer. Balance Sheet on December 31, 2017 is given below: Parent 7,250,000 Sub 260,000 1,065,000 1,500,000 Cash Accounts receivable 1,700,000 2,800,000 Inventory Shares in listed company Land and building - net Property, plant & equipment Accounts payable Mortgage loan Equity, Common stock, P50 par 800,000 3,500,000 6,500,000 1,100,000 2,000,000 5,250,000 3,250,000 7,500,000 10,000,000 1,800,000 2,000,000 1,500,000 7,500,000 175,000 Retained earnings The net assets of Sub Company are reflected at their fair values except for the following: Inventory, P1,300,000 fair market value Land and building, P4,000,000 fair market value Shares in listed companies, P900,000 fair market value

In December 2017, Parent Company started negotiating for the acquisition of Sub Company. The offer was for shareholders of Sub Company to receive one Parent Company share with a market value of P125 for every four shares held in exchange for all assets of Sub Company (except cash and shares in listed companies). In addition to the shares, Parent Company will transfer its shares in listed companies which has a fair market value of P750,000. Parent Company will also pay Sub Company sufficient cash to enable Sub Company to pay all its creditors then Sub will liquidate. The shareholders of Sub Company accepted the offer. Balance Sheet on December 31, 2017 is given below: Parent 7,250,000 Sub 260,000 1,065,000 1,500,000 Cash Accounts receivable 1,700,000 2,800,000 Inventory Shares in listed company Land and building - net Property, plant & equipment Accounts payable Mortgage loan Equity, Common stock, P50 par 800,000 3,500,000 6,500,000 1,100,000 2,000,000 5,250,000 3,250,000 7,500,000 10,000,000 1,800,000 2,000,000 1,500,000 7,500,000 175,000 Retained earnings The net assets of Sub Company are reflected at their fair values except for the following: Inventory, P1,300,000 fair market value Land and building, P4,000,000 fair market value Shares in listed companies, P900,000 fair market value

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 34P

Related questions

Question

Determine the total assets of Parent Company immediately after the merger.

Transcribed Image Text:In December 2017, Parent Company started negotiating for the acquisition of Sub Company. The offer was for shareholders of Sub

Company to receive one Parent Company share with a market value of P125 for every four shares held in exchange for all assets of Sub

Company (except cash and shares in listed companies). In addition to the shares, Parent Company will transfer its shares in listed

companies which has a fair market value of P750,000. Parent Company will also pay Sub Company sufficient cash to enable Sub

Company to pay all its creditors then Sub will liquidate. The shareholders of Sub Company accepted the offer.

Balance Sheet on December 31, 2017 is given below:

Sub

260,000

1,065,000

1,500,000

1,100,000

2,000,000

5,250,000

Parent

7,250,000

Cash

Accounts receivable

1,700,000

2,800,000

Inventory

Shares in listed company

Land and building – net

Property, plant & equipment

Accounts payable

Mortgage loan

Equity, Common stock, P50 par

800,000

3,500,000

6,500,000

3,250,000

2,000,000

1,500,000

7,500,000

175,000

7,500,000

10,000,000

1,800,000

Retained earnings

The net assets of Sub Company are reflected at their fair values except for the following:

Inventory, P1,300,000 fair market value

Land and building, P4,000,000 fair market value

Shares in listed companies, P900,000 fair market value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning