On January 1, 2017, Holland Corporation paid $8 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland’s outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $6.50 per share both before and after the acquisition by Holland. Zeeland’s acquisition date balance sheet follows: On January 1, 2017, Holland assessed the carrying amount of Zeeland’s equipment (5-year remaining life) to be undervalued by $55,000. Holland also determined that Zeeland possessed unrecorded patents (10-year remaining life) worth $285,000. Zeeland’s acquisition-date fair values for its current assets and liabilities were equal to their carrying amounts. Zeeland books showed 260,000 for net stockholder equity Any remaining excess of Zeeland’s acquisition-date fair value over its book value was attributed to goodwill. The companies’ financial statements for the year ending December 31, 2018, follow: At year-end, there were no intra-entity receivables or payables. a. Compute the amount of goodwill recognized in Holland’s acquisition of Zeeland and the allocation of goodwill to the controlling and noncontrolling interest. b. Show how Holland determined its December 31, 2018, Investment in Zeeland account balance and NCI investment in Zeeland. c. The amount of annual excess amortization and the ending balance of equipment. d. The allocation of Zeeland net income to Holland and NCI, e. The allocation of dividends declared by Holland to Zeeland and NCI for the consolidation entries needed in preparing the f. Prepare a worksheet to determine the amounts that should appear on Holland’s December 31, 2018, consolidated financial statemen

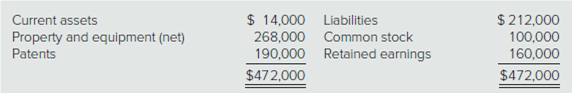

On January 1, 2017, Holland Corporation paid $8 per share to a group of Zeeland Corporation shareholders to acquire 60,000 shares of Zeeland’s outstanding voting stock, representing a 60 percent ownership interest. The remaining 40,000 shares of Zeeland continued to trade in the market close to its recent average of $6.50 per share both before and after the acquisition by Holland. Zeeland’s acquisition date balance sheet follows:

On January 1, 2017, Holland assessed the carrying amount of Zeeland’s equipment (5-year remaining life) to be undervalued by $55,000. Holland also determined that Zeeland possessed unrecorded patents (10-year remaining life) worth $285,000. Zeeland’s acquisition-date fair values for its current assets and liabilities were equal to their carrying amounts.

Zeeland books showed 260,000 for net

Any remaining excess of Zeeland’s acquisition-date fair value over its book value was attributed to

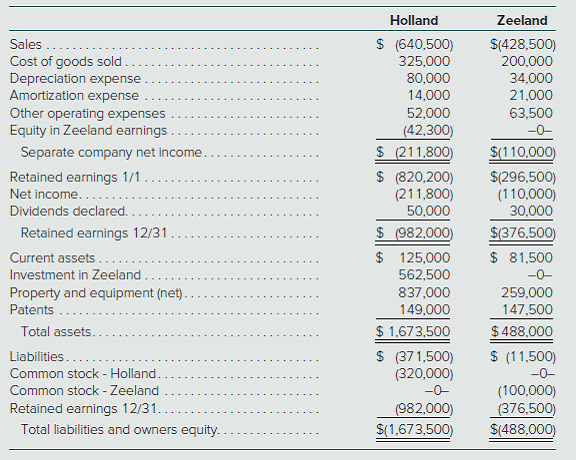

The companies’ financial statements for the year ending December 31, 2018, follow:

At year-end, there were no intra-entity receivables or payables.

a. Compute the amount of goodwill recognized in Holland’s acquisition of Zeeland and the allocation of goodwill to the controlling and noncontrolling interest.

b. Show how Holland determined its December 31, 2018, Investment in Zeeland account balance and NCI investment in Zeeland.

c. The amount of annual excess amortization and the ending balance of equipment.

d. The allocation of Zeeland net income to Holland and NCI,

e. The allocation of dividends declared by Holland to Zeeland and NCI for the consolidation entries needed in preparing the

f. Prepare a worksheet to determine the amounts that should appear on Holland’s December 31, 2018, consolidated financial statements.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps