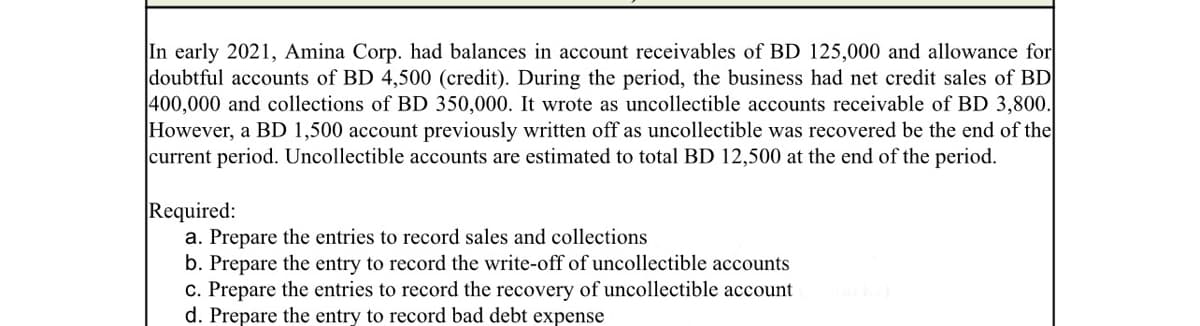

In early 2021, Amina Corp. had balances in account receivables of BD 125,000 and allowance for doubtful accounts of BD 4,500 (credit). During the period, the business had net credit sales of BD 400,000 and collections of BD 350,000. It wrote as uncollectible accounts receivable of BD 3,800. However, a BD 1,500 account previously written off as uncollectible was recovered be the end of the current period. Uncollectible accounts are estimated to total BD 12,500 at the end of the period.

In early 2021, Amina Corp. had balances in account receivables of BD 125,000 and allowance for doubtful accounts of BD 4,500 (credit). During the period, the business had net credit sales of BD 400,000 and collections of BD 350,000. It wrote as uncollectible accounts receivable of BD 3,800. However, a BD 1,500 account previously written off as uncollectible was recovered be the end of the current period. Uncollectible accounts are estimated to total BD 12,500 at the end of the period.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter16: Accounting For Accounts Receivable

Section: Chapter Questions

Problem 3CP: At the end of 20-3, Martel Co. had 410,000 in Accounts Receivable and a credit balance of 300 in...

Related questions

Question

Can you help me with a,b,c,d?

Transcribed Image Text:In early 2021, Amina Corp. had balances in account receivables of BD 125,000 and allowance for

doubtful accounts of BD 4,500 (credit). During the period, the business had net credit sales of BD

400,000 and collections of BD 350,000. It wrote as uncollectible accounts receivable of BD 3,800.

However, a BD 1,500 account previously written off as uncollectible was recovered be the end of the

current period. Uncollectible accounts are estimated to total BD 12,500 at the end of the period.

Required:

a. Prepare the entries to record sales and collections

b. Prepare the entry to record the write-off of uncollectible accounts

c. Prepare the entries to record the recovery of uncollectible account

d. Prepare the entry to record bad debt expense

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning