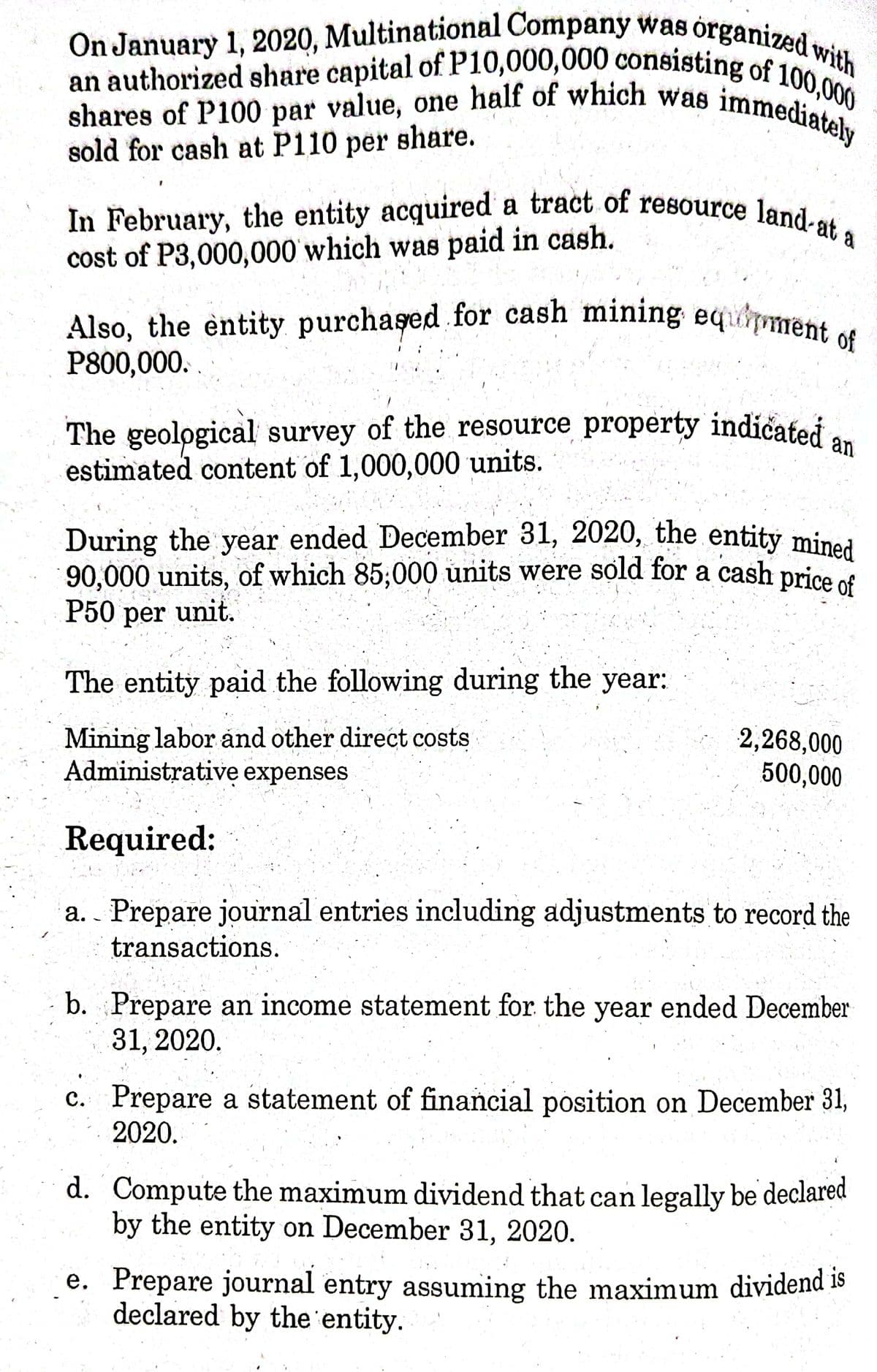

In February, the entity acquired a tract of resource land-at a an authorized share capital of P10,000,000 consisting of 100,000 On January 1, 2020, Multinational Company was órganized with shares of P100 par value, one halt of which was immedio sold for cash at P110 per share. a cost of P3,000,000' which was paid in cash.

In February, the entity acquired a tract of resource land-at a an authorized share capital of P10,000,000 consisting of 100,000 On January 1, 2020, Multinational Company was órganized with shares of P100 par value, one halt of which was immedio sold for cash at P110 per share. a cost of P3,000,000' which was paid in cash.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 23E

Related questions

Question

100%

Transcribed Image Text:an authorized share capital of P10,000,000 consisting of 100,000

On January 1, 2020, Multinational Company was organized with

shares of P100 par value, one half of which was immediately

In February, the entity acquired a tract of resource land-at a

Also, the entity purchaşed for cash mining equiment of

During the year ended December 31, 2020, the entity mined

shares of P100 par value, one half of which was

sold for cash at P110 per share.

immediately

In February, the entity acquired a tract of resource land

cost of P3,000,000 which was paid in cash.

Also, the entity purchased for cash mining

P800,000.

eqment

of

The geological survey of the resource property indicated

estimated content of 1,000,000 units.

an

6.

90,000 units, of which 85;000 units were sold for a cash price

P50 per unit.

The entity paid the following during the year:

Mining labor ånd other direct costs

Administrative expenses

2,268,000

500,000

Required:

Prepare journal entries including adjustments to record the

transactions.

а.

b. Prepare an income statement for the year ended December

31, 2020.

c. Prepare a statement of financial position on December 31,

2020.

d. Compute the maximum dividend that can legally be declared

by the entity on December 31, 2020.

e. Prepare journal entry assuming the maximum dividend 18

declared by the 'entity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning