On July 1, 2021, the Statement of Financial Position of Hershey Co. and Kisses Corp. are as follows Hershey Co. Kisses Corp. Assets 4,000,000 2,500,000 Liabilities 1,500,000 800,000 Share Capital, no par 2,000,000 Share Capital, P100 par 1,000,000 Share Premium 700,000 300,000 Retained earnings (200,000) 400,000 Hershey Co. on this date, agreed to acquire all the assets, and assume all the liabilities of Kisses Corp. in exchange for shares of stock that it will issue. The stock of Hershey Co. is selling in the market at P50 per share. The assets of Kisses Corp. are to be appraised, and Hershey Co. is to issu shares of its stock with a market value equal to that of the net assets transferred by Kisses Corp. The value of the assets of Kisses Corp., per appraisal, increased by P300,000. The share capital reflecting the combination under acquisition method is:

On July 1, 2021, the Statement of Financial Position of Hershey Co. and Kisses Corp. are as follows Hershey Co. Kisses Corp. Assets 4,000,000 2,500,000 Liabilities 1,500,000 800,000 Share Capital, no par 2,000,000 Share Capital, P100 par 1,000,000 Share Premium 700,000 300,000 Retained earnings (200,000) 400,000 Hershey Co. on this date, agreed to acquire all the assets, and assume all the liabilities of Kisses Corp. in exchange for shares of stock that it will issue. The stock of Hershey Co. is selling in the market at P50 per share. The assets of Kisses Corp. are to be appraised, and Hershey Co. is to issu shares of its stock with a market value equal to that of the net assets transferred by Kisses Corp. The value of the assets of Kisses Corp., per appraisal, increased by P300,000. The share capital reflecting the combination under acquisition method is:

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 19SP

Related questions

Question

8.8

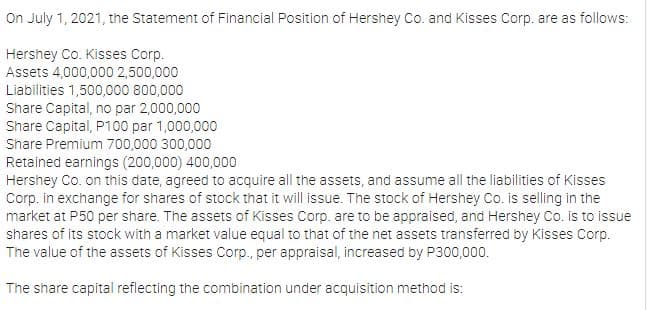

Transcribed Image Text:On July 1, 2021, the Statement of Financial Position of Hershey Co. and Kisses Corp. are as follows:

Hershey Co. Kisses Corp.

Assets 4,000,000 2,500,000

Liabilities 1,500,000 800,000

Share Capital, no par 2,000,000

Share Capital, P100 par 1,000,000

Share Premium 700,000 300,000

Retained earnings (200,000) 400,000

Hershey Co. on this date, agreed to acquire all the assets, and assume all the liabilities of Kisses

Corp. in exchange for shares of stock that it will issue. The stock of Hershey Co. is selling in the

market at P50 per share. The assets of Kisses Corp. are to be appraised, and Hershey Co. is to issue

shares of its stock with a market value equal to that of the net assets transferred by Kisses Corp.

The value of the assets of Kisses Corp., per appraisal, increased by P300,000.

The share capital reflecting the combination under acquisition method is:

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning