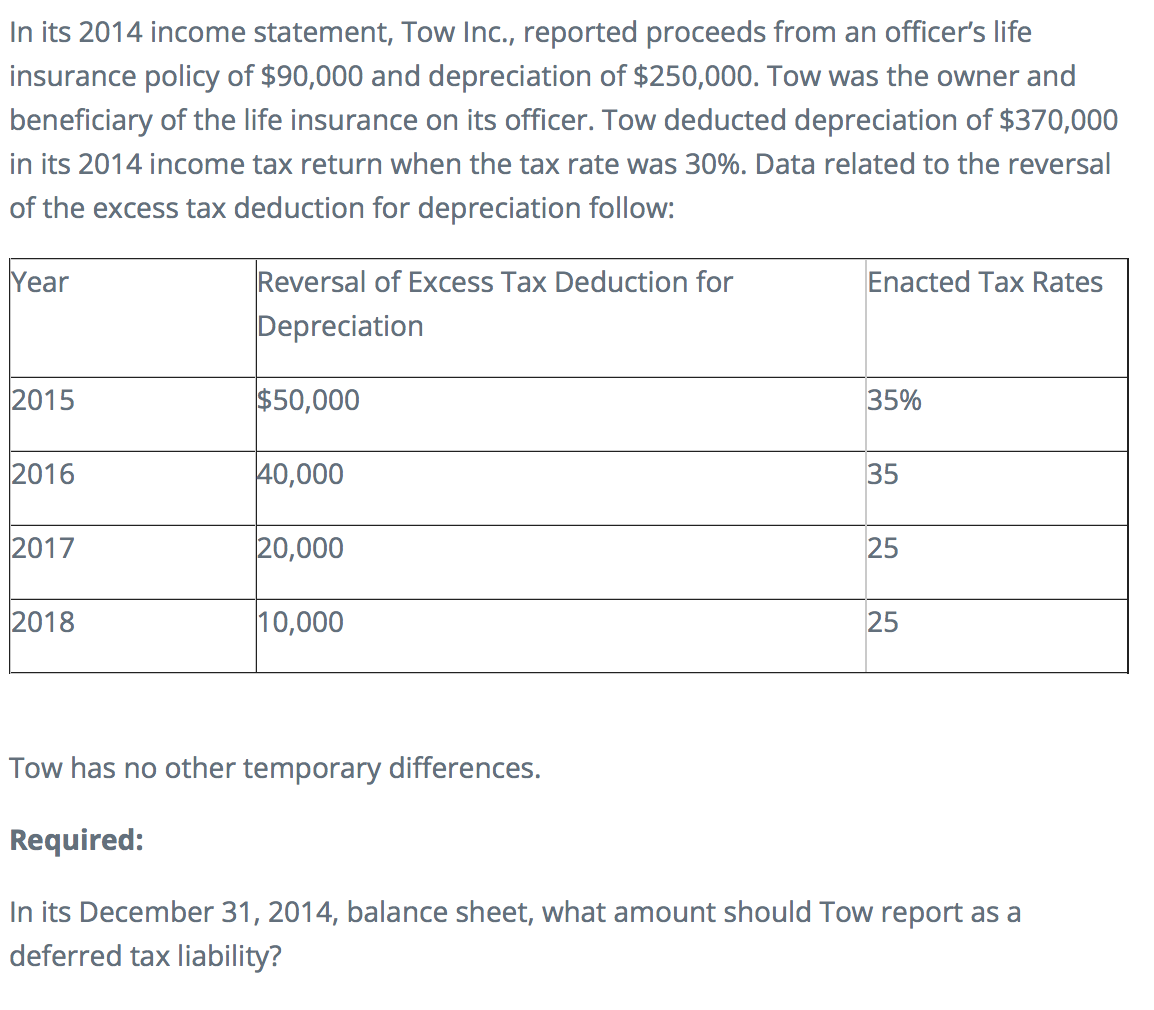

In its 2014 income statement, Tow Inc., reported proceeds from an officer's life insurance policy of $90,000 and depreciation of $250,000. Tow was the owner and beneficiary of the life insurance on its officer. Tow deducted depreciation of $370,000 in its 2014 income tax return when the tax rate was 30%. Data related to the reversal of the excess tax deduction for depreciation follow: Year 2015 2016 2017 2018 Reversal of Excess Tax Deduction for Depreciation $50,000 40,000 20,000 10,000 Enacted Tax Rates 35% 35 25 25 Tow has no other temporary differences. Required: In its December 31, 2014, balance sheet, what amount should Tow report as a deferred tax liability?

In its 2014 income statement, Tow Inc., reported proceeds from an officer's life insurance policy of $90,000 and depreciation of $250,000. Tow was the owner and beneficiary of the life insurance on its officer. Tow deducted depreciation of $370,000 in its 2014 income tax return when the tax rate was 30%. Data related to the reversal of the excess tax deduction for depreciation follow: Year 2015 2016 2017 2018 Reversal of Excess Tax Deduction for Depreciation $50,000 40,000 20,000 10,000 Enacted Tax Rates 35% 35 25 25 Tow has no other temporary differences. Required: In its December 31, 2014, balance sheet, what amount should Tow report as a deferred tax liability?

Chapter17: Corporations: Introduction And Operating Rules

Section: Chapter Questions

Problem 16DQ

Related questions

Question

Transcribed Image Text:In its 2014 income statement, Tow Inc., reported proceeds from an officer's life

insurance policy of $90,000 and depreciation of $250,000. Tow was the owner and

beneficiary of the life insurance on its officer. Tow deducted depreciation of $370,000

in its 2014 income tax return when the tax rate was 30%. Data related to the reversal

of the excess tax deduction for depreciation follow:

Year

2015

2016

2017

2018

Reversal of Excess Tax Deduction for

Depreciation

$50,000

40,000

20,000

10,000

Enacted Tax Rates

35%

35

25

25

Tow has no other temporary differences.

Required:

In its December 31, 2014, balance sheet, what amount should Tow report as a

deferred tax liability?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning