In October 2010, Paul acquired 100% of Shasta Corporation common stock by transferring property with an adjusted basis of $1,800,000 and fair market value of $4,400,000. Shasta is a qualified small business corporation. On April 1, 2021, Paul sels all of the Shasta Corporation common stock for $16,600,000. Read the requirements Requirement a. What is the amount of gain that may be excluded from Paul's gross income? (Enter a "0" if none of the gain may be excluded from the taxpayer's gross income.) The amount of gain that may be excluded from Pauls gross income is Requirement b. What would your answer be if the fair market value of the Shasta stock were only $820,000 upon its issue? (Enter a "0" if none of the gain may be excluded from the taxpayer's gross income.) Under this condition, the amount of gain that may be excluded from Paul's gross income is Requirement c. What would your answer be if the stock were sold after two years? (Enter a "0" if none of the gain may be excluded from the taxpayer's gross income.) If the stock were sold after two years, the amount of gain that may be excluded from Pau's gross income is Requirement d. Can Paul avoid recognizing gain by purchasing replacement stock? O A. Yes. If Paul acquires $4,400,000 or more of qualified stock within six months no gain is recognized, providing the original stock was held for over five years. O B. No. Paul must recognize gain on the sale of the Shasta Corporation common stock because the sale exceeded $10,000,000. OC. Yes. If Paul acquires $16,600,000 or more of qualified stock within 60 days no gain is recognized, providing the original stock was held for over six months. O D. Yes. If Paul acquires $10,000,000 or more of qualified stock within 60 days no gain is recognized, providing the original stock was held for over five years.

In October 2010, Paul acquired 100% of Shasta Corporation common stock by transferring property with an adjusted basis of $1,800,000 and fair market value of $4,400,000. Shasta is a qualified small business corporation. On April 1, 2021, Paul sels all of the Shasta Corporation common stock for $16,600,000. Read the requirements Requirement a. What is the amount of gain that may be excluded from Paul's gross income? (Enter a "0" if none of the gain may be excluded from the taxpayer's gross income.) The amount of gain that may be excluded from Pauls gross income is Requirement b. What would your answer be if the fair market value of the Shasta stock were only $820,000 upon its issue? (Enter a "0" if none of the gain may be excluded from the taxpayer's gross income.) Under this condition, the amount of gain that may be excluded from Paul's gross income is Requirement c. What would your answer be if the stock were sold after two years? (Enter a "0" if none of the gain may be excluded from the taxpayer's gross income.) If the stock were sold after two years, the amount of gain that may be excluded from Pau's gross income is Requirement d. Can Paul avoid recognizing gain by purchasing replacement stock? O A. Yes. If Paul acquires $4,400,000 or more of qualified stock within six months no gain is recognized, providing the original stock was held for over five years. O B. No. Paul must recognize gain on the sale of the Shasta Corporation common stock because the sale exceeded $10,000,000. OC. Yes. If Paul acquires $16,600,000 or more of qualified stock within 60 days no gain is recognized, providing the original stock was held for over six months. O D. Yes. If Paul acquires $10,000,000 or more of qualified stock within 60 days no gain is recognized, providing the original stock was held for over five years.

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 28P

Related questions

Question

answer quickly

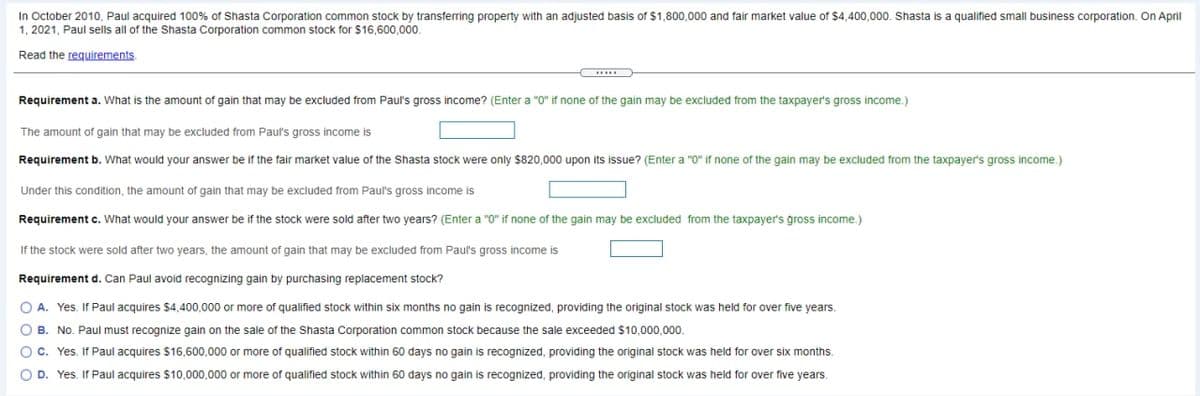

Transcribed Image Text:In October 2010, Paul acquired 100% of Shasta Corporation common stock by transferring property with an adjusted basis of $1,800,000 and fair market value of $4,400,000. Shasta is a qualified small business corporation. On April

1, 2021, Paul sells all of the Shasta Corporation common stock for $16,600,000.

Read the requirements

Requirement a. What is the amount of gain that may be excluded from Paul's gross income? (Enter a "0" if none of the gain may be excluded from the taxpayer's gross income.)

The amount of gain that may be excluded from Paul's gross income is

Requirement b. What would your answer be if the fair market value of the Shasta stock were only $820,000 upon its issue? (Enter a "0" if none of the gain may be excluded from the taxpayer's gross income.)

Under this condition, the amount of gain that may be excluded from Paul's gross income is

Requirement c. What would your answer be if the stock were sold after two years? (Enter a "0" if none of the gain may be excluded from the taxpayer's gross income.)

If the stock were sold after two years, the amount of gain that may be excluded from Paul's gross income is

Requirement d. Can Paul avoid recognizing gain by purchasing replacement stock?

O A. Yes. If Paul acquires $4,400,000 or more of qualified stock within six months no gain is recognized, providing the original stock was held for over five years.

OB. No. Paul must recognize gain on the sale of the Shasta Corporation common stock because the sale exceeded $10,000,000.

O C. Yes. If Paul acquires $16,600,000 or more of qualified stock within 60 days no gain is recognized, providing the original stock was held for over six months.

O D. Yes. If Paul acquires $10,000,000 or more of qualified stock within 60 days no gain is recognized, providing the original stock was held for over five years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT