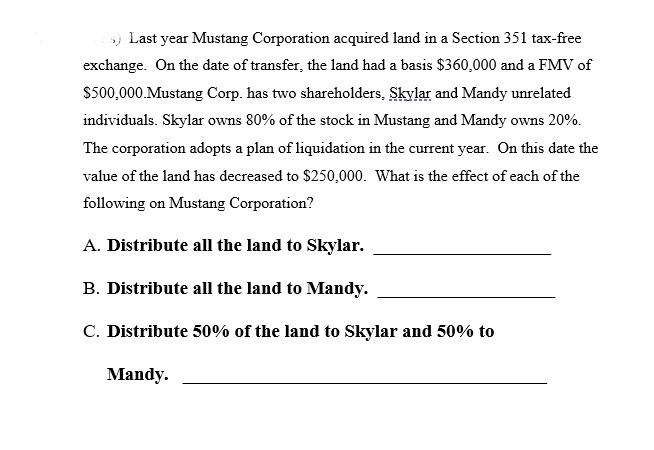

Last year Mustang Corporation acquired land in a Section 351 tax-free exchange. On the date of transfer, the land had a basis $360,000 and a FMV of $500,000.Mustang Corp. has two shareholders, Skylar and Mandy unrelated individuals. Skylar owns 80% of the stock in Mustang and Mandy owns 20%. The corporation adopts a plan of liquidation in the current year. On this date the value of the land has decreased to $250,000. What is the effect of each of the following on Mustang Corporation? A. Distribute all the land to Skylar. B. Distribute all the land to Mandy. C. Distribute 50% of the land to Skylar and 50% to Mandy.

Last year Mustang Corporation acquired land in a Section 351 tax-free exchange. On the date of transfer, the land had a basis $360,000 and a FMV of $500,000.Mustang Corp. has two shareholders, Skylar and Mandy unrelated individuals. Skylar owns 80% of the stock in Mustang and Mandy owns 20%. The corporation adopts a plan of liquidation in the current year. On this date the value of the land has decreased to $250,000. What is the effect of each of the following on Mustang Corporation? A. Distribute all the land to Skylar. B. Distribute all the land to Mandy. C. Distribute 50% of the land to Skylar and 50% to Mandy.

Chapter6: Corporations: Redemptions And Liquidations

Section: Chapter Questions

Problem 58P

Related questions

Question

Transcribed Image Text:s) Last year Mustang Corporation acquired land in a Section 351 tax-free

exchange. On the date of transfer, the land had a basis $360,000 and a FMV of

$500,000.Mustang Corp. has two shareholders, Skylar and Mandy unrelated

individuals. Skylar owns 80% of the stock in Mustang and Mandy owns 20%.

The corporation adopts a plan of liquidation in the current year. On this date the

value of the land has decreased to $250,000. What is the effect of each of the

following on Mustang Corporation?

A. Distribute all the land to Skylar.

B. Distribute all the land to Mandy.

C. Distribute 50% of the land to Skylar and 50% to

Mandy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you