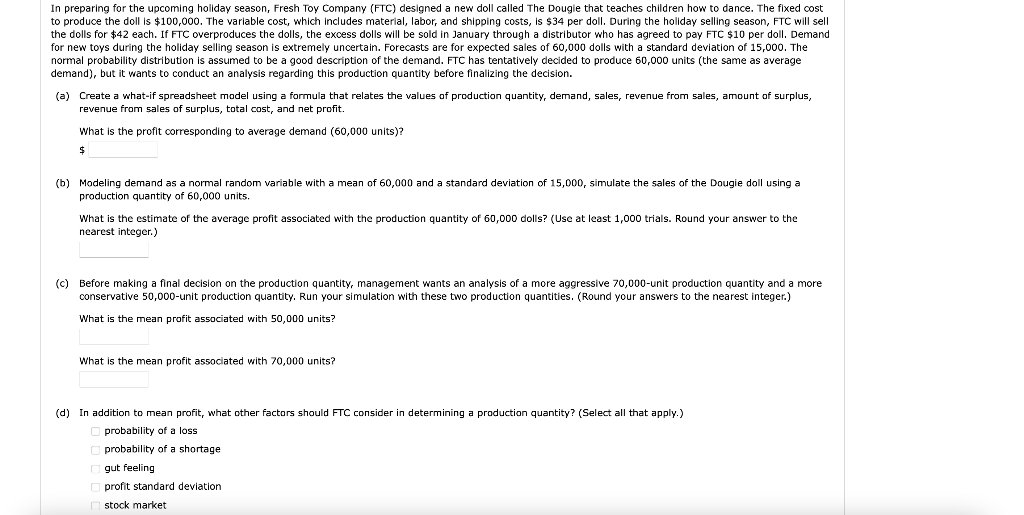

In preparing for the upcoming holiday season, Fresh Toy Company (FTC) designed a new doll called The Dougie that teaches children how to dance. The fixed cost to produce the doll is $100,000. The variable cost, which includes material, labor, and shipping costs, is $34 per doll. During the holiday selling season, FTC will sell the dolls for $42 each. If FTC overproduces the dolls, the excess dolls will be sold in January through a distributor who has agreed to pay FTC $10 per doll. Demand for new toys during the holiday selling season is extremely uncertain. Forecasts are for expected sales of 60,000 dolls with a standard deviation of 15,000. The normal probability distribution is assumed to be a good description of the demand. FTC has tentatively decided to produce 60,000 units (the same as average demand), but it wants to conduct an analysis regarding this production quantity before finalizing the decision. (a) Create a what-if spreadsheet model using a formula that relates the values of production quantity, demand, sales, revenue from sales, amount of surplus, revenue from sales of surplus, total cost, and net profit. What is the profit corresponding to average demand (60,000 units)? (b) Modeling demand as a normal random variable with a mean of 60,000 and a standard deviation of 15,000, simulate the sales of the Dougie doll using a production quantity of 60,000 units. What is the estimate of the average profit associated with the production quantity of 60,000 dolls? (Usc at least 1,000 trials. Round your answer to the nearest integer.) (c) Before making a final decision on the production quantity, management wants an analysis of a more aggressive 70,000-unit production quantity and a more conservative 50,000-unit production quantity. Run your simulation with these two production quantities. (Round your answers to the nearest integer.) What is the mean profit associated with 50,000 units? What is the mean profit associated with 70,000 units?

In preparing for the upcoming holiday season, Fresh Toy Company (FTC) designed a new doll called The Dougie that teaches children how to dance. The fixed cost to produce the doll is $100,000. The variable cost, which includes material, labor, and shipping costs, is $34 per doll. During the holiday selling season, FTC will sell the dolls for $42 each. If FTC overproduces the dolls, the excess dolls will be sold in January through a distributor who has agreed to pay FTC $10 per doll. Demand for new toys during the holiday selling season is extremely uncertain. Forecasts are for expected sales of 60,000 dolls with a standard deviation of 15,000. The normal probability distribution is assumed to be a good description of the demand. FTC has tentatively decided to produce 60,000 units (the same as average demand), but it wants to conduct an analysis regarding this production quantity before finalizing the decision. (a) Create a what-if spreadsheet model using a formula that relates the values of production quantity, demand, sales, revenue from sales, amount of surplus, revenue from sales of surplus, total cost, and net profit. What is the profit corresponding to average demand (60,000 units)? (b) Modeling demand as a normal random variable with a mean of 60,000 and a standard deviation of 15,000, simulate the sales of the Dougie doll using a production quantity of 60,000 units. What is the estimate of the average profit associated with the production quantity of 60,000 dolls? (Usc at least 1,000 trials. Round your answer to the nearest integer.) (c) Before making a final decision on the production quantity, management wants an analysis of a more aggressive 70,000-unit production quantity and a more conservative 50,000-unit production quantity. Run your simulation with these two production quantities. (Round your answers to the nearest integer.) What is the mean profit associated with 50,000 units? What is the mean profit associated with 70,000 units?

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter3: Linear And Nonlinear Functions

Section3.7: Piecewise And Step Functions

Problem 30PPS

Related questions

Question

100%

3

Transcribed Image Text:In preparing for the upcoming holiday season, Fresh Toy Company (FTC) designed a new doll called The Dougie that teaches children how to dance. The fixed cost

to produce the doll is $100,000. The variable cost, which includes material, labor, and shipping costs, is $34 per doll. During the holiday selling season, FTC will sell

the dolls for $42 each. If FTC overproduces the dolls, the excess dolls will be sold in January through a distributor who has agreed to pay FTC $10 per doll. Demand

for new toys during the holiday selling season is extremely uncertain. Forecasts are for expected sales of 60,000 dolls with a standard deviation of 15,000. The

normal probability distribution is assumed to be a good description of the demand. FTC has tentatively decided to produce 60,000 units (the same as average

demand), but it wants to conduct an analysis regarding this production quantity before finalizing the decision.

(a) Create a what-if spreadsheet model using a formula that relates the values of production quantity, demand, sales, revenue from sales, amount of surplus,

revenue from sales of surplus, total cost, and net profit.

What is the profit corresponding

average demand (60,000 units)?

24

(b) Modeling demand as a normal random variable with a mean of 60,000 and a standard deviation of 15,000, simulate the sales of the Dougie doll using a

production quantity of 60,000 units.

What is the estimate of the average profit associated with the production quantity of 60,000 dolls? (Use

least 1,000 trials. Round your answer to the

nearest integer.)

(c) Before making a final decision on the production quantity, management wants an analysis of a more aggressive 70,000-unit production quantity and a more

conservative 50,000-unit production quantity. Run your simulation with these two production quantities. (Round your answers to the nearest integer.)

What is the mean profit associated with 50,000 units?

What is the mean profit associated with 70,000 units?

(d) In addition to mean profit, what other factors should FTC consider

determining a production quantity? (Select all that apply.)

O probability of a loss

probability of a shortage

gut feeling

profit standard deviation

O stock market

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

College Algebra (MindTap Course List)

Algebra

ISBN:

9781305652231

Author:

R. David Gustafson, Jeff Hughes

Publisher:

Cengage Learning

Linear Algebra: A Modern Introduction

Algebra

ISBN:

9781285463247

Author:

David Poole

Publisher:

Cengage Learning

Algebra for College Students

Algebra

ISBN:

9781285195780

Author:

Jerome E. Kaufmann, Karen L. Schwitters

Publisher:

Cengage Learning

Algebra: Structure And Method, Book 1

Algebra

ISBN:

9780395977224

Author:

Richard G. Brown, Mary P. Dolciani, Robert H. Sorgenfrey, William L. Cole

Publisher:

McDougal Littell