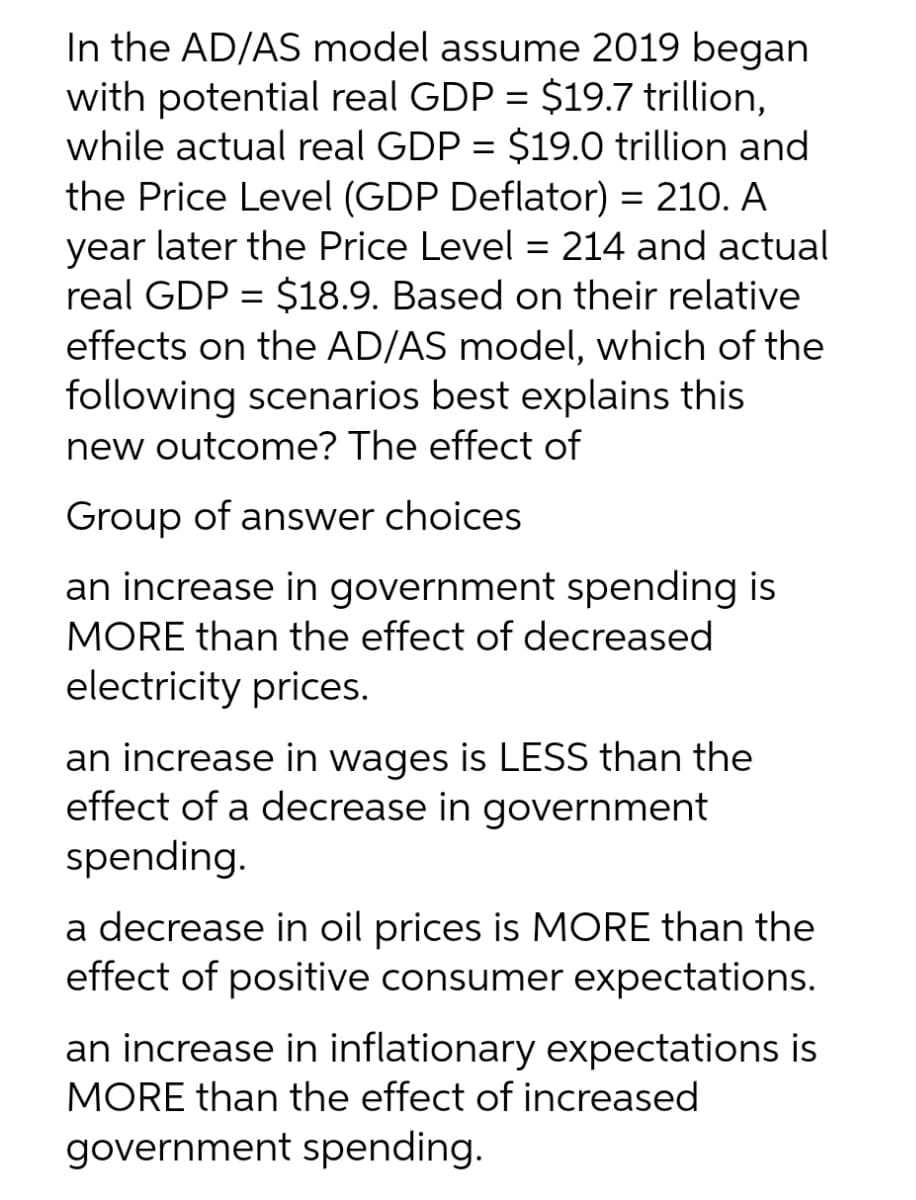

In the AD/AS model assume 2019 began with potential real GDP = $19.7 trillion, while actual real GDP = $19.0 trillion and the Price Level (GDP Deflator) = 210. A year later the Price Level = 214 and actual real GDP = $18.9. Based on their relative %3D effects on the AD/AS model, which of the following scenarios best explains this new outcome? The effect of Group of answer choices an increase in government spending is MORE than the effect of decreased electricity prices. an increase in wages is LESS than the effect of a decrease in government spending. a decrease in oil prices is MORE than the effect of positive consumer expectations. an increase in inflationary expectations is MORE than the effect of increased government spending.

In the AD/AS model assume 2019 began with potential real GDP = $19.7 trillion, while actual real GDP = $19.0 trillion and the Price Level (GDP Deflator) = 210. A year later the Price Level = 214 and actual real GDP = $18.9. Based on their relative %3D effects on the AD/AS model, which of the following scenarios best explains this new outcome? The effect of Group of answer choices an increase in government spending is MORE than the effect of decreased electricity prices. an increase in wages is LESS than the effect of a decrease in government spending. a decrease in oil prices is MORE than the effect of positive consumer expectations. an increase in inflationary expectations is MORE than the effect of increased government spending.

Chapter11: Managing Aggregate Demand: Fiscal Policy

Section: Chapter Questions

Problem 2TY

Related questions

Question

Transcribed Image Text:In the AD/AS model assume 2019 began

with potential real GDP = $19.7 trillion,

while actual real GDP = $19.0 trillion and

the Price Level (GDP Deflator) = 210. A

year later the Price Level = 214 and actual

real GDP = $18.9. Based on their relative

effects on the AD/AS model, which of the

following scenarios best explains this

new outcome? The effect of

%3D

Group of answer choices

an increase in government spending is

MORE than the effect of decreased

electricity prices.

an increase in wages is LESS than the

effect of a decrease in government

spending.

a decrease in oil prices is MORE than the

effect of positive consumer expectations.

an increase in inflationary expectations is

MORE than the effect of increased

government spending.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax