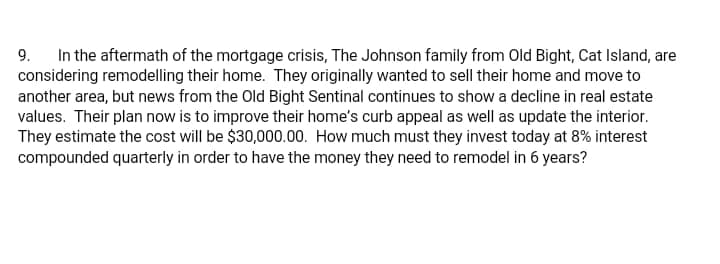

In the aftermath of the mortgage crisis, The Johnson family from Old Bight, Cat Island, are considering remodelling their home. They originally wanted to sell their home and move to another area, but news from the Old Bight Sentinal continues to show a decline in real estate values. Their plan now is to improve their home's curb appeal as well as update the interior. They estimate the cost will be $30,000.00. How much must they invest today at 8% interest compounded quarterly in order to have the money they need to remodel in 6 years? 9.

In the aftermath of the mortgage crisis, The Johnson family from Old Bight, Cat Island, are considering remodelling their home. They originally wanted to sell their home and move to another area, but news from the Old Bight Sentinal continues to show a decline in real estate values. Their plan now is to improve their home's curb appeal as well as update the interior. They estimate the cost will be $30,000.00. How much must they invest today at 8% interest compounded quarterly in order to have the money they need to remodel in 6 years? 9.

Chapter15: Property Transactions: Nontaxable Exchanges

Section: Chapter Questions

Problem 14DQ

Related questions

Question

Transcribed Image Text:In the aftermath of the mortgage crisis, The Johnson family from Old Bight, Cat Island, are

considering remodelling their home. They originally wanted to sell their home and move to

another area, but news from the Old Bight Sentinal continues to show a decline in real estate

values. Their plan now is to improve their home's curb appeal as well as update the interior.

They estimate the cost will be $30,000.00. How much must they invest today at 8% interest

compounded quarterly in order to have the money they need to remodel in 6 years?

9.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning