In the early part of 2021, the partners of Hugh, Jacobs, and Thomas sought assistance from a local accountant. They had begun a ne business in 2020 but had never used an accountant's services. Hugh and Jacobs began the partnership by contributing $155,000 and $105,000 in cash, respectively. Hugh was to work occasional at the business, and Jacobs was to be employed full-time. They decided that year-end profits and losses should be assigned as follows: • Each partner was to be allocated 10 percent interest computed on the beginning capital balances for the period. • A compensation allowance of $8,000 was to go to Hugh with a $25,000 amount assigned to Jacobs. • Any remaining income would be split on a 4:6 basis to Hugh and Jacobs, respectively. In 2020, revenues totaled $180,000, and expenses were $149,000 (not including the partners' compensation allowance). Hugh withdrew cash of $9,000 during the year, and Jacobs took out $14,000. In addition, the business paid $8,000 for repairs made to Hugh's home and charged it to repair expense. On January 1, 2021, the partnership sold a 10 percent interest to Thomas for $42,000 cash. This money was contributed to the business with the bonus method used for accounting purposes.

In the early part of 2021, the partners of Hugh, Jacobs, and Thomas sought assistance from a local accountant. They had begun a ne business in 2020 but had never used an accountant's services. Hugh and Jacobs began the partnership by contributing $155,000 and $105,000 in cash, respectively. Hugh was to work occasional at the business, and Jacobs was to be employed full-time. They decided that year-end profits and losses should be assigned as follows: • Each partner was to be allocated 10 percent interest computed on the beginning capital balances for the period. • A compensation allowance of $8,000 was to go to Hugh with a $25,000 amount assigned to Jacobs. • Any remaining income would be split on a 4:6 basis to Hugh and Jacobs, respectively. In 2020, revenues totaled $180,000, and expenses were $149,000 (not including the partners' compensation allowance). Hugh withdrew cash of $9,000 during the year, and Jacobs took out $14,000. In addition, the business paid $8,000 for repairs made to Hugh's home and charged it to repair expense. On January 1, 2021, the partnership sold a 10 percent interest to Thomas for $42,000 cash. This money was contributed to the business with the bonus method used for accounting purposes.

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter12: Corporations: Organization, Capital Structure, And Operating Rules

Section: Chapter Questions

Problem 27P

Related questions

Question

Please help me

Transcribed Image Text:In the early part of 2021, the partners of Hugh, Jacobs, and Thomas sought assistance from a local accountant. They had begun a new

business in 2020 but had never used an accountant's services.

Hugh and Jacobs began the partnership by contributing $155,000 and $105,000 in cash, respectively. Hugh was to work occasionally

at the business, and Jacobs was to be employed full-time. They decided that year-end profits and losses should be assigned as

follows:

• Each partner was to be allocated 10 percent interest computed on the beginning capital balances for the period.

• A compensation allowance of $8,000 was to go to Hugh with a $25,000 amount assigned to Jacobs.

• Any remaining income would be split on a 4:6 basis to Hugh and Jacobs, respectively.

In 2020, revenues totaled $180,000, and expenses were $149,000 (not including the partners' compensation allowance). Hugh

withdrew cash of $9,000 during the year, and Jacobs took out $14,000. In addition, the business paid $8,000 for repairs made to

Hugh's home and charged it to repair expense.

On January 1, 2021, the partnership sold a 10 percent interest to Thomas for $42,000 cash. This money was contributed to the

business with the bonus method used for accounting purposes.

Answer the following questions:

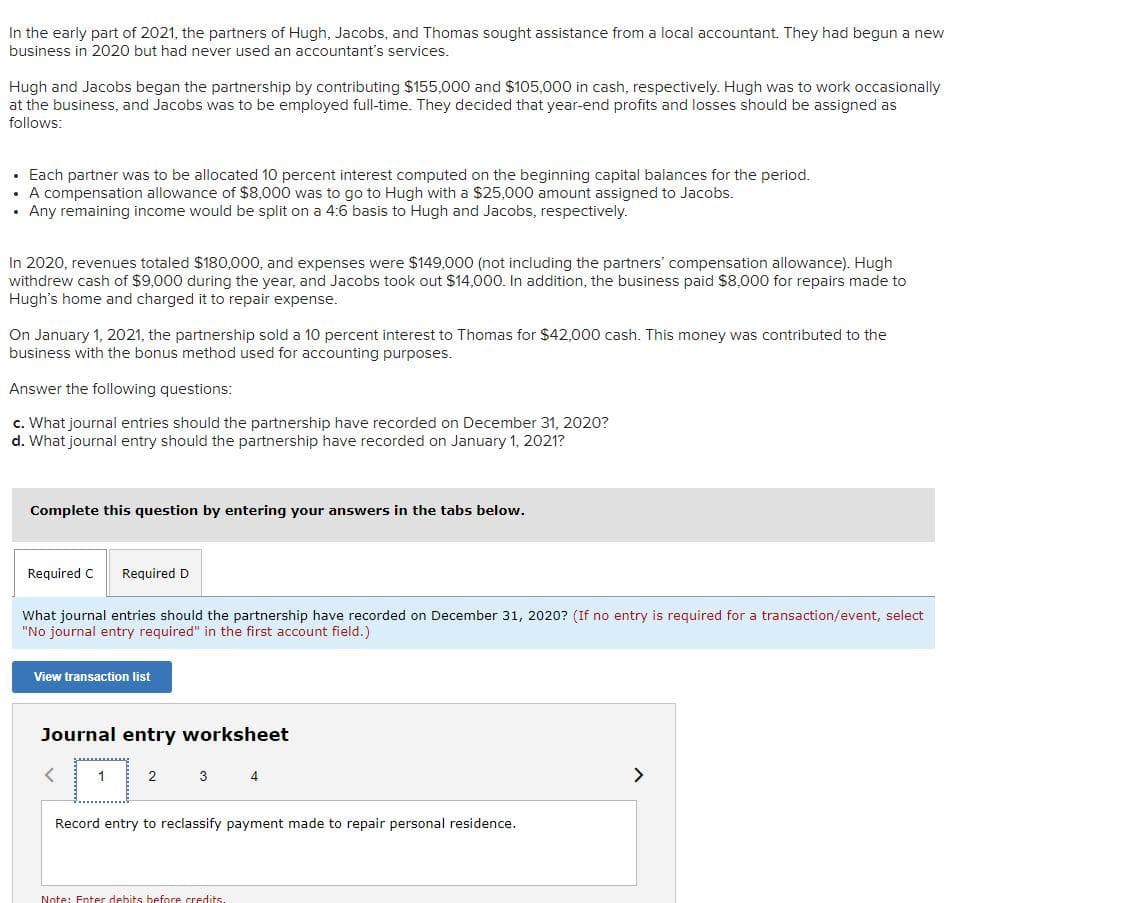

c. What journal entries should the partnership have recorded on December 31, 2020?

d. What journal entry should the partnership have recorded on January 1, 2021?

Complete this question by entering your answers in the tabs below.

Required C

Required D

What journal entries should the partnership have recorded on December 31, 2020? (If no entry is required for a transaction/event, select

"No journal entry required" in the first account field.)

View transaction list

Journal entry worksheet

1

2

3 4

>

Record entry to reclassify payment made to repair personal residence.

Note: Enter debits before credits

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you