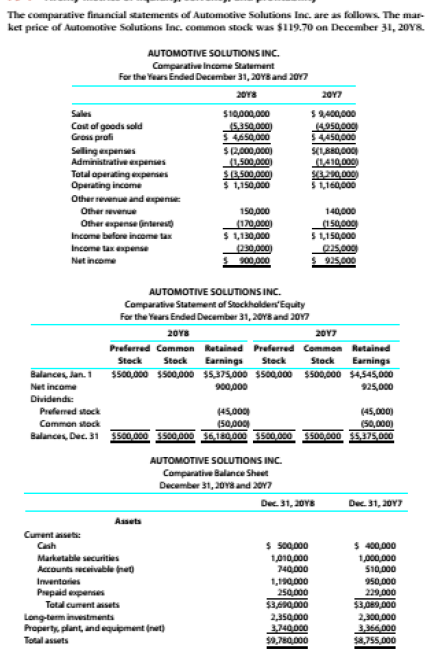

The comparative financial statements of Automotive Solutions Inc. are as follows. The mar- ket price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8. AUTOMOTIVE SOLUTIONS INC. Comparative Income Statement For the Years Ended December 31, 20Y8 and 2017 20Y8 20Y7 $10,000,000 (5350,000) 3 4650,000 Sales Cost of goods sold Grons profi S9400,000 (4950000 $4450,000 Selling expenses Administrative espenses Total operating expenses Operating income S2,000,000) (1.500 000) SE500,000) $ 1,150,000 S1,160,000 Other revenue and expense Other evenue Other espense nterest Income before income tax 140,000 (150,000 S 1,150,000 015,000 925,000 150,000 (170,000) $ 130,000 p30,000) S 900.000 Income tax espense Net income AUTOMOTIVE SOLUTIONS INC. Comparative Statement of Stockhalders'Equity For the Years Ended December 31, 20Y8 and 20Y7 20Y8 20Y7 Preferred Common Retained Preferred Common Retained Stock Stock Earnings Steck Stock Earnings Balances, Jan. 1 $500,000 s500,000 $5,375,000 $5o0.000 $500,000 $4,545,000 900,000 Net income 925,000 Dividends: (45,000) (50,000) $500,000 $5.375,000 Prefered stock (45,000 (50,000 Common stock Balances, Dec. 31 3500.000 3500.000 36,180.000 3500.000 AUTOMOTIVE SOLUTIONS INC. Comparative Balance Sheet December 31, 20Y8 and 2017 Dec. 31, 20v8 Dec. 31, 20Y7 Assets Cument aseti: $ so0.000 $ 400,000 1,000,000 510,000 Cash Marketable securities 1,010,000 740,000 1,190,000 250,000 $3,60.000 2,35000 3740000 $0,780,000 Accounts neceivable net Inventories 950,000 229,000 $3,089,000 2,300,000 3366 000 $8,755,000 Prepaid expenses Total cument ansets Long-term investments Property, plant, and equipment (ret) Total assets Liabilities Cument labilities S 900,000 Long-term liabilities: Mortgage note payable, 10% Bonds payable, 10% Total long-tarm lablities $ 200,000 1,500,000 $1,700,000 2600,000 1,500,000 $1,500,000 $20.000 Total liabiliies Stockholders Equity Prefemed sas0 stock, $10 par Comman stock, 5 par Rutained eamings Total stockholders'equity Tetal liabilies and stockholden'equity $ s00,000 500,000 6.180000 7.180,000 59780,000 S s00,000 500,000 5.375,500 56.375,000 58755,000 Instructions Determine the following measures for 20Y8. Round all ratios to one decimal place. Round camings per share and dividends per share to the nearest cent. 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Days' sales in receivables 6. Imventory turnover 7. Days' sales in inventory & Debe ratio 9. Ratio of liabilities to stockholders equity 10. Ratio of fixed assets to long-term liabilities 11. Times interest eamed 12. Times preferred dividends carned 13. Asset turnover 14. Return on total assets 15. Return on stockholders' equity 16. Return on common stockholders' equity 17. Earnings per share on common stock 18 Price-camings ratio 19. Dividends per share of common stock 20. Dividend yield

The comparative financial statements of Automotive Solutions Inc. are as follows. The mar- ket price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8. AUTOMOTIVE SOLUTIONS INC. Comparative Income Statement For the Years Ended December 31, 20Y8 and 2017 20Y8 20Y7 $10,000,000 (5350,000) 3 4650,000 Sales Cost of goods sold Grons profi S9400,000 (4950000 $4450,000 Selling expenses Administrative espenses Total operating expenses Operating income S2,000,000) (1.500 000) SE500,000) $ 1,150,000 S1,160,000 Other revenue and expense Other evenue Other espense nterest Income before income tax 140,000 (150,000 S 1,150,000 015,000 925,000 150,000 (170,000) $ 130,000 p30,000) S 900.000 Income tax espense Net income AUTOMOTIVE SOLUTIONS INC. Comparative Statement of Stockhalders'Equity For the Years Ended December 31, 20Y8 and 20Y7 20Y8 20Y7 Preferred Common Retained Preferred Common Retained Stock Stock Earnings Steck Stock Earnings Balances, Jan. 1 $500,000 s500,000 $5,375,000 $5o0.000 $500,000 $4,545,000 900,000 Net income 925,000 Dividends: (45,000) (50,000) $500,000 $5.375,000 Prefered stock (45,000 (50,000 Common stock Balances, Dec. 31 3500.000 3500.000 36,180.000 3500.000 AUTOMOTIVE SOLUTIONS INC. Comparative Balance Sheet December 31, 20Y8 and 2017 Dec. 31, 20v8 Dec. 31, 20Y7 Assets Cument aseti: $ so0.000 $ 400,000 1,000,000 510,000 Cash Marketable securities 1,010,000 740,000 1,190,000 250,000 $3,60.000 2,35000 3740000 $0,780,000 Accounts neceivable net Inventories 950,000 229,000 $3,089,000 2,300,000 3366 000 $8,755,000 Prepaid expenses Total cument ansets Long-term investments Property, plant, and equipment (ret) Total assets Liabilities Cument labilities S 900,000 Long-term liabilities: Mortgage note payable, 10% Bonds payable, 10% Total long-tarm lablities $ 200,000 1,500,000 $1,700,000 2600,000 1,500,000 $1,500,000 $20.000 Total liabiliies Stockholders Equity Prefemed sas0 stock, $10 par Comman stock, 5 par Rutained eamings Total stockholders'equity Tetal liabilies and stockholden'equity $ s00,000 500,000 6.180000 7.180,000 59780,000 S s00,000 500,000 5.375,500 56.375,000 58755,000 Instructions Determine the following measures for 20Y8. Round all ratios to one decimal place. Round camings per share and dividends per share to the nearest cent. 1. Working capital 2. Current ratio 3. Quick ratio 4. Accounts receivable turnover 5. Days' sales in receivables 6. Imventory turnover 7. Days' sales in inventory & Debe ratio 9. Ratio of liabilities to stockholders equity 10. Ratio of fixed assets to long-term liabilities 11. Times interest eamed 12. Times preferred dividends carned 13. Asset turnover 14. Return on total assets 15. Return on stockholders' equity 16. Return on common stockholders' equity 17. Earnings per share on common stock 18 Price-camings ratio 19. Dividends per share of common stock 20. Dividend yield

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 4PB

Related questions

Question

| Twenty metrics of liquidity solvency and profitability the comparative financial statements |

Transcribed Image Text:The comparative financial statements of Automotive Solutions Inc. are as follows. The mar-

ket price of Automotive Solutions Inc. common stock was $119.70 on December 31, 20Y8.

AUTOMOTIVE SOLUTIONS INC.

Comparative Income Statement

For the Years Ended December 31, 20Y8 and 2017

20Y8

20Y7

$10,000,000

(5350,000)

3 4650,000

Sales

Cost of goods sold

Grons profi

S9400,000

(4950000

$4450,000

Selling expenses

Administrative espenses

Total operating expenses

Operating income

S2,000,000)

(1.500 000)

SE500,000)

$ 1,150,000

S1,160,000

Other revenue and expense

Other evenue

Other espense nterest

Income before income tax

140,000

(150,000

S 1,150,000

015,000

925,000

150,000

(170,000)

$ 130,000

p30,000)

S 900.000

Income tax espense

Net income

AUTOMOTIVE SOLUTIONS INC.

Comparative Statement of Stockhalders'Equity

For the Years Ended December 31, 20Y8 and 20Y7

20Y8

20Y7

Preferred Common Retained Preferred Common Retained

Stock

Stock Earnings

Steck

Stock

Earnings

Balances, Jan. 1

$500,000 s500,000 $5,375,000 $5o0.000 $500,000 $4,545,000

900,000

Net income

925,000

Dividends:

(45,000)

(50,000)

$500,000 $5.375,000

Prefered stock

(45,000

(50,000

Common stock

Balances, Dec. 31 3500.000 3500.000 36,180.000 3500.000

AUTOMOTIVE SOLUTIONS INC.

Comparative Balance Sheet

December 31, 20Y8 and 2017

Dec. 31, 20v8

Dec. 31, 20Y7

Assets

Cument aseti:

$ so0.000

$ 400,000

1,000,000

510,000

Cash

Marketable securities

1,010,000

740,000

1,190,000

250,000

$3,60.000

2,35000

3740000

$0,780,000

Accounts neceivable net

Inventories

950,000

229,000

$3,089,000

2,300,000

3366 000

$8,755,000

Prepaid expenses

Total cument ansets

Long-term investments

Property, plant, and equipment (ret)

Total assets

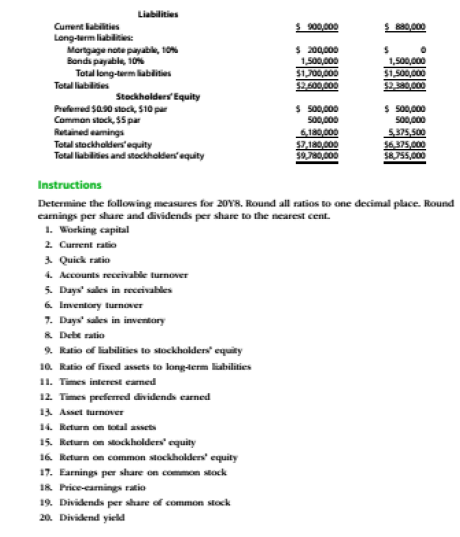

Transcribed Image Text:Liabilities

Cument labilities

S 900,000

Long-term liabilities:

Mortgage note payable, 10%

Bonds payable, 10%

Total long-tarm lablities

$ 200,000

1,500,000

$1,700,000

2600,000

1,500,000

$1,500,000

$20.000

Total liabiliies

Stockholders Equity

Prefemed sas0 stock, $10 par

Comman stock, 5 par

Rutained eamings

Total stockholders'equity

Tetal liabilies and stockholden'equity

$ s00,000

500,000

6.180000

7.180,000

59780,000

S s00,000

500,000

5.375,500

56.375,000

58755,000

Instructions

Determine the following measures for 20Y8. Round all ratios to one decimal place. Round

camings per share and dividends per share to the nearest cent.

1. Working capital

2. Current ratio

3. Quick ratio

4. Accounts receivable turnover

5. Days' sales in receivables

6. Imventory turnover

7. Days' sales in inventory

& Debe ratio

9. Ratio of liabilities to stockholders equity

10. Ratio of fixed assets to long-term liabilities

11. Times interest eamed

12. Times preferred dividends carned

13. Asset turnover

14. Return on total assets

15. Return on stockholders' equity

16. Return on common stockholders' equity

17. Earnings per share on common stock

18 Price-camings ratio

19. Dividends per share of common stock

20. Dividend yield

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning