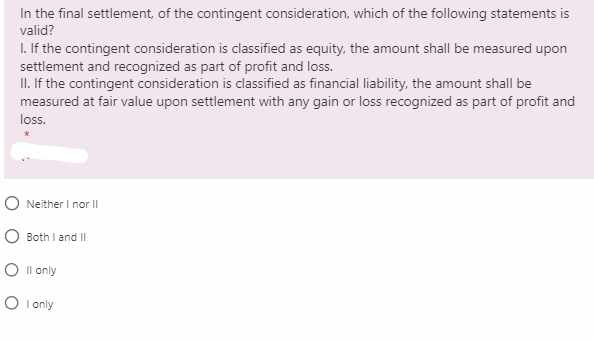

In the final settlement, of the contingent consideration, which of the following statements is valid? I. If the contingent consideration is classified as equity, the amount shall be measured upon settlement and recognized as part of profit and loss. II. If the contingent consideration is classified as financial liability, the amount shall be measured at fair value upon settlement with any gain or loss recognized as part of profit and loss.

In the final settlement, of the contingent consideration, which of the following statements is valid? I. If the contingent consideration is classified as equity, the amount shall be measured upon settlement and recognized as part of profit and loss. II. If the contingent consideration is classified as financial liability, the amount shall be measured at fair value upon settlement with any gain or loss recognized as part of profit and loss.

Chapter11: Investor Losses

Section: Chapter Questions

Problem 3BCRQ

Related questions

Question

100%

23

Transcribed Image Text:In the final settlement, of the contingent consideration, which of the following statements is

valid?

I. If the contingent consideration is classified as equity, the amount shall be measured upon

settlement and recognized as part of profit and loss.

II. If the contingent consideration is classified as financial liability, the amount shall be

measured at fair value upon settlement with any gain or loss recognized as part of profit and

loss.

O Neither I nor II

Both I and II

O Il only

O I only

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning