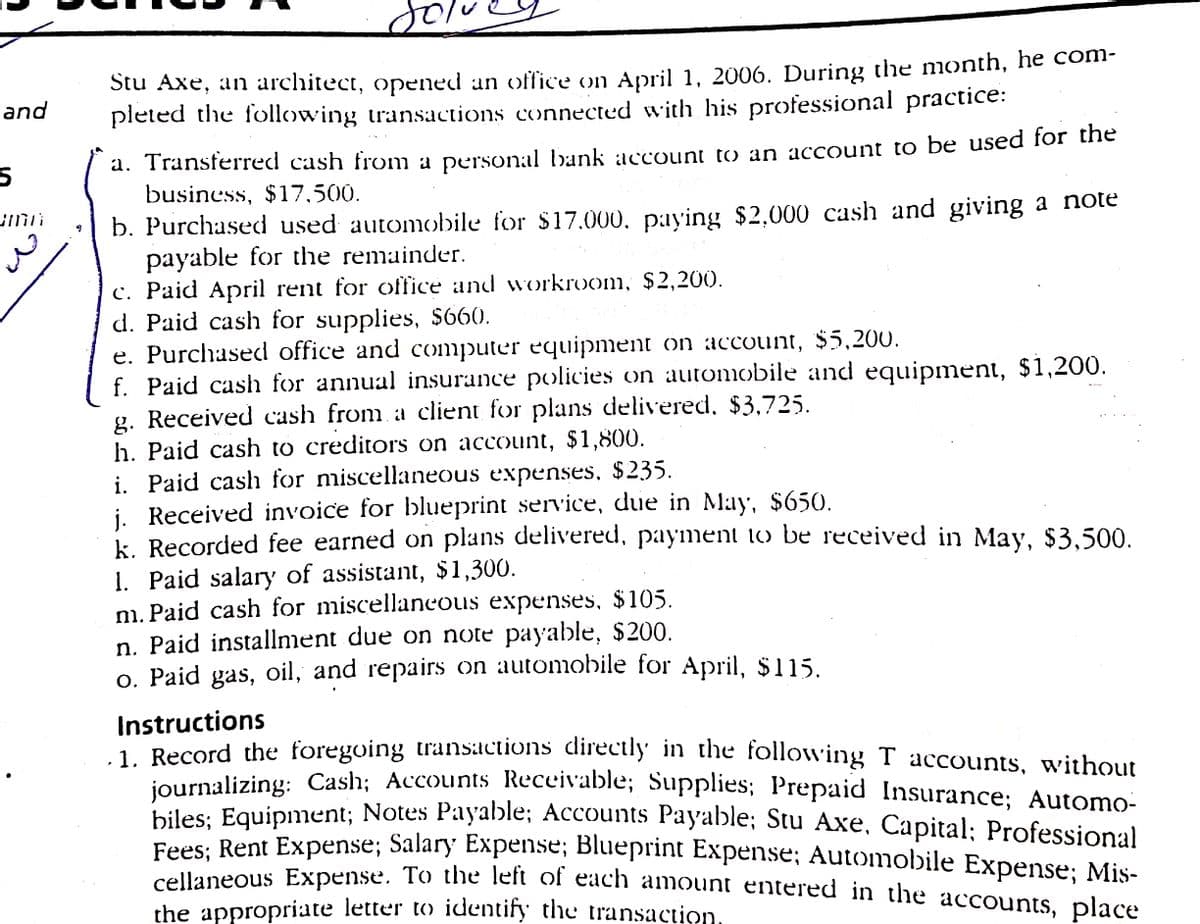

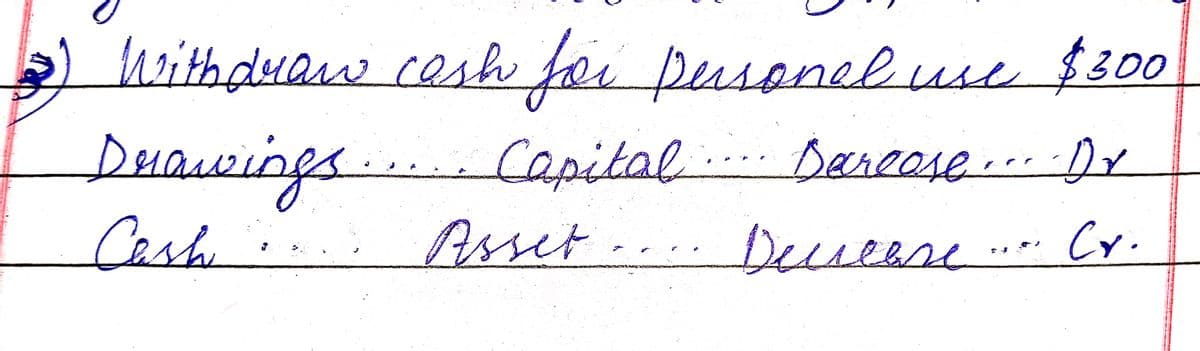

In the first picture, it's the question to be solved by just providing the transactions and showing its affects on other factors like asset, liability etc In the second picture, it's the example given. By following this way, we need to solve the whole question . Please help me solving this problem. I'm waiting for the response.

In the first picture, it's the question to be solved by just providing the transactions and showing its affects on other factors like asset, liability etc In the second picture, it's the example given. By following this way, we need to solve the whole question . Please help me solving this problem. I'm waiting for the response.

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter2: Analyzing Transactions

Section: Chapter Questions

Problem 3PB: On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During...

Related questions

Concept explainers

Question

In the first picture, it's the question to be solved by just providing the transactions and showing its affects on other factors like asset, liability etc

In the second picture, it's the example given. By following this way, we need to solve the whole question . Please help me solving this problem. I'm waiting for the response.

Thankyou!

Transcribed Image Text:Stu Axe, an architect, opened an office on April 1, 2006. During the month, he comr

pleted the following transactions connected with his professional practice:

and

a. Transferred cash from a personal bank account to an account to be used for the

business, $17,500.

b. Purchased used automobile for $17.000, paying $2,000 cash and giving a note

payable for the remainder.

c. Paid April rent for office and workroom, $2,200.

d. Paid cash for supplies, S660.

e. Purchased office and computer equipment on acCount, $5,200.

f. Paid cash for annual insurance policies on automobile and equipment, $1,200.

g. Received cash from a client for plans delivered, $3,725.

h. Paid cash to creditors on account, $1,800.

i. Paid cash for miscellaneous expenses, $235.

j. Received invoice for blueprint service, due in May, $650.

k. Recorded fee earned on plans delivered, payment lo be received in May, $3,500.

1. Paid salary of assistant, $1,300.

mm. Paid cash for miscellancous expenses, $105.

n. Paid installment due on note payable, $200.

o. Paid gas, oil, and repairs on automobile for April, $115.

Instructions

1 Record the foregoing transactions directly in the following T accounts, without

journalizing: Cash; Accounts Receivable; Supplies; Prepaid Insurance; Automo-

biles: Equipment; Notes Payable; Accounts Payable; Stu Axe, Capital; Professional

Fees: Rent Expense; Salary Expense; Blueprint Expense; Automobile Expense; Mis-

cellaneous Expense. To the left of each amount entered in the accounts., place

the appropriate letter to identify the transaction.

Transcribed Image Text:Wwith dyaw cash foi pusonel use $300

Derawings

Capital....Darease...Dy

Cash

Asset.

... Deucere.. Cy.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning