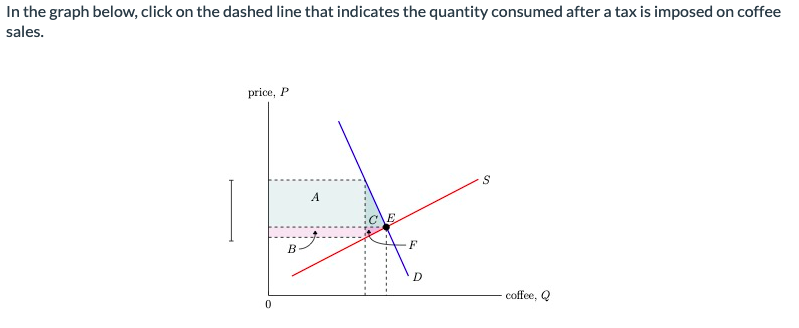

In the graph below, click on the dashed line that indicates the quantity consumed after a tax is imposed on coffee sales. price, P 0 B A D S coffee, Q

When a government imposes a tax on the sale of a commodity, it requires that a certain percentage or amount of the sale price be paid to the government in the form of a tax. This tax is typically added to the price of the commodity and paid by the buyer, who then remits it to the government on behalf of the seller.

The effect of the tax on the market depends on its size and how it is distributed between buyers and sellers. If the tax is large, it can increase the price of the commodity and reduce the quantity demanded, leading to a decrease in sales and production. The tax may also result in a reduction in the profits earned by the seller, which may discourage them from producing and selling the commodity.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images