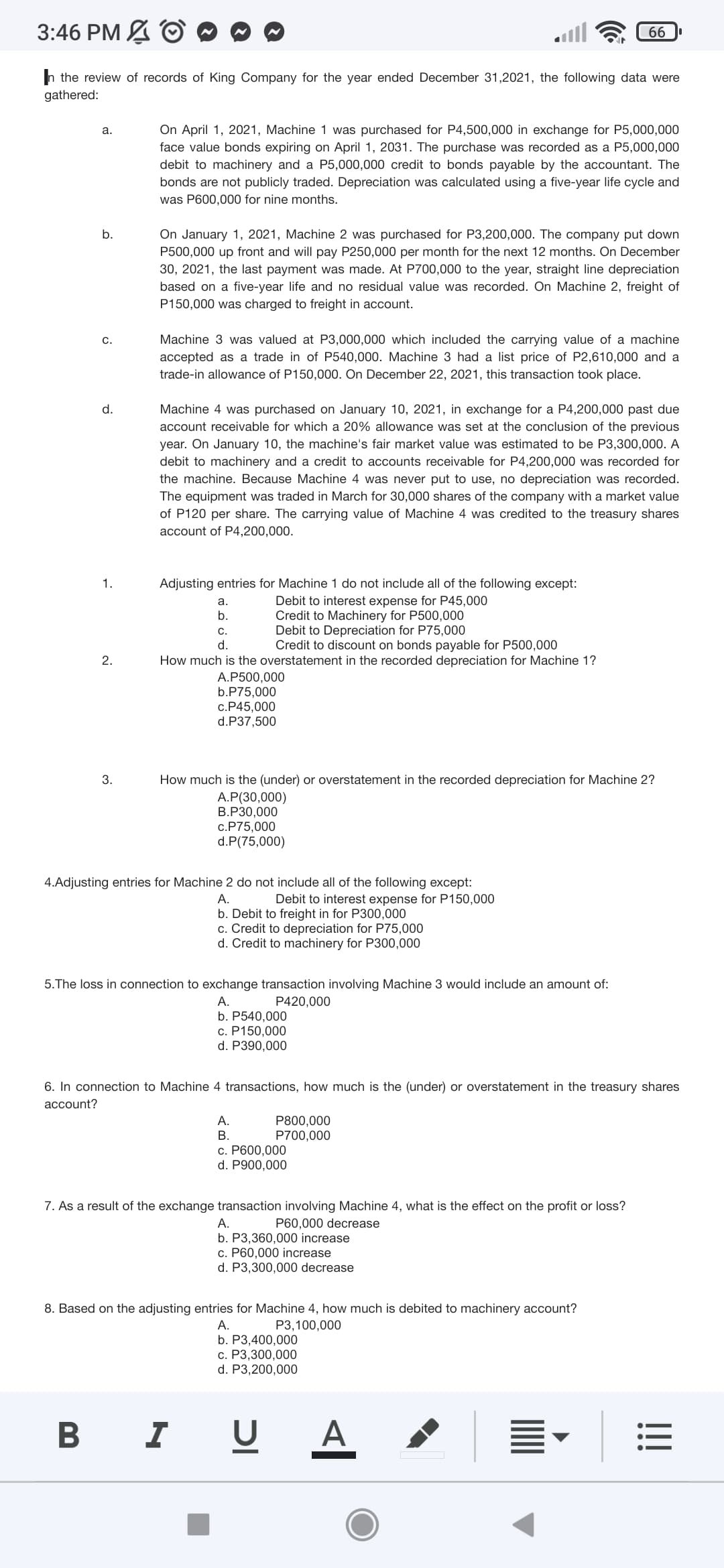

In the review of records of King Company for the year ended December 31,2021, the following data were gathered: a. On April 1, 2021, Machine 1 was purchased for P4,500,000 in exchange for P5,000,000 face value bonds expiring on April 1, 2031. The purchase was recorded as a P5,000,000 debit to machinery and a P5,000,000 credit to bonds payable by the accountant. The bonds are not publicly traded. Depreciation was calculated using a five-year life cycle and was P600,000 for nine months. On January 1, 2021, Machine 2 was purchased for P3,200,000. The company put down P500,000 up front and will pay P250,000 per month for the next 12 months. On December 30, 2021, the last payment was made. At P700,000 to the year, straight line depreciation based on a five-year life and no residual value was recorded. On Machine 2, freight of P150,000 was charged to freight in account. Machine 3 was valued at P3,000,000 which included the carrying value of a machine accepted as a trade in of P540,000. Machine 3 had a list price of P2,610,000 and a trade-in allowance of P150,000. On December 22, 2021, this transaction took place. Machine 4 was purchased on January 10, 2021, in exchange for a P4,200,000 past due account receivable for which a 20% allowance was set at the conclusion of the previous year. On January 10, the machine's fair market value was estimated to be P3,300,000. A debit to machinery and a credit to accounts receivable for P4,200,000 was recorded for the machine. Because Machine 4 was never put to use, no depreciation was recorded. The equipment was traded in March for 30,000 shares of the company with a market value of P120 per share. The carrying value of Machine 4 was credited to the treasury shares account of P4,200,000. Adjusting entries for Machine 1 do not include all of the following except: a. Debit to interest expense for P45,000 b. Credit to Machinery for P500,000 C. Debit to Depreciation for P75,000 d. Credit to discount on bonds payable for P500,000 How much is the overstatement in the recorded depreciation for Machine 1? A.P500,000 b.P75,000 c.P45,000 d.P37,500 How much is the (under) or overstatement in the recorded depreciation for Machine 2? A.P(30,000) B.P30,000 c.P75,000 d.P(75,000) b. C. d. 1. 2. 3.

In the review of records of King Company for the year ended December 31,2021, the following data were gathered: a. On April 1, 2021, Machine 1 was purchased for P4,500,000 in exchange for P5,000,000 face value bonds expiring on April 1, 2031. The purchase was recorded as a P5,000,000 debit to machinery and a P5,000,000 credit to bonds payable by the accountant. The bonds are not publicly traded. Depreciation was calculated using a five-year life cycle and was P600,000 for nine months. On January 1, 2021, Machine 2 was purchased for P3,200,000. The company put down P500,000 up front and will pay P250,000 per month for the next 12 months. On December 30, 2021, the last payment was made. At P700,000 to the year, straight line depreciation based on a five-year life and no residual value was recorded. On Machine 2, freight of P150,000 was charged to freight in account. Machine 3 was valued at P3,000,000 which included the carrying value of a machine accepted as a trade in of P540,000. Machine 3 had a list price of P2,610,000 and a trade-in allowance of P150,000. On December 22, 2021, this transaction took place. Machine 4 was purchased on January 10, 2021, in exchange for a P4,200,000 past due account receivable for which a 20% allowance was set at the conclusion of the previous year. On January 10, the machine's fair market value was estimated to be P3,300,000. A debit to machinery and a credit to accounts receivable for P4,200,000 was recorded for the machine. Because Machine 4 was never put to use, no depreciation was recorded. The equipment was traded in March for 30,000 shares of the company with a market value of P120 per share. The carrying value of Machine 4 was credited to the treasury shares account of P4,200,000. Adjusting entries for Machine 1 do not include all of the following except: a. Debit to interest expense for P45,000 b. Credit to Machinery for P500,000 C. Debit to Depreciation for P75,000 d. Credit to discount on bonds payable for P500,000 How much is the overstatement in the recorded depreciation for Machine 1? A.P500,000 b.P75,000 c.P45,000 d.P37,500 How much is the (under) or overstatement in the recorded depreciation for Machine 2? A.P(30,000) B.P30,000 c.P75,000 d.P(75,000) b. C. d. 1. 2. 3.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter14: Financing Liabilities: Bonds And Long-term Notes Payable

Section: Chapter Questions

Problem 7P: Wilbury Corporation issued 1 million of 13.5% bonds for 985,071.68. The bonds are dated and issued...

Related questions

Question

Transcribed Image Text:3:46 PM

66

In the review of records of King Company for the year ended December 31,2021, the following data were

gathered:

a.

On April 1, 2021, Machine 1 was purchased for P4,500,000 in exchange for P5,000,000

face value bonds expiring on April 1, 2031. The purchase was recorded as a P5,000,000

debit to machinery and a P5,000,000 credit to bonds payable by the accountant. The

bonds are not publicly traded. Depreciation was calculated using a five-year life cycle and

was P600,000 for nine months.

On January 1, 2021, Machine 2 was purchased for P3,200,000. The company put down

P500,000 up front and will pay P250,000 per month for the next 12 months. On December

30, 2021, the last payment was made. At P700,000 to the year, straight line depreciation

based on a five-year life and no residual value was recorded. On Machine 2, freight of

P150,000 was charged to freight in account.

Machine 3 was valued at P3,000,000 which included the carrying value of a machine

accepted as a trade in of P540,000. Machine 3 had a list price of P2,610,000 and a

trade-in allowance of P150,000. On December 22, 2021, this transaction took place.

Machine 4 was purchased on January 10, 2021, in exchange for a P4,200,000 past due

account receivable for which a 20% allowance was set at the conclusion of the previous

year. On January 10, the machine's fair market value was estimated to be P3,300,000. A

debit to machinery and a credit to accounts receivable for P4,200,000 was recorded for

the machine. Because Machine 4 was never put to use, no depreciation was recorded.

The equipment was traded in March for 30,000 shares of the company with a market value

of P120 per share. The carrying value of Machine 4 was credited to the treasury shares

account of P4,200,000.

Adjusting entries for Machine 1 do not include all of the following except:

a.

Debit to interest expense for P45,000

b.

Credit to Machinery for P500,000

C.

Debit to Depreciation for P75,000

d.

Credit to discount on bonds payable for P500,000

How much is the overstatement in the recorded depreciation for Machine 1?

A.P500,000

b.P75,000

c.P45,000

d.P37,500

3.

How much is the (under) or overstatement in the recorded depreciation for Machine 2?

A.P(30,000)

B.P30,000

c.P75,000

d.P(75,000)

4.Adjusting entries for Machine 2 do not include all of the following except:

A.

Debit to interest expense for P150,000

b. Debit to freight in for P300,000

c. Credit to depreciation for P75,000

d. Credit to machinery for P300,000

5.The loss in connection to exchange transaction involving Machine 3 would include an amount of:

A.

P420,000

b. P540,000

c. P150,000

d. P390,000

6. In connection to Machine 4 transactions, how much is the (under) or overstatement in the treasury shares

account?

A.

P800,000

P700,000

B.

c. P600,000

d. P900,000

7. As a result of the exchange transaction involving Machine 4, what is the effect on the profit or loss?

A.

P60,000 decrease

b. P3,360,000 increase

c. P60,000 increase

d. P3,300,000 decrease

8. Based on the adjusting entries for Machine 4, how much is debited to machinery account?

A.

P3,100,000

b. P3,400,000

c. P3,300,000

d. P3,200,000

B

I U

b.

C.

d.

1.

2.

A

!!!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning