Inč. iš čomplêting the preparation of the draft finančiål štatement för thể year ended December 31, 2021. The financial statements are authorized for issue on March 31, 2022 On January 31, 2022, a dividend of P3,000,000 was declared and a contractual profit share payment of of P1,000,000 was made both based on the profit for the year ended December 31, 2021 On February 15, 2022, a customer went into liquidation having owed the entity P500,000 for the past 5 months. No allowance had been made agains this debt in the draft financial statements. On March 1, 2022, a manufacturing plant was destroyed by fire resultin in a financial loss of P2,500,000.

Inč. iš čomplêting the preparation of the draft finančiål štatement för thể year ended December 31, 2021. The financial statements are authorized for issue on March 31, 2022 On January 31, 2022, a dividend of P3,000,000 was declared and a contractual profit share payment of of P1,000,000 was made both based on the profit for the year ended December 31, 2021 On February 15, 2022, a customer went into liquidation having owed the entity P500,000 for the past 5 months. No allowance had been made agains this debt in the draft financial statements. On March 1, 2022, a manufacturing plant was destroyed by fire resultin in a financial loss of P2,500,000.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter3: Accrual Accounting

Section: Chapter Questions

Problem 10MCQ: Reinhardt Company reported revenues of $122,000 and expenses of $83,000 on its 2019 income...

Related questions

Question

What total amount should be recognized in profit or loss of Sushi Inc. for the year ended December 31, 2021 to reflect adjusting events?

A. 4,500,000

B. 3,000,000

C. 2,500 000

D. 1,500,000

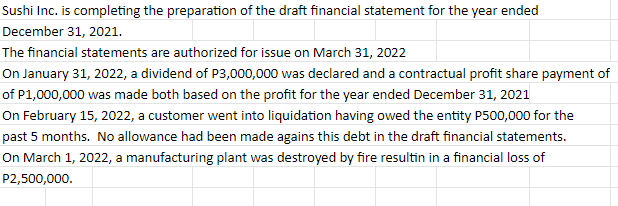

Transcribed Image Text:Sushi Inc. is completing the preparation of the draft financial statement for the year ended

December 31, 2021.

The financial statements are authorized for issue on March 31, 2022

On January 31, 2022, a dividend of P3,000,000 was declared and a contractual profit share payment of

of P1,000,000 was made both based on the profit for the year ended December 31, 2021

On February 15, 2022, a customer went into liquidation having owed the entity P500,000 for the

past 5 months. No allowance had been made agains this debt in the draft financial statements.

On March 1, 2022, a manufacturing plant was destroyed by fire resultin in a financial loss of

P2,500,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT