inc. Ist ing to determine whether to use the F inventory information: Date Oct. 2 15 29 Purchases Units Cost 8,100 $11 13,500 Total $89,100 15 202,500 or average cost formula. The acc Cost of Goods Sold Units 20,600 [6] [8] Cost Total ing records show the following selecte [1] [3] Ending Inventory Units Cost Total 8,100 $11 $89,100 [2] [4] [7] [9] [10] [11] [12] [5] [13] The company accountant has prepared the following partial statement of income to help management understand the financial statement impact of each cost determination cost formula.

inc. Ist ing to determine whether to use the F inventory information: Date Oct. 2 15 29 Purchases Units Cost 8,100 $11 13,500 Total $89,100 15 202,500 or average cost formula. The acc Cost of Goods Sold Units 20,600 [6] [8] Cost Total ing records show the following selecte [1] [3] Ending Inventory Units Cost Total 8,100 $11 $89,100 [2] [4] [7] [9] [10] [11] [12] [5] [13] The company accountant has prepared the following partial statement of income to help management understand the financial statement impact of each cost determination cost formula.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 2RE: Black Corporation uses the LIFO cost flow assumption. Each unit of its inventory has a net...

Related questions

Topic Video

Question

Hi there,

I'm having trouble solving this question

Thanks

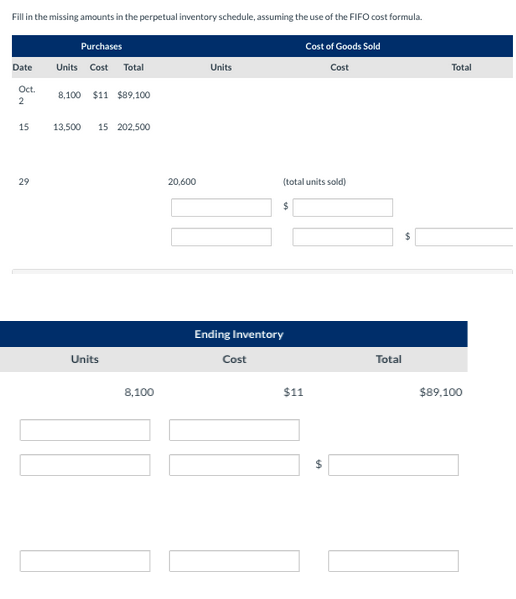

Transcribed Image Text:Fill in the missing amounts in the perpetual inventory schedule, assuming the use of the FIFO cost formula.

Date

Oct.

2

15

29

Purchases

Units Cost Total

8,100 $11 $89.100

13,500 15 202,500

Units

8,100

20,600

Units

Cost

(total units sold)

$

Ending Inventory

Cost of Goods Sold

Cost

$11

$

549

Total

$

Total

$89,100

![Pina Inc. is trying to determine whether to use the FIFO or average cost formula. The accounting records show the following selected

inventory information:

Date

Oct. 2

15

29

Purchases

Units Cost

8,100 $11

13,500

15

Sales

Cost of goods sold

Gross profit

Net income

Operating expenses

Income before income tax

Income tax expense (30%)

Total

$89,100

202,500

FIFO

$563,000

Cost of Goods Sold

182,000

Units

20,600

[6]

[8]

Average

$563,000

Cost Total

182,000

Units

8,100

[1]

[3]

The company accountant has prepared the following partial statement of income to help management understand the financial

statement impact of each cost determination cost formula.

[7]

[9] [10] [11]

Ending Inventory

Cost Total

$11

$89,100

[2]

[4]

[12]

[5]

[13]](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2Ff0a8a8b2-22c4-42fd-96b3-e86c4fe33385%2F72ccbb75-852f-439e-996d-0871c97772bd%2Fgp165tg_processed.png&w=3840&q=75)

Transcribed Image Text:Pina Inc. is trying to determine whether to use the FIFO or average cost formula. The accounting records show the following selected

inventory information:

Date

Oct. 2

15

29

Purchases

Units Cost

8,100 $11

13,500

15

Sales

Cost of goods sold

Gross profit

Net income

Operating expenses

Income before income tax

Income tax expense (30%)

Total

$89,100

202,500

FIFO

$563,000

Cost of Goods Sold

182,000

Units

20,600

[6]

[8]

Average

$563,000

Cost Total

182,000

Units

8,100

[1]

[3]

The company accountant has prepared the following partial statement of income to help management understand the financial

statement impact of each cost determination cost formula.

[7]

[9] [10] [11]

Ending Inventory

Cost Total

$11

$89,100

[2]

[4]

[12]

[5]

[13]

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning