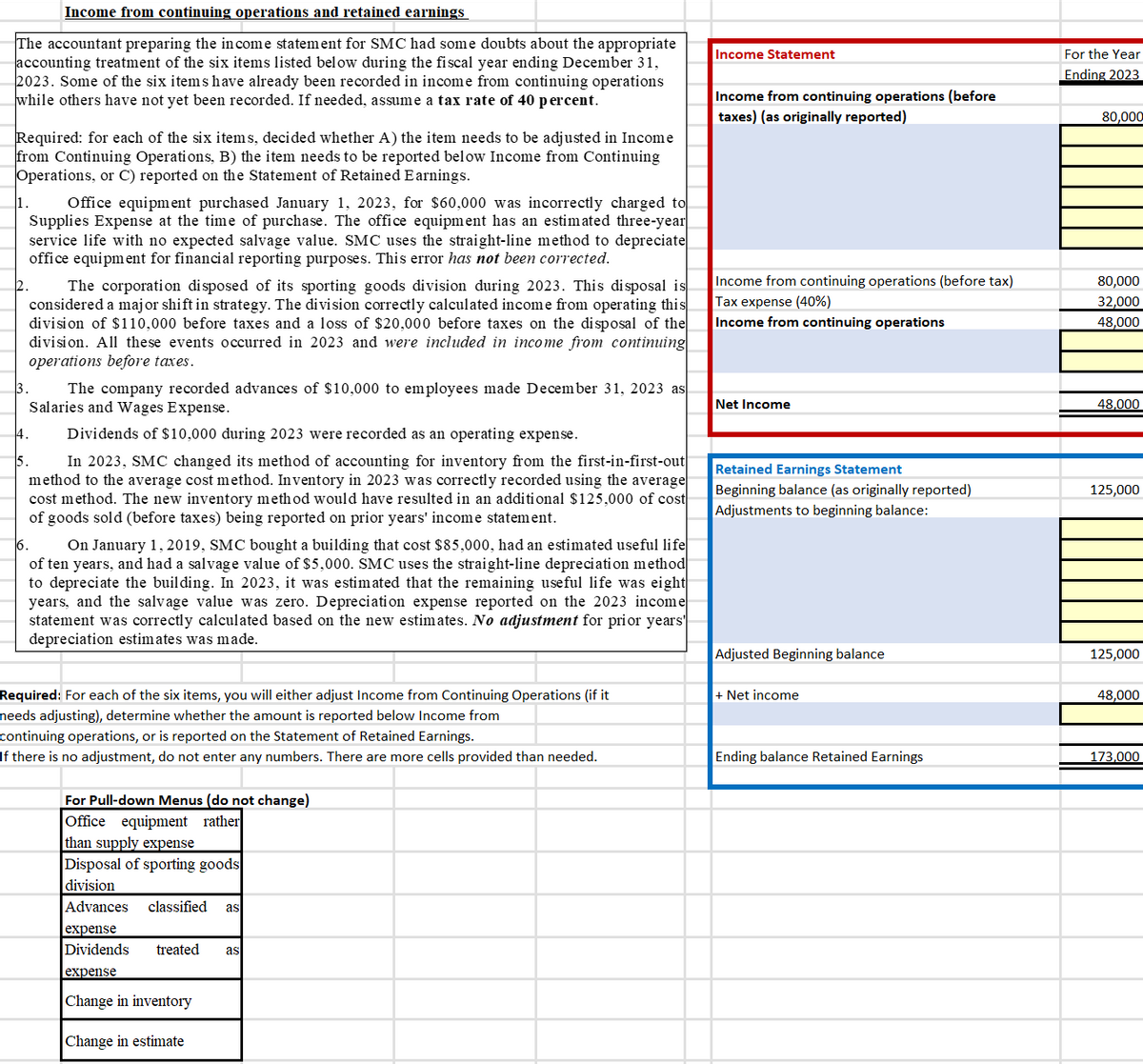

Income from continuing operations and retained earnings The accountant preparing the income statement for SMC had some doubts about the appropriate accounting treatment of the six items listed below during the fiscal year ending December 31, 2023. Some of the six items have already been recorded in income from continuing operations while others have not yet been recorded. If needed, assume a tax rate of 40 percent. Required: for each of the six items, decided whether A) the item needs to be adjusted in Income from Continuing Operations, B) the item needs to be reported below Income from Continuing Operations, or C) reported on the Statement of Retained Earnings. 1. Office equipment purchased January 1, 2023, for $60,000 was incorrectly charged to Supplies Expense at the time of purchase. The office equipment has an estimated three-year service life with no expected salvage value. SMC uses the straight-line method to depreciate office equipment for financial reporting purposes. This error has not been corrected. The corporation disposed of its sporting goods division during 2023. This disposal is considered a major shift in strategy. The division correctly calculated income from operating this division of $110,000 before taxes and a loss of $20,000 before taxes on the disposal of the division. All these events occurred in 2023 and were included in income from continuing operations before taxes. 2. 4. 5. The company recorded advances of $10,000 to employees made December 31, 2023 as Salaries and Wages Expense. Dividends of $10,000 during 2023 were recorded as an operating expense. In 2023, SMC changed its method of accounting for inventory from the first-in-first-out method to the average cost method. Inventory in 2023 was correctly recorded using the average cost method. The new inventory method would have resulted in an additional $125,000 of cost of goods sold (before taxes) being reported on prior years' income statement. 6. On January 1, 2019, SMC bought a building that cost $85,000, had an estimated useful life of ten years, and had a salvage value of $5,000. SMC uses the straight-line depreciation method to depreciate the building. In 2023, it was estimated that the remaining useful life was eight years, and the salvage value was zero. Depreciation expense reported on the 2023 income statement was correctly calculated based on the new estimates. No adjustment for prior years' depreciation estimates was made. Required: For each of the six items, you will either adjust Income from Continuing Operations (if it needs adjusting), determine whether the amount is reported below Income from continuing operations, or is reported on the Statement of Retained Earnings. If there is no adjustment, do not enter any numbers. There are more cells provided than needed. For Pull-down Menus (do not change) Office equipment rather than supply expense Disposal of sporting goods division Advances classified as expense Dividends treated as expense Change in inventory Change in estimate Income Statement Income from continuing operations (before taxes) (as originally reported) Income from continuing operations (before tax) Tax expense (40%) Income from continuing operations Net Income Retained Earnings Statement Beginning balance (as originally reported) Adjustments to beginning balance: Adjusted Beginning balance + Net income Ending balance Retained Earnings For the Year Ending 2023 80,000 80,000 32,000 48,000 48,000 125,000 125,000 48,000 173,000

Income from continuing operations and retained earnings The accountant preparing the income statement for SMC had some doubts about the appropriate accounting treatment of the six items listed below during the fiscal year ending December 31, 2023. Some of the six items have already been recorded in income from continuing operations while others have not yet been recorded. If needed, assume a tax rate of 40 percent. Required: for each of the six items, decided whether A) the item needs to be adjusted in Income from Continuing Operations, B) the item needs to be reported below Income from Continuing Operations, or C) reported on the Statement of Retained Earnings. 1. Office equipment purchased January 1, 2023, for $60,000 was incorrectly charged to Supplies Expense at the time of purchase. The office equipment has an estimated three-year service life with no expected salvage value. SMC uses the straight-line method to depreciate office equipment for financial reporting purposes. This error has not been corrected. The corporation disposed of its sporting goods division during 2023. This disposal is considered a major shift in strategy. The division correctly calculated income from operating this division of $110,000 before taxes and a loss of $20,000 before taxes on the disposal of the division. All these events occurred in 2023 and were included in income from continuing operations before taxes. 2. 4. 5. The company recorded advances of $10,000 to employees made December 31, 2023 as Salaries and Wages Expense. Dividends of $10,000 during 2023 were recorded as an operating expense. In 2023, SMC changed its method of accounting for inventory from the first-in-first-out method to the average cost method. Inventory in 2023 was correctly recorded using the average cost method. The new inventory method would have resulted in an additional $125,000 of cost of goods sold (before taxes) being reported on prior years' income statement. 6. On January 1, 2019, SMC bought a building that cost $85,000, had an estimated useful life of ten years, and had a salvage value of $5,000. SMC uses the straight-line depreciation method to depreciate the building. In 2023, it was estimated that the remaining useful life was eight years, and the salvage value was zero. Depreciation expense reported on the 2023 income statement was correctly calculated based on the new estimates. No adjustment for prior years' depreciation estimates was made. Required: For each of the six items, you will either adjust Income from Continuing Operations (if it needs adjusting), determine whether the amount is reported below Income from continuing operations, or is reported on the Statement of Retained Earnings. If there is no adjustment, do not enter any numbers. There are more cells provided than needed. For Pull-down Menus (do not change) Office equipment rather than supply expense Disposal of sporting goods division Advances classified as expense Dividends treated as expense Change in inventory Change in estimate Income Statement Income from continuing operations (before taxes) (as originally reported) Income from continuing operations (before tax) Tax expense (40%) Income from continuing operations Net Income Retained Earnings Statement Beginning balance (as originally reported) Adjustments to beginning balance: Adjusted Beginning balance + Net income Ending balance Retained Earnings For the Year Ending 2023 80,000 80,000 32,000 48,000 48,000 125,000 125,000 48,000 173,000

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 13P

Related questions

Question

Transcribed Image Text:Income from continuing operations and retained earnings

The accountant preparing the income statement for SMC had some doubts about the appropriate

accounting treatment of the six items listed below during the fiscal year ending December 31,

2023. Some of the six items have already been recorded in income from continuing operations

while others have not yet been recorded. If needed, assume a tax rate of 40 percent.

Required: for each of the six items, decided whether A) the item needs to be adjusted in Income

from Continuing Operations, B) the item needs to be reported below Income from Continuing

Operations, or C) reported on the Statement of Retained Earnings.

1.

Office equipment purchased January 1, 2023, for $60,000 was incorrectly charged to

Supplies Expense at the time of purchase. The office equipment has an estimated three-year

service life with no expected salvage value. SMC uses the straight-line method to depreciate

office equipment for financial reporting purposes. This error has not been corrected.

The corporation disposed of its sporting goods division during 2023. This disposal is

considered a major shift in strategy. The division correctly calculated income from operating this

division of $110,000 before taxes and a loss of $20,000 before taxes on the disposal of the

division. All these events occurred in 2023 and were included in income from continuing

operations before taxes.

2.

4.

5.

The company recorded advances of $10,000 to employees made December 31, 2023 as

Salaries and Wages Expense.

Dividends of $10,000 during 2023 were recorded as an operating expense.

In 2023, SMC changed its method of accounting for inventory from the first-in-first-out

method to the average cost method. Inventory in 2023 was correctly recorded using the average

cost method. The new inventory method would have resulted in an additional $125,000 of cost

of goods sold (before taxes) being reported on prior years' income statement.

6.

On January 1, 2019, SMC bought a building that cost $85,000, had an estimated useful life

of ten years, and had a salvage value of $5,000. SMC uses the straight-line depreciation method

to depreciate the building. In 2023, it was estimated that the remaining useful life was eight

years, and the salvage value was zero. Depreciation expense reported on the 2023 income

statement was correctly calculated based on the new estimates. No adjustment for prior years'

depreciation estimates was made.

Required: For each of the six items, you will either adjust Income from Continuing Operations (if it

needs adjusting), determine whether the amount is reported below Income from

continuing operations, or is reported on the Statement of Retained Earnings.

If there is no adjustment, do not enter any numbers. There are more cells provided than needed.

For Pull-down Menus (do not change)

Office equipment rather

than supply expense

Disposal of sporting goods

division

Advances classified as

expense

Dividends treated as

expense

Change in inventory

Change in estimate

Income Statement

Income from continuing operations (before

taxes) (as originally reported)

Income from continuing operations (before tax)

Tax expense (40%)

Income from continuing operations

Net Income

Retained Earnings Statement

Beginning balance (as originally reported)

Adjustments to beginning balance:

Adjusted Beginning balance

+ Net income

Ending balance Retained Earnings

For the Year

Ending 2023

80,000

80,000

32,000

48,000

48,000

125,000

125,000

48,000

173,000

AI-Generated Solution

Unlock instant AI solutions

Tap the button

to generate a solution

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning