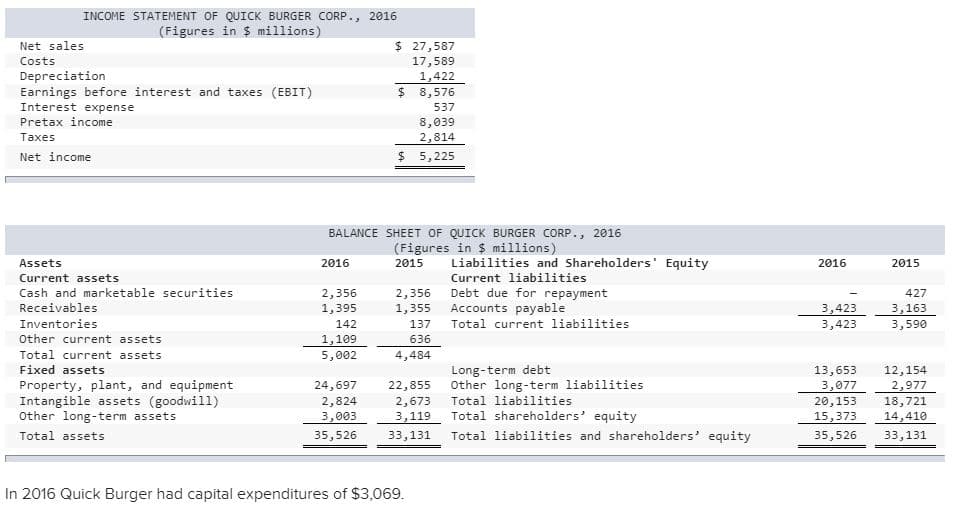

INCOME STATEMENT OF QUICK BURGER CORP., 2016 (Figures in $ millions) $ 27,587 17,589 1,422 $ 8,576 Net sales Costs Depreciation Earnings before interest and taxes (EBIT) Interest expense Pretax income 537 8,039 2,814 $ 5,225 Таxes Net income BALANCE SHEET OF QUICK BURGER CORP., 2016 (Figures in $ millions) 2015 Liabilities and Shareholders' Equity Assets 2016 2016 2015 Current liabilities 2,356 Debt due for repayment 1,355 Accounts payable Current assets Cash and marketable securities Receivables 2,356 1,395 427 Total current liabilities 3,423 3,423 3,163 3,590 Inventories 142 137 Other current assets 1,109 5,002 636 Total current assets Fixed assets 4,484 Property, plant, and equipment Intangible assets (goodwill) Other long-term assets 24,697 2,824 3,003 Long-term debt 22,855 other long-term liabillities Total liabilities Total shareholders' equity 13,653 3,077 20,153 15,373 12,154 2,977 18,721 14,410 2,673 3,119 Total assets 35,526 33,131 Total liabilities and shareholders' equity 35,526 33,131 In 2016 Quick Burger had capital expenditures of $3,069.

INCOME STATEMENT OF QUICK BURGER CORP., 2016 (Figures in $ millions) $ 27,587 17,589 1,422 $ 8,576 Net sales Costs Depreciation Earnings before interest and taxes (EBIT) Interest expense Pretax income 537 8,039 2,814 $ 5,225 Таxes Net income BALANCE SHEET OF QUICK BURGER CORP., 2016 (Figures in $ millions) 2015 Liabilities and Shareholders' Equity Assets 2016 2016 2015 Current liabilities 2,356 Debt due for repayment 1,355 Accounts payable Current assets Cash and marketable securities Receivables 2,356 1,395 427 Total current liabilities 3,423 3,423 3,163 3,590 Inventories 142 137 Other current assets 1,109 5,002 636 Total current assets Fixed assets 4,484 Property, plant, and equipment Intangible assets (goodwill) Other long-term assets 24,697 2,824 3,003 Long-term debt 22,855 other long-term liabillities Total liabilities Total shareholders' equity 13,653 3,077 20,153 15,373 12,154 2,977 18,721 14,410 2,673 3,119 Total assets 35,526 33,131 Total liabilities and shareholders' equity 35,526 33,131 In 2016 Quick Burger had capital expenditures of $3,069.

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter15: Investments And Fair Value Accounting

Section: Chapter Questions

Problem 18E

Related questions

Question

The images contain the questions - I am unable to figure out part c.

Transcribed Image Text:INCOME STATEMENT OF QUICK BURGER CORP., 2016

(Figures in $ millions)

$ 27,587

17,589

1,422

$ 8,576

Net sales

Costs

Depreciation

Earnings before interest and taxes (EBIT)

Interest expense

Pretax income

537

8,039

2,814

$ 5,225

Таxes

Net income

BALANCE SHEET OF QUICK BURGER CORP., 2016

(Figures in $ millions)

2015

Liabilities and Shareholders' Equity

Assets

2016

2016

2015

Current liabilities

2,356 Debt due for repayment

1,355 Accounts payable

Current assets

Cash and marketable securities

Receivables

2,356

1,395

427

Total current liabilities

3,423

3,423

3,163

3,590

Inventories

142

137

Other current assets

1,109

5,002

636

Total current assets

Fixed assets

4,484

Property, plant, and equipment

Intangible assets (goodwill)

Other long-term assets

24,697

2,824

3,003

Long-term debt

22,855 other long-term liabillities

Total liabilities

Total shareholders' equity

13,653

3,077

20,153

15,373

12,154

2,977

18,721

14,410

2,673

3,119

Total assets

35,526

33,131

Total liabilities and shareholders' equity

35,526

33,131

In 2016 Quick Burger had capital expenditures of $3,069.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning