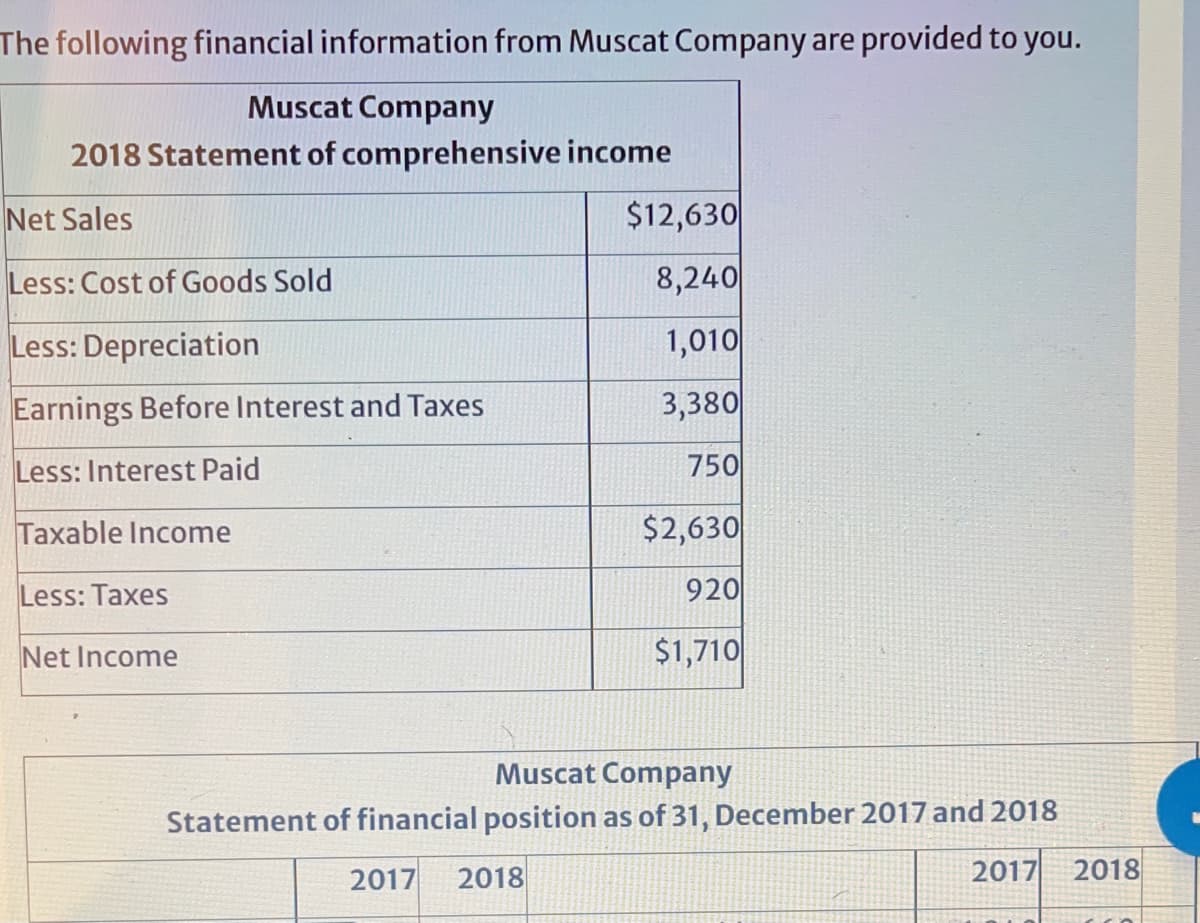

The following financial information from Muscat Company are provided to you. Muscat Company 2018 Statement of comprehensive income Net Sales $12,630 Less: Cost of Goods Sold 8,240 Less: Depreciation 1,010 Earnings Before Interest and Taxes 3,380 Less: Interest Paid 750 Taxable Income $2,630 Less: Taxes 920 Net Income $1,710 Muscat Company Statement of financial position as of 31, December 2017 and 2018

The following financial information from Muscat Company are provided to you. Muscat Company 2018 Statement of comprehensive income Net Sales $12,630 Less: Cost of Goods Sold 8,240 Less: Depreciation 1,010 Earnings Before Interest and Taxes 3,380 Less: Interest Paid 750 Taxable Income $2,630 Less: Taxes 920 Net Income $1,710 Muscat Company Statement of financial position as of 31, December 2017 and 2018

Chapter6: Merchandising Transactions

Section: Chapter Questions

Problem 15EA: The following select account data is taken from the records of Reese Industries for 2019. A. Use the...

Related questions

Question

Could you please help me

Transcribed Image Text:The following financial information from Muscat Company are provided to you.

Muscat Company

2018 Statement of comprehensive income

Net Sales

$12,630

Less: Cost of Goods Sold

8,240

Less: Depreciation

1,010

Earnings Before Interest and Taxes

3,380

Less: Interest Paid

750

Taxable Income

$2,630

Less: Taxes

920

Net Income

$1,710

Muscat Company

Statement of financial position as of 31, December 2017 and 2018

2017

2018

2017

2018

![Muscat Company

Statement of financial position as of 31, December 2017 and 2018

2017

2018

2017 2018

Cash

$640 $590Accounts payable

1,240

660

Accounts rec.

1,200 1,390 Long-term debt

2,500 2,800

Inventory

2,300 2,470Common stock

4,000 4,500

Total

$4,140 $4,450Retained earnings

1,040 1,690

Net fixed assets

4,640 5,200

Total assets

$8,780 $9,650Total liabilities & equity

$8,780|$9,650

Required:

Comment on the performance of the Company by calculating:

a. Liquidity ratios [ Current ratio; Quick ratio and Cash ratio]

b. Turnover ratios [Inventory turnover & Days' sales in inventory; Receivable

turnover & Receivable turnover period and Total assets turnover] and

C. Profitability ratios [ Profit margin; ROA and ROE]](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F5f3732b7-3b8f-4fb3-a549-0cc1315617f5%2Ff9a1e4e5-a52d-41d5-b6ac-bf0822a1d899%2F0ggmuxk_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Muscat Company

Statement of financial position as of 31, December 2017 and 2018

2017

2018

2017 2018

Cash

$640 $590Accounts payable

1,240

660

Accounts rec.

1,200 1,390 Long-term debt

2,500 2,800

Inventory

2,300 2,470Common stock

4,000 4,500

Total

$4,140 $4,450Retained earnings

1,040 1,690

Net fixed assets

4,640 5,200

Total assets

$8,780 $9,650Total liabilities & equity

$8,780|$9,650

Required:

Comment on the performance of the Company by calculating:

a. Liquidity ratios [ Current ratio; Quick ratio and Cash ratio]

b. Turnover ratios [Inventory turnover & Days' sales in inventory; Receivable

turnover & Receivable turnover period and Total assets turnover] and

C. Profitability ratios [ Profit margin; ROA and ROE]

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27 (New in Account…

Accounting

ISBN:

9781305666160

Author:

James A. Heintz, Robert W. Parry

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning