TLC Company Comparatiove Statement of Comprehensie Income For Year 2015 and 2016 2016 2015 Net Sales 700,000 900,000 Less Cont of Goods Sold (100,000) (80,000) Gross Profit 600,000 820,000 Less Operating Expenses Earnings Before Interest and Taxen Less Interest Expense (50,000) (120,000) 700,000 (50,000) 550,000 (10.000) Net Income Blefore Tax 540,000 650,000 Less Income TaN (162,000) (195,000) Net Income 378,000 455,000 Ansuer on a separate sheet. Pad paper or any paper avaiable in yyour hame. Write your NAME: FARM2/(estion DATE Despen W7:M14-Fin T Ratios Compute the ratios listed below for 2016 and tell if it is good ar bad. Show asolution. 1. Working Capital 2. Current Ratio 3. Quick/Acid Teat Ratio 4. A/R Turnover Ratio 5. Avernge Collection Period 6. Inventory Turmover Ratio 13. Profit Margin Ratio 14. Return on Assets 15. Return on Equity 16. Asset Turnover Ratio

TLC Company Comparatiove Statement of Comprehensie Income For Year 2015 and 2016 2016 2015 Net Sales 700,000 900,000 Less Cont of Goods Sold (100,000) (80,000) Gross Profit 600,000 820,000 Less Operating Expenses Earnings Before Interest and Taxen Less Interest Expense (50,000) (120,000) 700,000 (50,000) 550,000 (10.000) Net Income Blefore Tax 540,000 650,000 Less Income TaN (162,000) (195,000) Net Income 378,000 455,000 Ansuer on a separate sheet. Pad paper or any paper avaiable in yyour hame. Write your NAME: FARM2/(estion DATE Despen W7:M14-Fin T Ratios Compute the ratios listed below for 2016 and tell if it is good ar bad. Show asolution. 1. Working Capital 2. Current Ratio 3. Quick/Acid Teat Ratio 4. A/R Turnover Ratio 5. Avernge Collection Period 6. Inventory Turmover Ratio 13. Profit Margin Ratio 14. Return on Assets 15. Return on Equity 16. Asset Turnover Ratio

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter8: Current And Contingent Liabilities

Section: Chapter Questions

Problem 84.3C

Related questions

Question

numbers 4, 5, 6 only please

Transcribed Image Text:TLC Campany

Companatiie Statement of Comprehensitve Income

For Year 2015 and 2016

2016

2015

Net Sales

700,000

900,000

Less Cont of Goods Sold

(100.000)

600,000

(80.000)

820,000

Gross Profit

Less Operuting Expenses

Earnings Before Interest and Taxen

Less Interest Expense

Net Income Before Tax

Less Income Tax

(50,000)

(120,000)

550,000

700,000

(10,000)

(50,000)

540,000

(162,000)

378,000

650,000

(195.000)

Net Income

455,000

Ansuer on a separate sheet. Pad paper or any paper availabie in your hame.

Write your NAME:

FARM2/uection

DATE

Deepen W7:M14-Fin TRation

Compute the ration linted below for 2016 and tell if it is good or bad. Show solution.

1. Working Capital

2. Current Ratio

13. Profit Margin Ratio

14. Return on Assets

15. Return on Equity

16. Asset Turnover Ratio

3. Quick/Acid Teat Ratio

4. A/R Turnover Ratio

5. Average Collection Period

6. Iniventory Turmover Ratio

7. Average Days in Inventory

8. Number of Days in OC

9. Debt to Total Assets Ratio

10. Debt to Equity Ratio

11. Times Interest Earned

Rutio

12. Gros Profit Ratio

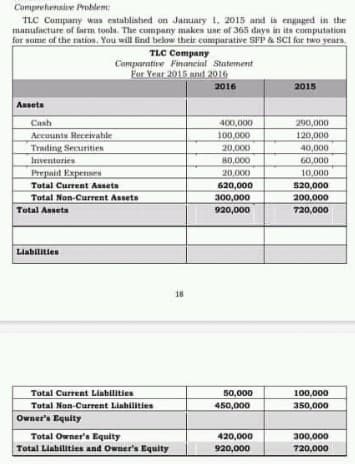

Transcribed Image Text:Comprehensive Problem

TLC Company wus eatablishied on January 1, 2015 and is enguged in the

manufacture of farm toolu. The company makes une of 365 days in its computation

for some of the ratios. You will find below their eumparative SFP & SCI for two years

TLC Company

Comparative Financial Statement

For Year 2015 and 2016

2016

2015

Anseta

Cash

Accounts Receivahle

Trailing Securitien

Inventaries

400,000

100,000

20,000

290,000

120,000

40,000

60,000

10,000

80,000

Prepaid Expenes

20,00)

Total Current Assets

620,000

520,000

Tatal Non-Current Assets

300,000

200,000

720,000

Total Asseta

920,000

Liabilities

18

Total Current Liabilities

Tutal Non-Current Liahities

Owner's Equity

50,000

450,000

100,000

350,000

Total Owner's Equity

Total Liahilities and Owner's Equity

420,000

300,000

920,000

720,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning