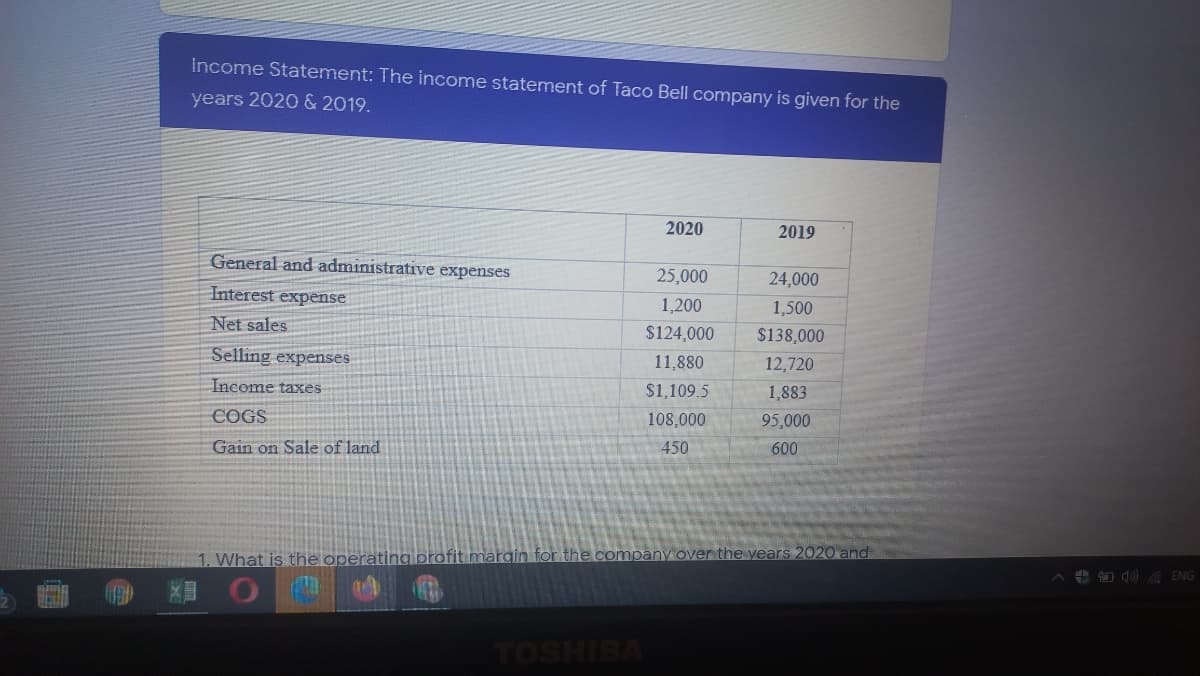

Income Statement: The income statement of Taco Bell company is given for the years 2020 & 2019. 2020 2019 General and administrative expenses 25,000 24,000 Interest expense 1,200 1,500 Net sales $124,000 $138,000 Selling expenses 11,880 12,720 Income taxes $1,109.5 1,883 COGS 108,000 95,000 Gain on Sale of land 450 600

Income Statement: The income statement of Taco Bell company is given for the years 2020 & 2019. 2020 2019 General and administrative expenses 25,000 24,000 Interest expense 1,200 1,500 Net sales $124,000 $138,000 Selling expenses 11,880 12,720 Income taxes $1,109.5 1,883 COGS 108,000 95,000 Gain on Sale of land 450 600

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 3MC

Related questions

Question

Transcribed Image Text:Income Statement: The income statement of Taco Bell company is given for the

years 2020 & 2019.

2020

2019

General and administrative expenses

25,000

24,000

Interest expense

1,200

1,500

Net sales

$124,000

$138,000

Selling expenses

11,880

12,720

Income taxes

$1,109.5

1,883

COGS

108,000

95,000

Gain on Sale of land

450

600

1. What is the operating profit marain for the company over the years 2020 and

+ O d) ENG

TOSHIBA

Transcribed Image Text:zvcHy9vKm0jUnAg/formResponse?pli= 1

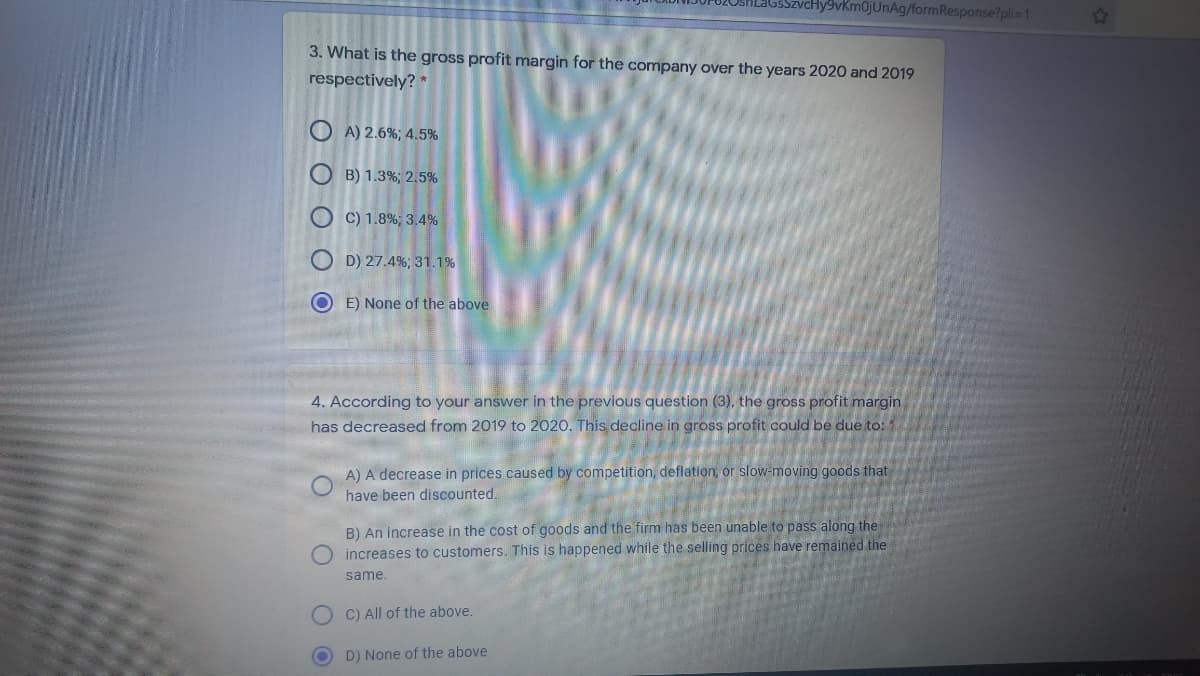

3. What is the gross profit margin for the company over the years 2020 and 2019

respectively? *

O A) 2.6%; 4.5%

O B) 1.3%; 2,5%

C) 1.8%; 3.4%

O D) 27.4%; 31.1%

O E) None of the above

4. According to your answer in the previous question (3), the gross profit margin

has decreased from 2019 to 2020. This decline in gross profit could be due to:

A) A decrease in prices caused by competition, deflation, or slow-moving goods that

have been discounted.

B) An increase in the cost of goods and the firm has been unable to pass along the

increases to customers. This is happened while the selling prices have remained the

same.

C) All of the above.

D) None of the above

O O O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning