INCOME STATEMENTS Net sales COGS (excl. depr.) Depreciation Other operating expenses EBIT Interest expense Pre-tax earnings Taxes (40%) NI before pref. div. Preferred div. Net income Other Data Common dividends Addition to RE Tax rate Shares of common stock Earnings per share Dividends per share Price per share 2014 $ 4,760 3,560 170 480 550 100 450 180 270 8 S 262 $48 $214 40% 50 $5.24 $0.96 $40.00 S S S $5,000 3,800 200 500 500 120 380 Total assets 152 228 Liabilities and equity 8 Accounts payable 220 Accruals Notes payable Total CL Long-term bonds Total liabilities $50 $170 40% Preferred stock 50 $4.40 $1.00 $27.00 S S S BALANCE SHEETS 2015 Assets Cash ST Investments Accounts receivable Inventories Total CA Net PP&E S Common stock Retained earnings Total common equity Total liabs. & equity 2014 60 50 40 380 500 820 1,000 $ 1,300 $ 1,550 1,700 2,000 $ 3,000 $ 3,550 S 190 S 200 280 300 130 S 600 280 780 1,200 1,000 $ 1,600 $ 1,980 100 100 500 500 800 970 $ 1,300 $ 1,470 $3,000 $ 3,550 S 2015 S

INCOME STATEMENTS Net sales COGS (excl. depr.) Depreciation Other operating expenses EBIT Interest expense Pre-tax earnings Taxes (40%) NI before pref. div. Preferred div. Net income Other Data Common dividends Addition to RE Tax rate Shares of common stock Earnings per share Dividends per share Price per share 2014 $ 4,760 3,560 170 480 550 100 450 180 270 8 S 262 $48 $214 40% 50 $5.24 $0.96 $40.00 S S S $5,000 3,800 200 500 500 120 380 Total assets 152 228 Liabilities and equity 8 Accounts payable 220 Accruals Notes payable Total CL Long-term bonds Total liabilities $50 $170 40% Preferred stock 50 $4.40 $1.00 $27.00 S S S BALANCE SHEETS 2015 Assets Cash ST Investments Accounts receivable Inventories Total CA Net PP&E S Common stock Retained earnings Total common equity Total liabs. & equity 2014 60 50 40 380 500 820 1,000 $ 1,300 $ 1,550 1,700 2,000 $ 3,000 $ 3,550 S 190 S 200 280 300 130 S 600 280 780 1,200 1,000 $ 1,600 $ 1,980 100 100 500 500 800 970 $ 1,300 $ 1,470 $3,000 $ 3,550 S 2015 S

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 24E

Related questions

Question

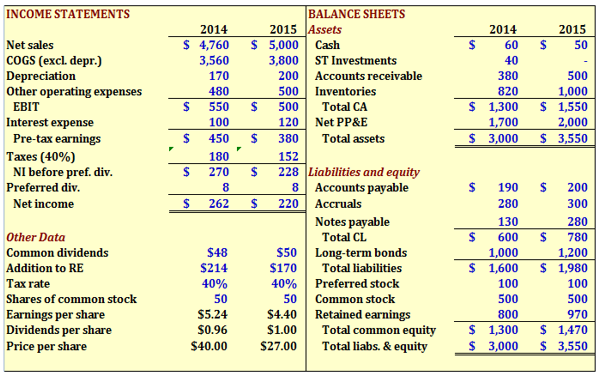

Bruno Inc.'s Financial Statement for years 2014-2015. Compute for the Bruno Inc. Year 2015 Debt to Equity Ratio. (Answer Format: 12.23%, if computed answer is 12.343% answer should be 12.34%, if computed answer is 12.347% answer should be 12.35%)

Transcribed Image Text:INCOME STATEMENTS

Net sales

COGS (excl. depr.)

Depreciation

Other operating expenses

EBIT

Interest expense

Pre-tax earnings

Taxes (40%)

NI before pref. div.

Preferred div.

Net income

Other Data

Common dividends

Addition to RE

Tax rate

Shares of common stock

Earnings per share

Dividends per share

Price per share

2014

$ 4,760

3,560

170

480

$

550

100

$

450

180

$

270

8

$ 262

$48

$214

40%

50

$5.24

$0.96

$40.00

BALANCE SHEETS

2015 Assets

5,000

Cash

3,800

ST Investments

200 Accounts receivable

500

Inventories

$

500

Total CA

120

Net PP&E

$ 380

Total assets

152

$

228 Liabilities and equity

8

Accounts payable

$

220

Accruals

Notes payable

Total CL

Long-term bonds

$50

$170

Total liabilities

40%

Preferred stock

50

Common stock

$4.40

Retained earnings

$1.00

Total common equity

Total liabs. & equity

$27.00

$

2014

$

60

40

380

820

$ 1,300

1,700

$ 3,000

$

$

1,000

$ 1,600

100

500

800

$ 1,300

$ 3,000

2015

50

500

1,000

$ 1,550

2,000

$ 3,550

200

300

280

780

1,200

$ 1,980

100

500

970

$ 1,470

$ 3,550

$

190 $

280

130

600 $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage