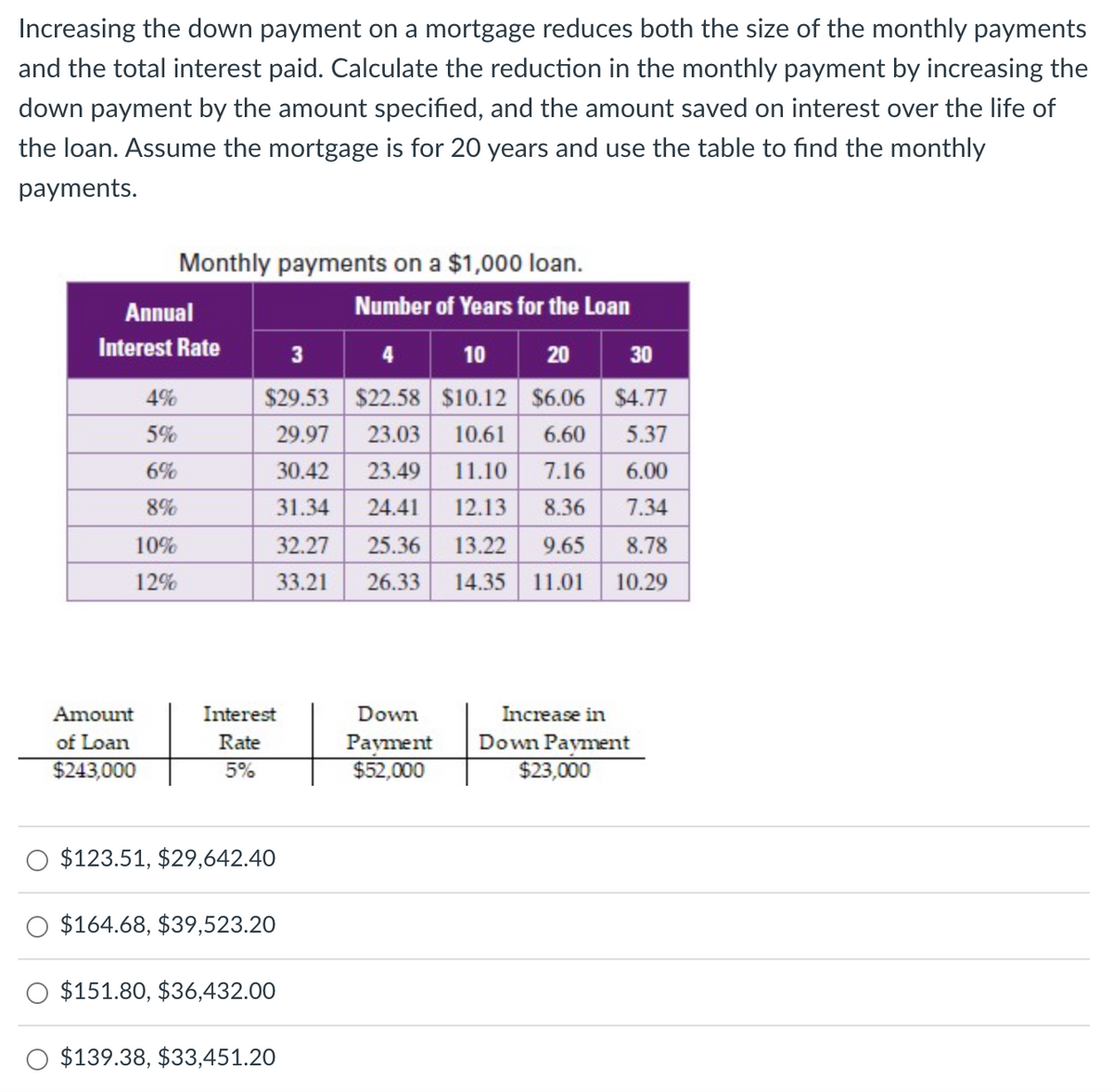

Increasing the down payment on a mortgage reduces both the size of the monthly payments and the total interest paid. Calculate the reduction in the monthly payment by increasing the down payment by the amount specified, and the amount saved on interest over the life of the loan. Assume the mortgage is for 20 years and use the table to find the monthly payments. Monthly payments on a $1,000 loan. Number of Years for the Loan Annual Interest Rate 3 10 20 30 4% $29.53 $22.58 $10.12 $6.06 $4.77 5% 29.97 23.03 10.61 6% 30.42 23.49 6.60 5.37 11.10 7.16 6.00 8% 31.34 24.41 12.13 8.36 7.34 10% 32.27 25.36 13.22 9.65 8.78 12% 33.21 26.33 14.35 11.01 10.29 Amount Interest Down Increase in of Loan $243,000 Rate Payment Down Payment 5% $52,000 $23,000 $123.51, $29,642.40 $164.68, $39,523.20 $151.80, $36,432.00 $139.38, $33,451.20

Increasing the down payment on a mortgage reduces both the size of the monthly payments and the total interest paid. Calculate the reduction in the monthly payment by increasing the down payment by the amount specified, and the amount saved on interest over the life of the loan. Assume the mortgage is for 20 years and use the table to find the monthly payments. Monthly payments on a $1,000 loan. Number of Years for the Loan Annual Interest Rate 3 10 20 30 4% $29.53 $22.58 $10.12 $6.06 $4.77 5% 29.97 23.03 10.61 6% 30.42 23.49 6.60 5.37 11.10 7.16 6.00 8% 31.34 24.41 12.13 8.36 7.34 10% 32.27 25.36 13.22 9.65 8.78 12% 33.21 26.33 14.35 11.01 10.29 Amount Interest Down Increase in of Loan $243,000 Rate Payment Down Payment 5% $52,000 $23,000 $123.51, $29,642.40 $164.68, $39,523.20 $151.80, $36,432.00 $139.38, $33,451.20

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter7: Using Consumer Loans

Section: Chapter Questions

Problem 9FPE: Calculating and comparing add-on and simple interest loans. Eli Nelson is borrowing 10,000 for five...

Related questions

Question

Transcribed Image Text:Increasing the down payment on a mortgage reduces both the size of the monthly payments

and the total interest paid. Calculate the reduction in the monthly payment by increasing the

down payment by the amount specified, and the amount saved on interest over the life of

the loan. Assume the mortgage is for 20 years and use the table to find the monthly

payments.

Monthly payments on a $1,000 loan.

Number of Years for the Loan

Annual

Interest Rate

3

10

20

30

4%

$29.53 $22.58 $10.12 $6.06 $4.77

5%

29.97

23.03

10.61

6%

30.42

23.49

6.60 5.37

11.10 7.16 6.00

8%

31.34

24.41

12.13

8.36 7.34

10%

32.27

25.36

13.22 9.65 8.78

12%

33.21

26.33

14.35 11.01 10.29

Amount

Interest

Down

Increase in

of Loan

$243,000

Rate

Payment

Down Payment

5%

$52,000

$23,000

$123.51, $29,642.40

$164.68, $39,523.20

$151.80, $36,432.00

$139.38, $33,451.20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning