Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter16: Financial Statement Analysis

Section: Chapter Questions

Problem 1PB

Related questions

Question

25

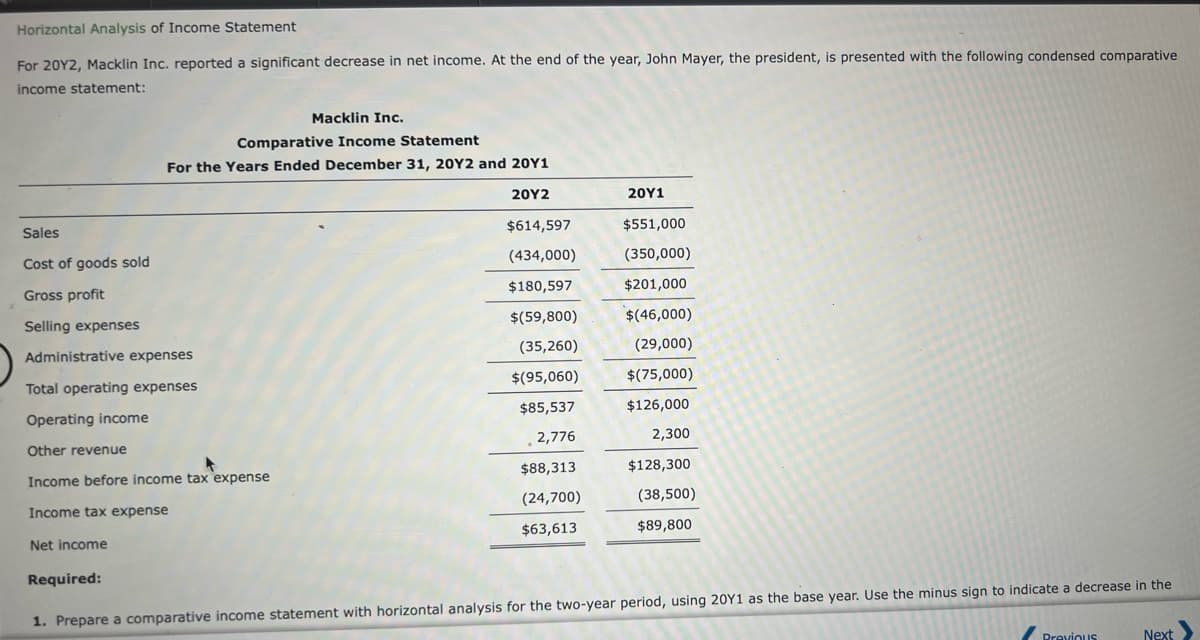

Transcribed Image Text:Horizontal Analysis of Income Statement

For 20Y2, Macklin Inc. reported a significant decrease in net income. At the end of the year, John Mayer, the president, is presented with the following condensed comparative

income statement:

Macklin Inc.

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

20Υ2

20Υ1

Sales

$614,597

$551,000

Cost of goods sold

(434,000)

(350,000)

Gross profit

$180,597

$201,000

Selling expenses

$(59,800)

$(46,000)

Administrative expenses

(35,260)

(29,000)

Total operating expenses

$(95,060)

$(75,000)

Operating income

$85,537

$126,000

Other revenue

2,776

2,300

Income before income tax expense

$88,313

$128,300

Income tax expense

(24,700)

(38,500)

Net income

$63,613

$89,800

Required:

1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Use the minus sign to indicate a decrease in the

Previous

Next

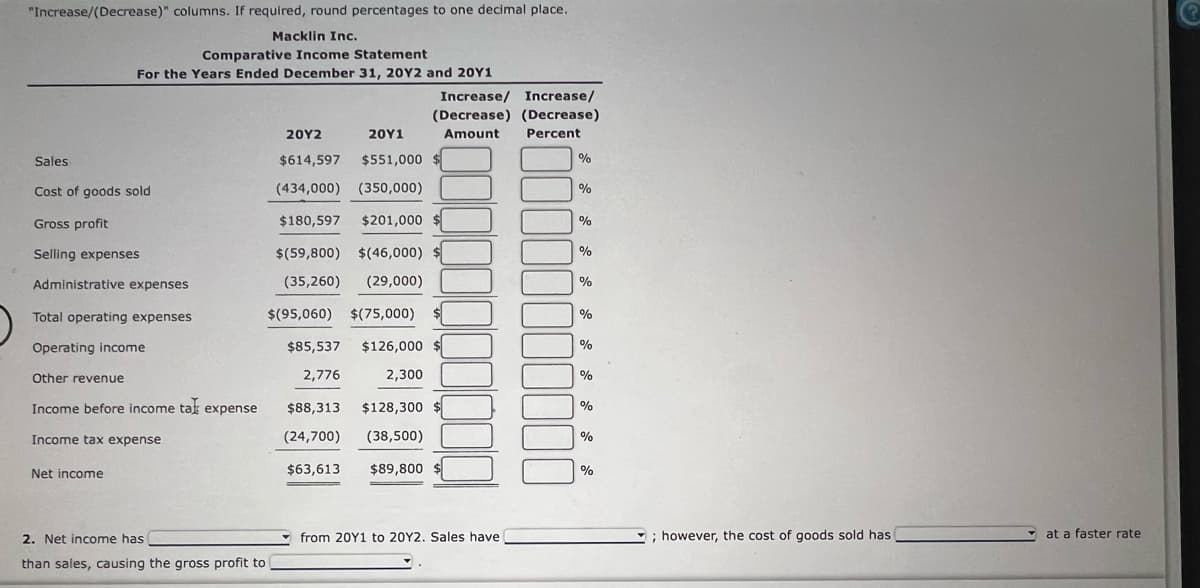

Transcribed Image Text:"Increase/(Decrease)" columns. If required, round percentages to one decimal place.

Macklin Inc.

Comparative Income Statement

For the Years Ended December 31, 20Y2 and 20Y1

Increase/ Increase/

(Decrease) (Decrease)

20Υ2

20Υ1

Amount

Percent

Sales

$614,597

$551,000 $

%

Cost of goods sold

(434,000) (350,000)

%

Gross profit

$180,597

$201,000

%

Selling expenses

$(59,800) $(46,000) $

%

Administrative expenses

(35,260)

(29,000)

%

Total operating expenses

$(95,060) $(75,000)

%

Operating income

$85,537

$126,000

%

Other revenue

2,776

2,300

%

Income before income tak expense

$88,313

$128,300

%

Income tax expense

(24,700)

(38,500)

%

Net income

$63,613

$89,800 $

%

2. Net income has

from 20Y1 to 20Y2. Sales have

; however, the cost of goods sold has

at a faster rate

than sales, causing the gross profit to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning