Index Fund Investing Let's continue with some more specifics :) Let's pretend that at the age of twenty we start to invest in Index Funds which is pretty much "buying the entire stock market." Think of it as a giant mutual fund. Let's pretend that in our twenties we invest one hundred dollars a month into an index fund that pays us 8% APR compounded monthly. Let's pretend that we make this a habit we do it for ten years. Then in our thirties we invest two hundred dollars a month. Let's

Index Fund Investing Let's continue with some more specifics :) Let's pretend that at the age of twenty we start to invest in Index Funds which is pretty much "buying the entire stock market." Think of it as a giant mutual fund. Let's pretend that in our twenties we invest one hundred dollars a month into an index fund that pays us 8% APR compounded monthly. Let's pretend that we make this a habit we do it for ten years. Then in our thirties we invest two hundred dollars a month. Let's

PFIN (with PFIN Online, 1 term (6 months) Printed Access Card) (New, Engaging Titles from 4LTR Press)

6th Edition

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter13: Investing In Mutual Funds, Etfs, And Real Estate

Section: Chapter Questions

Problem 7FPE

Related questions

Question

Transcribed Image Text:10:40

Back

G

Finance Millionaire.docx

for-smarter-investing

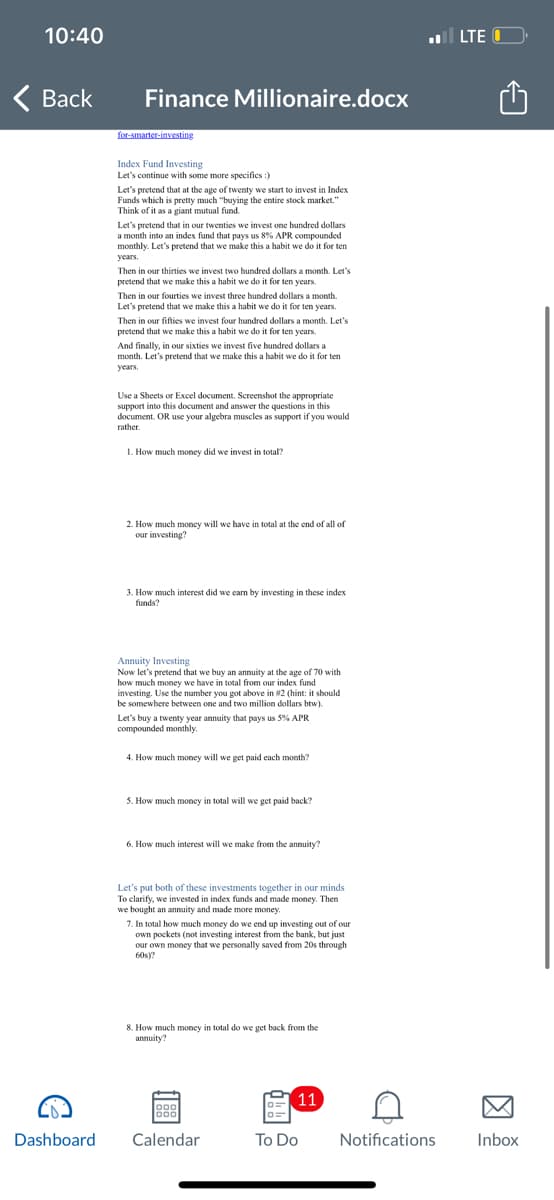

Index Fund Investing

Let's continue with some more specifics :)

Let's pretend that at the age of twenty we start to invest in Index

Funds which is pretty much "buying the entire stock market."

Think of it as a giant mutual fund.

Let's pretend that in our twenties we invest one hundred dollars

a month into an index fund that pays us 8% APR compounded

monthly. Let's pretend that we make this a habit we do it for ten

years.

Then in our thirties we invest two hundred dollars a month. Let's

pretend that we make this a habit we do it for ten years.

Then in our fourties we invest three hundred dollars a month.

Let's pretend that we make this a habit we do it for ten years.

Then in our fifties we invest four hundred dollars a month. Let's

pretend that we make this a habit we do it for ten years.

And finally, in our sixties we invest five hundred dollars a

month. Let's pretend that we make this a habit we do it for ten

years.

Use a Sheets or Excel document. Screenshot the appropriate

support into this document and answer the questions in this

document. OR use your algebra muscles as support if you would

rather.

1. How much money did we invest in total?

2. How much money will we have in total at the end of all of

our investing?

3. How much interest did we earn by investing in these index

funds?

Annuity Investing

Now let's pretend that we buy an annuity at the age of 70 with

how much money we have in total from our index fund

investing. Use the number you got above in #2 (hint: it should

be somewhere between one and two million dollars btw).

Let's buy a twenty year annuity that pays us 5% APR

compounded monthly,

4. How much money will we get paid each month?

5. How much money in total will we get paid back?

6. How much interest will we make from the annuity?

Let's put both of these investments together in our minds

To clarify, we invested in index funds and made money. Then

we bought an annuity and made more money.

7. In total how much money do we end up investing out of our

own pockets (not investing interest from the bank, but just

our own money that we personally saved from 20s through

60s)?

8. How much money in total do we get back from the

annuity?

998

Dashboard Calendar

DE

11

To Do

A

.. LTE

Notifications

Inbox

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning