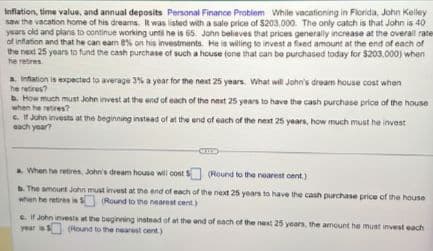

Inflation, time value, and annual deposits Personal Finance Problem While vacationing in Florida, John Kelley saw the vacation home of his dreams. It was listed with a sale price of $203.000. The only catch is that John is 40 years old and plans to continue working until he is 65. John believes that prices generally increase at the overall rat of inflation and that he can earn 8% on his investments. He is willing to invest a fixed amount at the end of each of the next 25 years to fund the cash purchase of such a house (one that can be purchased today for $203.000) when he retires a Inflation is expected to average 3% a year for the next 25 years. What will John's dream house cost when he retires? b. How much must John invest at the end of each of the next 25 years to have the cash purchase price of the house when he retires? c. John invests at the beginning instead of at the end of each of the next 25 years, how much must he invest each year?

Inflation, time value, and annual deposits Personal Finance Problem While vacationing in Florida, John Kelley saw the vacation home of his dreams. It was listed with a sale price of $203.000. The only catch is that John is 40 years old and plans to continue working until he is 65. John believes that prices generally increase at the overall rat of inflation and that he can earn 8% on his investments. He is willing to invest a fixed amount at the end of each of the next 25 years to fund the cash purchase of such a house (one that can be purchased today for $203.000) when he retires a Inflation is expected to average 3% a year for the next 25 years. What will John's dream house cost when he retires? b. How much must John invest at the end of each of the next 25 years to have the cash purchase price of the house when he retires? c. John invests at the beginning instead of at the end of each of the next 25 years, how much must he invest each year?

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter2: Using Financial Statements And Budgets

Section: Chapter Questions

Problem 8FPE: Inflation and interest rates. Jessica Adams is 21 years old and has just graduated from college. In...

Related questions

Question

solve fast thank u

Transcribed Image Text:Inflation, time value, and annual deposits Personal Finance Problem While vacationing in Florida, John Kelley

saw the vacation home of his dreams. It was listed with a sale price of $203,000. The only catch is that John is 40

years old and plans to continue working until he is 65. John believes that prices generally increase at the overall rater

of inflation and that he can earn 8% on his investments. He is willing to invest a fixed amount at the end of each of

the next 25 years to fund the cash purchase of such a house (one that can be purchased today for $203.000) when

he retires

a. Inflation is expected to average 3% a year for the next 25 years. What will John's dream house cost when

he retires?

b. How much must John invest at the end of each of the next 25 years to have the cash purchase price of the house

when he retires?

c. If John invests at the beginning instead of at the end of each of the next 25 years, how much must he invest

each year?

a. When he retires, John's dream house will cost $(Round to the nearest cent.)

b. The amount John must invest at the end of each of the next 25 years to have the cash purchase price of the house

when he retires iss (Round to the nearest cent.)

e. If John invests at the beginning instead of at the end of each of the next 25 years, the amount he must invest each

year is (Round to the nearest cent)

s

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 6 images

Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed…

Finance

ISBN:

9781337117005

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning