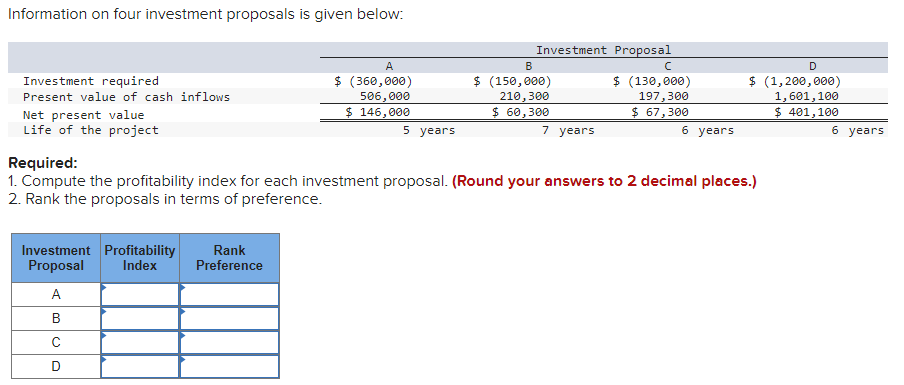

Information on four investment proposals is given below: A B Investment required Present value of cash inflows $ (360,000) 506,000 $ (150,000) 210,300 Investment Proposal с $ (130,000) 197,300 Net present value $ 146,000 $ 60,300 $ 67,300 Life of the project 5 years 7 years 6 years Required: D $ (1,200,000) 1,601,100 $ 401,100 6 years 1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference. Investment Profitability Proposal Index A B C D Rank Preference

Information on four investment proposals is given below: A B Investment required Present value of cash inflows $ (360,000) 506,000 $ (150,000) 210,300 Investment Proposal с $ (130,000) 197,300 Net present value $ 146,000 $ 60,300 $ 67,300 Life of the project 5 years 7 years 6 years Required: D $ (1,200,000) 1,601,100 $ 401,100 6 years 1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.) 2. Rank the proposals in terms of preference. Investment Profitability Proposal Index A B C D Rank Preference

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter12: Capital Investment Analysis

Section: Chapter Questions

Problem 4BE: Internal rate of return A project is estimated to cost 463,565 and provide annual net cash flows of...

Related questions

Question

100%

Transcribed Image Text:Information on four investment proposals is given below:

A

B

Investment required

Present value of cash inflows

$ (360,000)

506,000

$ (150,000)

210,300

Investment Proposal

с

$ (130,000)

197,300

Net present value

$ 146,000

$ 60,300

$ 67,300

Life of the project

5 years

7 years

6 years

Required:

D

$ (1,200,000)

1,601,100

$ 401,100

6 years

1. Compute the profitability index for each investment proposal. (Round your answers to 2 decimal places.)

2. Rank the proposals in terms of preference.

Investment Profitability

Proposal Index

A

B

C

D

Rank

Preference

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning