information provided below to answer the following questions: Calculate the profit or loss on the vehicle sold. Prepare the Accumulated Depreciation on Vehicles account in all the relevant transactions for the year ended 28 February 202 Complete the note to the financial statements "Property, plant a February 2022. MATION

information provided below to answer the following questions: Calculate the profit or loss on the vehicle sold. Prepare the Accumulated Depreciation on Vehicles account in all the relevant transactions for the year ended 28 February 202 Complete the note to the financial statements "Property, plant a February 2022. MATION

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter3: Basic Accounting Systems: Accrual Basis

Section: Chapter Questions

Problem 3.23E: Adjustment for depreciation The estimated amount of depredation on equipment for the current year is...

Related questions

Question

Transcribed Image Text:REQUIRED

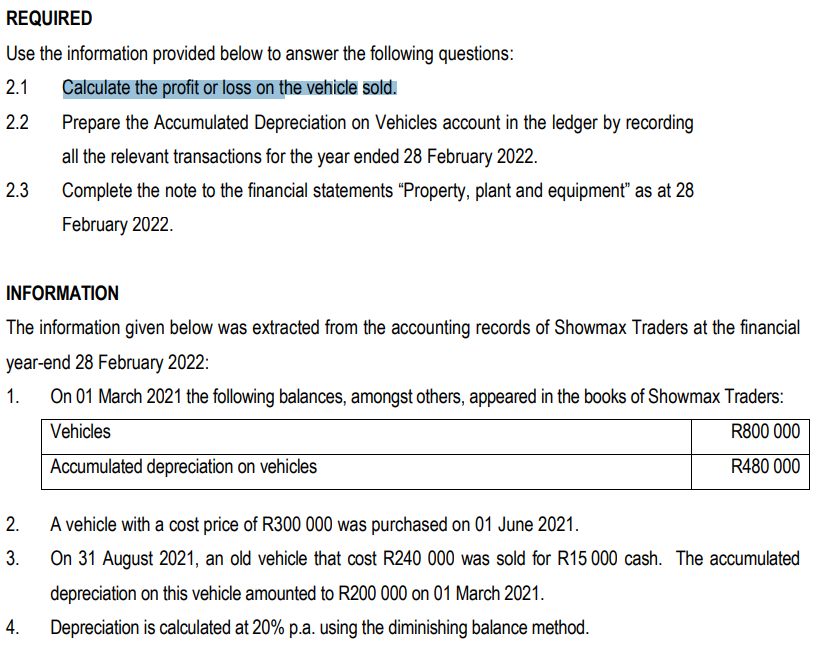

Use the information provided below to answer the following questions:

2.1 Calculate the profit or loss on the vehicle sold.

2.2

2.3

INFORMATION

The information given below was extracted from the accounting records of Showmax Traders at the financial

year-end 28 February 2022:

1.

On 01 March 2021 the following balances, amongst others, appeared in the books of Showmax Traders:

Vehicles

R800 000

Accumulated depreciation on vehicles

R480 000

2.

3.

Prepare the Accumulated Depreciation on Vehicles account in the ledger by recording

all the relevant transactions for the year ended 28 February 2022.

Complete the note to the financial statements "Property, plant and equipment" as at 28

February 2022.

4.

A vehicle with a cost price of R300 000 was purchased on 01 June 2021.

On 31 August 2021, an old vehicle that cost R240 000 was sold for R15 000 cash. The accumulated

depreciation on this vehicle amounted to R200 000 on 01 March 2021.

Depreciation is calculated at 20% p.a. using the diminishing balance method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning