ing income statement was prepared by a new and inex organized as a corporation, PHOENIX, INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2021 Les in sale of treasury stock of issuance price over par value of capital stock period adjustment (net of income tax) al revenue. of goods sold Ling expenses eral and administrative expenses. alement of litigation. $6,000,000 1,104,000 1,896,000 24,000 720,000 $10,800,000 62,000 510,000 96,000 $11,468,000

ing income statement was prepared by a new and inex organized as a corporation, PHOENIX, INC. INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2021 Les in sale of treasury stock of issuance price over par value of capital stock period adjustment (net of income tax) al revenue. of goods sold Ling expenses eral and administrative expenses. alement of litigation. $6,000,000 1,104,000 1,896,000 24,000 720,000 $10,800,000 62,000 510,000 96,000 $11,468,000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.23E: Unusual income statement items Assume that the amount of each of the following items is material to...

Related questions

Question

Transcribed Image Text:nd Video...

gnment

(17) MY

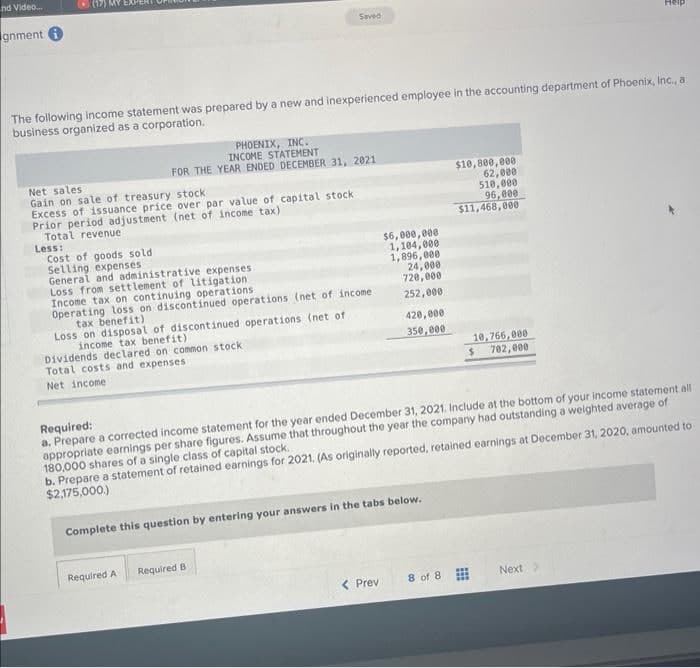

The following income statement was prepared by a new and inexperienced employee in the accounting department of Phoenix, Inc., a

business organized as a corporation.

Less:

Net sales

Gain on sale of treasury stock

Excess of issuance price over par value of capital stock

Prior period adjustment (net of income tax)

Total revenue

Saved

PHOENIX, INC.

INCOME STATEMENT

FOR THE YEAR ENDED DECEMBER 31, 2021

Cost of goods sold

Selling expenses

General and administrative expenses.

Loss from settlement of litigation

Income tax on continuing operations.

Operating loss on discontinued operations (net of income

tax benefit)

Loss on disposal of discontinued operations (net of

income tax benefit)

Dividends declared on common stock

Total costs and expenses

Net income

Required A

Required B

$6,000,000

1,104,000

1,896,000

24,000

720,000

252,000

Complete this question by entering your answers in the tabs below.

420,000

350,000

Required:

a. Prepare a corrected income statement for the year ended December 31, 2021. Include at the bottom of your income statement all

appropriate earnings per share figures. Assume that throughout the year the company had outstanding a weighted average of

180,000 shares of a single class of capital stock.

b. Prepare a statement of retained earnings for 2021. (As originally reported, retained earnings at December 31, 2020, amounted to

$2,175,000.)

< Prev

$10,800,000

62,000

510,000

96,000

$11,468,000

8 of 8

10,766,000

$ 702,000

www

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning