Initial Annual Annual Salvage Value Investment Investment Receipts Disbursements 1 $300,000 $205,000 $125,000 $50,000 $400,000 $230,000 $130,000 $50,000 3 $450,000 $245,000 $140,000 $60,000 4 $500,000 $260,000 $135,000 $75,000 5 $600,000 $290,000 $150,000 $75,000 2. In addition to the original opportunity statement, Bayer declares that investments 2 and4 are mutually exclusive, investment 5 is contingent on 2 being funded, and at least two investments must be made. d. Now, which alternatives should be selected by Bayer? e. What is the present worth for the resulting investment portfolio? f What is the resulting IRR? Again consider the original opportunity statement: g. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current limit on investment capital, (2) plus 20%, and (3) minus 20%. h. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current MARR, (2) a MARR of 12%, and (3) a MARR of 8%.

Initial Annual Annual Salvage Value Investment Investment Receipts Disbursements 1 $300,000 $205,000 $125,000 $50,000 $400,000 $230,000 $130,000 $50,000 3 $450,000 $245,000 $140,000 $60,000 4 $500,000 $260,000 $135,000 $75,000 5 $600,000 $290,000 $150,000 $75,000 2. In addition to the original opportunity statement, Bayer declares that investments 2 and4 are mutually exclusive, investment 5 is contingent on 2 being funded, and at least two investments must be made. d. Now, which alternatives should be selected by Bayer? e. What is the present worth for the resulting investment portfolio? f What is the resulting IRR? Again consider the original opportunity statement: g. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current limit on investment capital, (2) plus 20%, and (3) minus 20%. h. Determine the optimum portfolio (state the investments selected and the portfolio PW) using (1) the current MARR, (2) a MARR of 12%, and (3) a MARR of 8%.

Chapter14: Security Structures And Determining Enterprise Values

Section: Chapter Questions

Problem 8EP

Related questions

Question

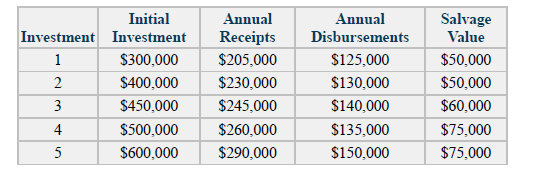

A laboratory within Bayer is considering the five indivisible investment proposals below to further upgrade their diagnostic capabilities to ensure continued leadership and state-of-the-art performance. The laboratory uses a 10-year planning horizon, has a MARR of 10%, and a capital limit of $1,000,000. For the original opportunity statement: a. Which alternatives should be selected to form the optimum portfolio for the lab? b. What is the present worth for the optimum investment portfolio? c. What is the IRR for the portfolio?

Transcribed Image Text:Initial

Annual

Annual

Salvage

Value

Investment Investment

Receipts

Disbursements

1

$300,000

$205,000

$125,000

$50,000

$400,000

$230,000

$130,000

$50,000

3

$450,000

$245,000

$140,000

$60,000

4

$500,000

$260,000

$135,000

$75,000

5

$600,000

$290,000

$150,000

$75,000

2.

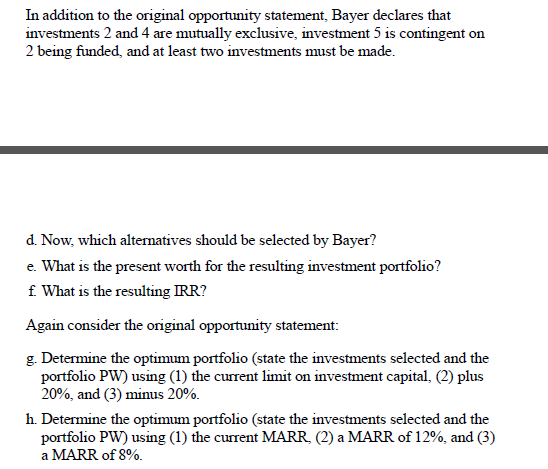

Transcribed Image Text:In addition to the original opportunity statement, Bayer declares that

investments 2 and4 are mutually exclusive, investment 5 is contingent on

2 being funded, and at least two investments must be made.

d. Now, which alternatives should be selected by Bayer?

e. What is the present worth for the resulting investment portfolio?

f What is the resulting IRR?

Again consider the original opportunity statement:

g. Determine the optimum portfolio (state the investments selected and the

portfolio PW) using (1) the current limit on investment capital, (2) plus

20%, and (3) minus 20%.

h. Determine the optimum portfolio (state the investments selected and the

portfolio PW) using (1) the current MARR, (2) a MARR of 12%, and (3)

a MARR of 8%.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 8 steps with 7 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you