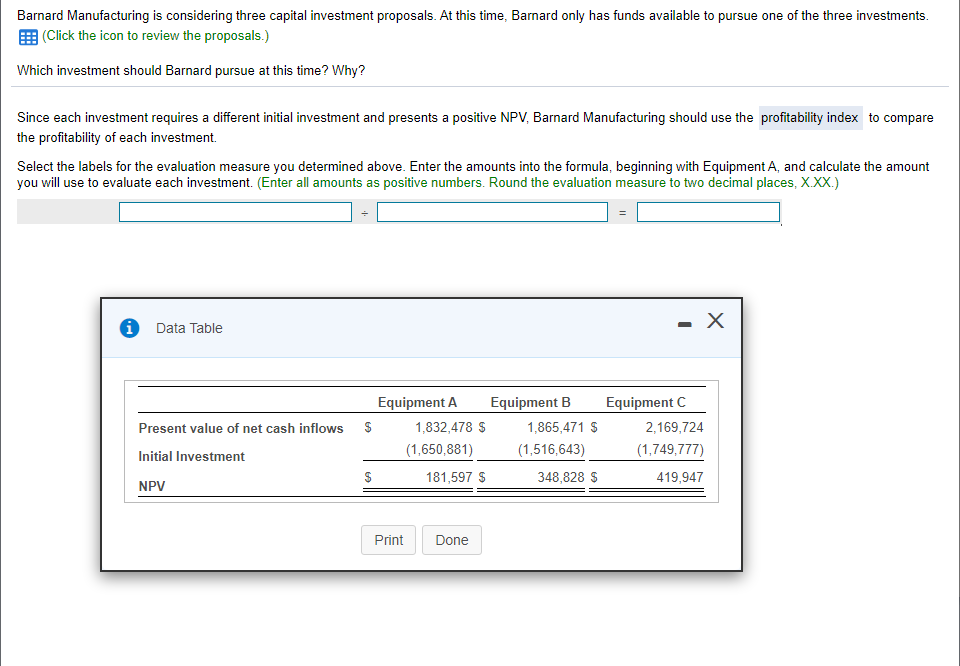

Barnard Manufacturing is considering three capital investment proposals. At this time, Barnard only has funds available to pursue one of the three investments. E (Click the icon to review the proposals.) Which investment should Barnard pursue at this time? Why? Since each investment requires a different initial investment and presents a positive NPV, Barnard Manufacturing should use the profitability index to compare the profitability of each investment. Select the labels for the evaluation measure you determined above. Enter the amounts into the formula, beginning with Equipment A, and calculate the amount you will use to evaluate each investment. (Enter all amounts as positive numbers. Round the evaluation measure to two decimal places, X.XX.) Data Table Equipment A Equipment B Equipment C Present value of net cash inflowsS 1,832,478 $ 1,865,471 $ 2,169,724 (1,650,881) (1,516,643) (1,749,777) Initial Investment 181,597 $ 348,828 $ 419,947 NPV Print Done

Barnard Manufacturing is considering three capital investment proposals. At this time, Barnard only has funds available to pursue one of the three investments. E (Click the icon to review the proposals.) Which investment should Barnard pursue at this time? Why? Since each investment requires a different initial investment and presents a positive NPV, Barnard Manufacturing should use the profitability index to compare the profitability of each investment. Select the labels for the evaluation measure you determined above. Enter the amounts into the formula, beginning with Equipment A, and calculate the amount you will use to evaluate each investment. (Enter all amounts as positive numbers. Round the evaluation measure to two decimal places, X.XX.) Data Table Equipment A Equipment B Equipment C Present value of net cash inflowsS 1,832,478 $ 1,865,471 $ 2,169,724 (1,650,881) (1,516,643) (1,749,777) Initial Investment 181,597 $ 348,828 $ 419,947 NPV Print Done

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter12: Capital Investment Decisions

Section: Chapter Questions

Problem 52P

Related questions

Question

100%

Transcribed Image Text:Barnard Manufacturing is considering three capital investment proposals. At this time, Barnard only has funds available to pursue one of the three investments.

|(Click the icon to review the proposals.)

Which investment should Barnard pursue at this time? Why?

Since each investment requires a different initial investment and presents a positive NPV, Barnard Manufacturing should use the profitability index to compare

the profitability of each investment.

Select the labels for the evaluation measure you determined above. Enter the amounts into the formula, beginning with Equipment A, and calculate the amount

you will use to evaluate each investment. (Enter all amounts as positive numbers. Round the evaluation measure to two decimal places, X.XX.)

- X

Data Table

Equipment A

Equipment B

Equipment C

Present value of net cash inflows

1,832,478 S

1,865,471 $

2,169,724

(1,650,881)

(1,516,643)

(1,749,777)

Initial Investment

181,597 S

348,828 S

419,947

NPV

Print

Done

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College