The Scotty Corporation, maker of Scotty's electronic components, is considering replacing one of its current hand-operated assembly machines with a new fully automated machine. This replacement would mean the elimination of one employee, generating salary and benefit saving. Given the following information, determine the cash flows associated with this replacement. Existing situation: One full-time machine operator --- salary and benefits, $25,000 per year Cost of maintenance -- $2,000 per year Cost of defects $6,000 per year Original depreciable value of old machine --- -- $50,000 Annual depreciation --- $5,000 per year Expected life-10 years Age 5 years old Expected salvage value in 5 years --- $0 Current salvage value --- --- $5,000 Marginal tax rate --- 34 percent --- ---

The Scotty Corporation, maker of Scotty's electronic components, is considering replacing one of its current hand-operated assembly machines with a new fully automated machine. This replacement would mean the elimination of one employee, generating salary and benefit saving. Given the following information, determine the cash flows associated with this replacement. Existing situation: One full-time machine operator --- salary and benefits, $25,000 per year Cost of maintenance -- $2,000 per year Cost of defects $6,000 per year Original depreciable value of old machine --- -- $50,000 Annual depreciation --- $5,000 per year Expected life-10 years Age 5 years old Expected salvage value in 5 years --- $0 Current salvage value --- --- $5,000 Marginal tax rate --- 34 percent --- ---

Chapter9: Capital Budgeting And Cash Flow Analysis

Section: Chapter Questions

Problem 8P

Related questions

Question

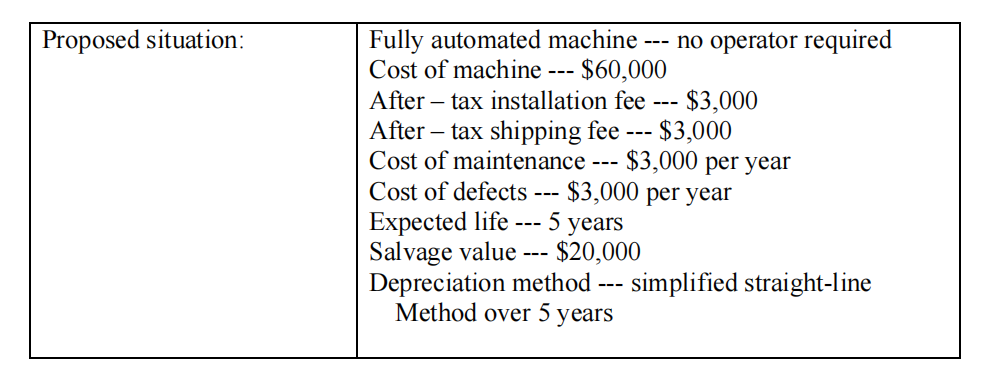

Transcribed Image Text:Proposed situation:

Fully automated machine --- no operator required

Cost of machine

$60,000

After tax installation fee

$3,000

---

After-tax shipping fee - $3,000

Cost of maintenance. $3,000 per year

Cost of defects

Expected life ---

5 years

Salvage value- $20,000

---

---

---

$3,000 per year

Depreciation method --- simplified straight-line

Method over 5 years

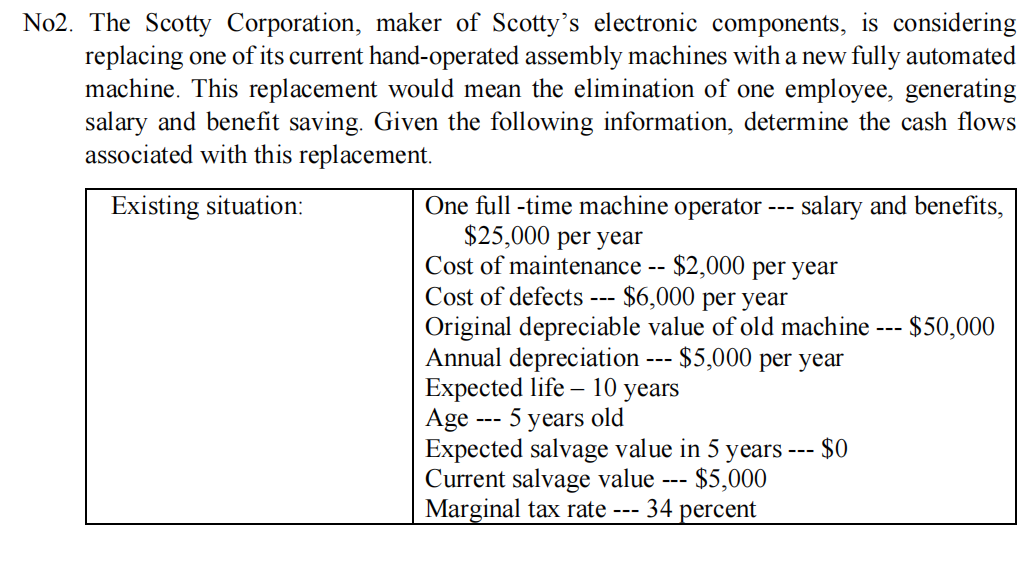

Transcribed Image Text:No2. The Scotty Corporation, maker of Scotty's electronic components, is considering

replacing one of its current hand-operated assembly machines with a new fully automated

machine. This replacement would mean the elimination of one employee, generating

salary and benefit saving. Given the following information, determine the cash flows

associated with this replacement.

Existing situation:

One full-time machine operator --- salary and benefits,

$25,000 per year

Cost of maintenance -- $2,000 per year

Cost of defects --- $6,000 per year

Original depreciable value of old machine --- $50,000

Annual depreciation --- $5,000 per year

Expected life 10 years

Age

5 years old

Expected salvage value in 5 years. $0

Current salvage value

Marginal tax rate --- 34 percent

$5,000

---

-

---

---

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning