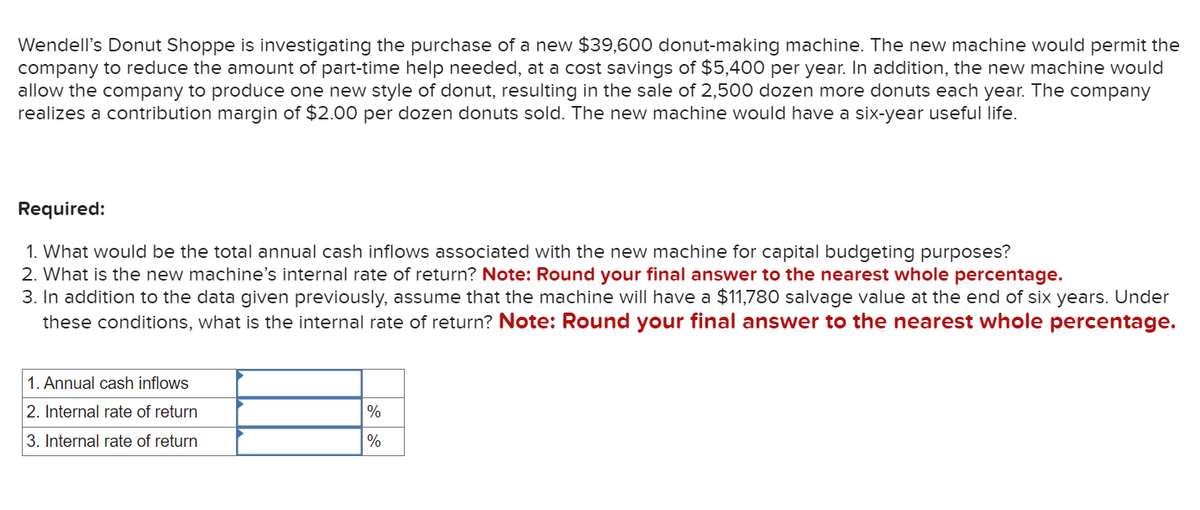

Wendell's Donut Shoppe is investigating the purchase of a new $39,600 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $5,400 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,500 dozen more donuts each year. The company realizes a contribution margin of $2.00 per dozen donuts sold. The new machine would have a six-year useful life. Required: 1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes? 2. What is the new machine's internal rate of return? Note: Round your final answer to the nearest whole percentage. 3. In addition to the data given previously, assume that the machine will have a $11,780 salvage value at the end of six years. Under these conditions, what is the internal rate of return? Note: Round your final answer to the nearest whole percentage.

Wendell's Donut Shoppe is investigating the purchase of a new $39,600 donut-making machine. The new machine would permit the company to reduce the amount of part-time help needed, at a cost savings of $5,400 per year. In addition, the new machine would allow the company to produce one new style of donut, resulting in the sale of 2,500 dozen more donuts each year. The company realizes a contribution margin of $2.00 per dozen donuts sold. The new machine would have a six-year useful life. Required: 1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes? 2. What is the new machine's internal rate of return? Note: Round your final answer to the nearest whole percentage. 3. In addition to the data given previously, assume that the machine will have a $11,780 salvage value at the end of six years. Under these conditions, what is the internal rate of return? Note: Round your final answer to the nearest whole percentage.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter19: Capital Investment

Section: Chapter Questions

Problem 15E: Gina Ripley, president of Dearing Company, is considering the purchase of a computer-aided...

Related questions

Question

Please help me

Transcribed Image Text:Wendell's Donut Shoppe is investigating the purchase of a new $39,600 donut-making machine. The new machine would permit the

company to reduce the amount of part-time help needed, at a cost savings of $5,400 per year. In addition, the new machine would

allow the company to produce one new style of donut, resulting in the sale of 2,500 dozen more donuts each year. The company

realizes a contribution margin of $2.00 per dozen donuts sold. The new machine would have a six-year useful life.

Required:

1. What would be the total annual cash inflows associated with the new machine for capital budgeting purposes?

2. What is the new machine's internal rate of return? Note: Round your final answer to the nearest whole percentage.

3. In addition to the data given previously, assume that the machine will have a $11,780 salvage value at the end of six years. Under

these conditions, what is the internal rate of return? Note: Round your final answer to the nearest whole percentage.

1. Annual cash inflows

2. Internal rate of return

3. Internal rate of return

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning